- EUR/USD has been unable to rise amid uncertainty about eurozone fiscal and monetary support.

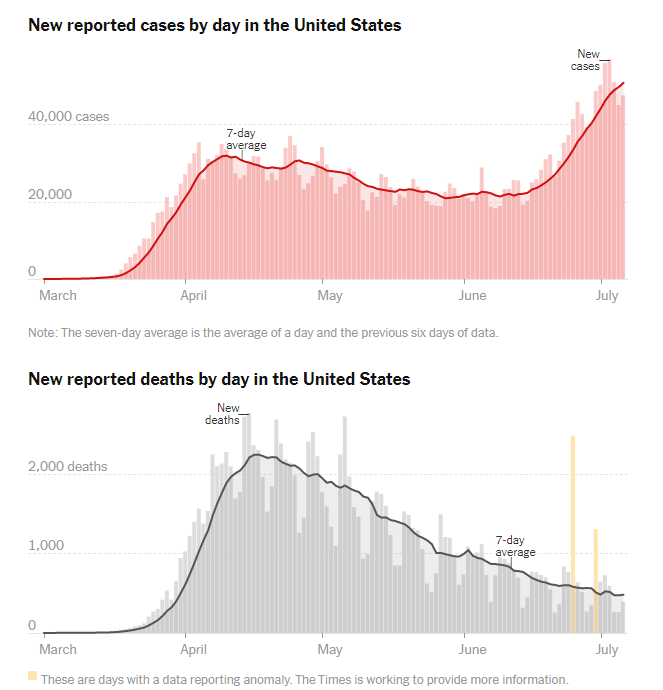

- US coronavirus cases tend to rise on Wednesdays, potentially dampening the mood.

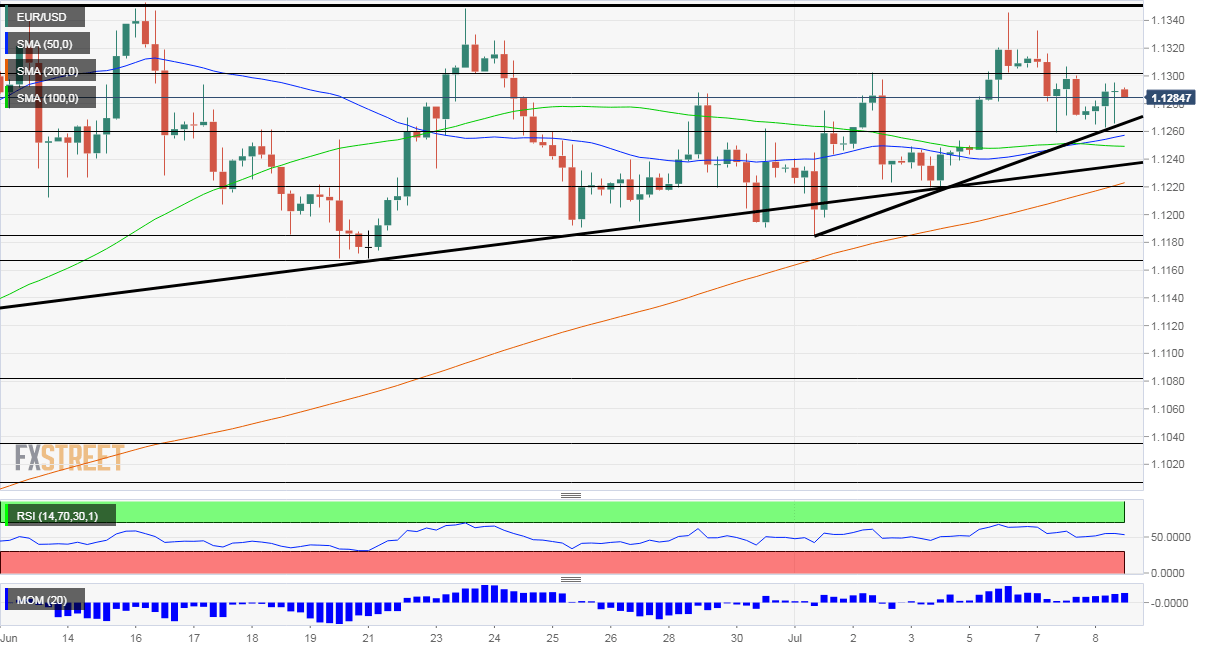

- Wednesday's four-hour chart is showing uptrend support is getting close.

A one-two punch against EUR/USD? The world's most popular currency pair failed to recover – despite an improvement in stock markets and a drop in the US dollar. The common currency has been held back by doubts about the EU Fund.

German Chancellor Angela Merkel said that she expects "good cooperation" with EU partners – a sign that a compromise on the EU fund has yet to be reached. Despite a Franco-German agreement on €500 billion mutually funded grants, the "Frugal Four" remain opposed. The group – Austria, the Netherlands, Sweden, and Denmark – prefer loans over awarding money.

Tension is mounting ahead of the face-to-face leaders' summit next week. Christine Lagarde, President of the European Central Bank, lowered expectations of the event and ahead of the bank's rate decision next week. She said that the ECB's actions were effective and efficient, hinting at a pause. However, she may try pushing politicians to act.

See European Central Bank Preview: EUR/USD depends on Lagarde's fearless nudging of the Frugal Four

Worrying Wednesday

Markets were partially encouraged by the relatively low COVID-19 figures published on Monday, and the moderate increase on Tuesday. However, the drops are common after the weekend, and especially so after the long Independence Day holiday. However, administrative work tends to catch up by mid-week, causing spikes on Wednesdays.

It is essential to note that Texas, California, Florida, and Arizona have only recently reimposed restrictions. There is a lag of some two-three weeks before lockdown measures have any effect. The US heatwave – keeping people indoors with airconditioning – may also propagate the virus.

An increase in cases, hospitalizations, and deaths – the latter seeming to bottom out – may dampen the mood and boost the safe-haven dollar.

Source: New York Times

Overall, EUR/USD may come under renewed pressure.

EUR/USD Technical Analysis

Euro/dollar is trading above one uptrend support line, which has been accompanying since early July and also tops another more moderate one. However, its failure to advance makes these lines closer and risks losing them. The uptrend lines are backed up by the 50, 100, and 200 Simple Moving Averages on the four-hour chart. Momentum remains positive.

All in all, bulls are in the lead but are at growing risk.

Support awaits at 1.1260, the daily low, followed by 1.1220, where the 200 SMA hits the price, and then by 1.1185 and 1.1165.

Resistance is at 1.13, a round number that previously capped EUR/USD, followed by 1.1350, the recent double-top. Further above, 1.1385 awaits the currency pair.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD appreciates to near 1.0400 ahead of Eurozone HICP inflation

EUR/USD continues its winning streak for the third successive session, trading around 1.0400 during the Asian hours on Tuesday. The upside of the EUR/USD pair is attributed to the subdued US Dollar.

GBP/USD rises toward 1.2550 as US Dollar continues to correct downwards

GBP/USD continues to rise for the third consecutive day, trading near 1.2530 during Tuesday's Asian session. The pair's upward momentum is driven by a subdued US Dollar. Later in the day, the US ISM Services Purchasing Managers Index is set to be released.

Gold price sticks to modest gains; lacks bullish conviction amid Fed's hawkish shift

Gold price attracts some haven flows amid worries about Trump’s tariff plans. The Fed’s hawkish shift and elevated US bond yields cap gains for the XAU/USD. Traders seem reluctant ahead of FOMC minutes and US NFP releases later this week.

Solana Price Forecast: Open Interest reaches an all-time high of $6.48 billion

Solana price trades slightly down on Tuesday after rallying more than 12% the previous week. On-chain data hints for rallying continuation as SOL’s open interest reaches a new all-time high of $6.48 billion on Tuesday.

Five fundamentals for the week: Nonfarm Payrolls to keep traders on edge in first full week of 2025 Premium

Did the US economy enjoy a strong finish to 2024? That is the question in the first full week of trading in 2025. The all-important NFP stand out, but a look at the Federal Reserve and the Chinese economy is also of interest.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.