EUR/USD Forecast: US inflation unwinds panic selling

EUR/USD Current Price: 0.9650

- The US Consumer Price Index rose 8.2% in September, barely easing from the previous month.

- Market players anticipate a more aggressive Fed and a recession due to monetary tightening.

- EUR/USD plunged to a fresh weekly low and will likely remain on the back foot.

The EUR/USD pair fell to a fresh weekly low of 0.9630 following the release of the US Consumer Price Index. According to the official release, US inflation rose 8.2% YoY in September, barely easing from the previous 8.3% and higher than the 8.1% expected. In addition, the core reading was higher than anticipated, reaching a multi-year high of 6.6%. Hell broke loose with the news, and the greenback soared after spending the first half of the day on the back foot as market players rushed to price in a potentially more aggressive US Federal Reserve.

The central bank will continue tightening its monetary policy, regardless of the negative effects on economic growth. For the two meetings left this year, 75 bps are priced in, which will lead to a rate of 4.4%, in line with the Fed’s objective. The downside is that it would probably translate into a recession. Wall Street collapsed with the news, while government bond yields soared. Markets are in panic mode, a situation that will likely extend after the US opening.

Ahead of US inflation data, Germany released the final version of the September Consumer Price Index, confirmed at 10.9% YoY in its EU-harmonized version. The core reading also matched the preliminary estimate of 2.2%.

EUR/USD short-term technical outlook

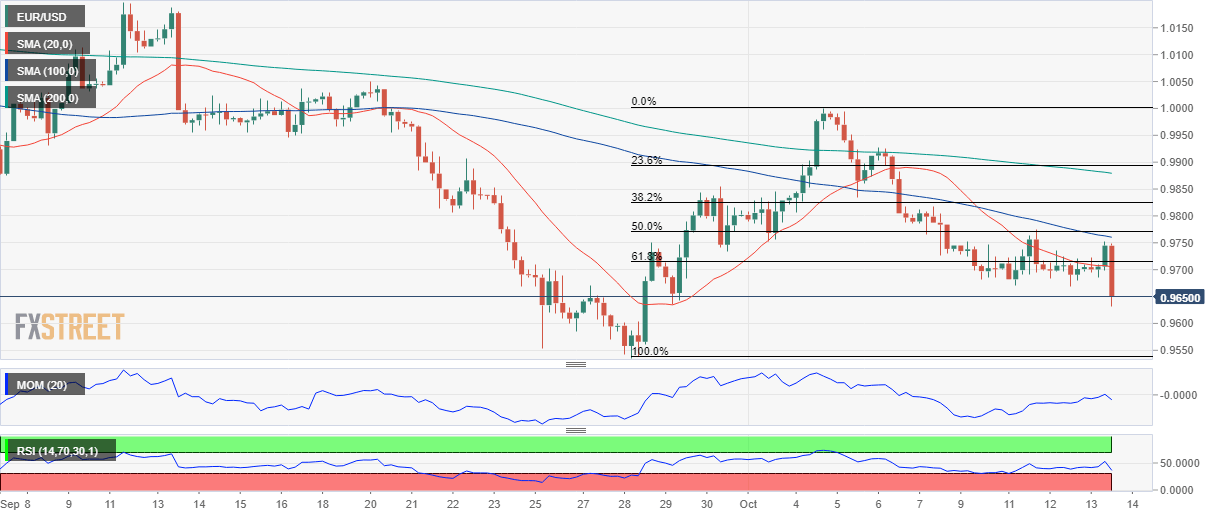

The EUR/USD pair is currently hovering around 0.9650, maintaining its near-term bearish stance. The 4-hour chart shows that it broke below a mildly bearish 20 SMA, also below the 23.6% Fibonacci retracement of its latest daily rally at 0.9690. The Momentum indicator barely retreats from its midline, while the RSI indicator is stable at around 39, suggesting sellers are not yet strong enough. However, a bearish extension seems likely, given the broad greenback strength.

Support levels: 0.9615 0.9570 0.9525

Resistance levels: 0.9690 0.9745 0.9790

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.