EUR/USD Forecast: US growth, employment, and Fed updates

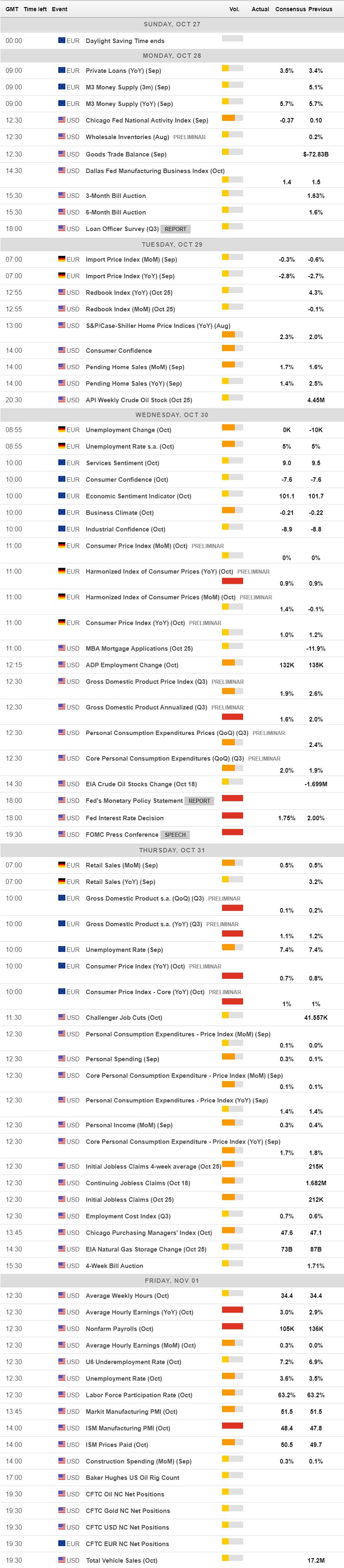

- Busy macroeconomic in the US with plenty of first-tier data this week.

- EU’s growth still slowing at the beginning of Q4, non-event ECB.

- EUR/USD long-term upward correction complete, ready to resume its fall.

The EUR/USD pair is closing the week with loses below the 1.1100 level, having spent these last few days consolidating at the upper end of the previous week’s range. It reached a fresh October high of 1.1179 before turning south, with the greenback finding support by the end of the week on persistent Brexit uncertainty.

Economic slowdown and non-event ECB

The data coming from Europe and the US didn’t trigger a market’s reaction, as it confirmed what investors already knew. The preliminary October Markit estimates on manufacturing and services output in the Union signaled that the economic slowdown extended into Q4. Those of the US came in slightly better, also leaning the scale in dollar’s favor.

The European Central Bank had a monetary policy meeting, but given the recent decision to extend stimulus by cutting rates and resuming bond-buying, it was a non-event. Moreover, it was the last one preside by Mario Draghi, and he gave no hints of what his successor, Mrs. Christine Lagarde, will do.

US Durable Goods Orders fell 1.1% in September, while Non-defense Capital Goods Orders ex-Aircraft, seen as an indicator of business investment spending, fell for a second consecutive month, down by 0.5% following a 0.6% slump. The data spurred concerns about the latest US Federal Reserve rate cut not being enough to underpin the economy.

Busy week ahead

The US Federal Reserve it’s having a monetary policy meeting next Wednesday, and the market is already pricing in a 25bps rate cut. However, Powell & Co. could well refrain from acting, as one of the main arguments for a rate cut was trade tensions between the US and China. Progress in that front is slow, but at this point, representatives from both countries hint a deal is coming, cooling down concerns. As for macroeconomic data, it may not be indicating strong economic progress, but remains away from suggesting contraction.

The upcoming days will also bring the preliminary estimate of the US Q3 Gross Domestic Product, foreseen at 1.6% from the previous 2.0%. The figures will be released ahead of the Fed’s decision, which may limit the market’s reaction to growth data.

On Friday, the US will release the October Nonfarm Payroll report with the US economy seen adding 105K new jobs, while the unemployment rate is seen up to 3.6%.

In between, the EU will also release its Q3 GDP, with the economy seen growing a modest 0.1%, and October preliminary inflation seen up by 0.7% YoY after a 0.8% advance in the previous month.

EUR/USD technical outlook

The EUR/USD pair, in its weekly chart, is retreating below a bearish 20 SMA, while technical indicators faltered around their midlines, slowly turning south. Such behavior suggests that the latest advance was just a correction in the dominant long-term bearish trend.

Daily basis, the pair has lost ground and retreated below a bearish 100 DMA, although the 20 SMA maintains its bullish slope below the current level. In this last time frame, technical indicators have retreated from overbought levels, heading lower within positive ground.

Measuring the latest bullish run between 1.0878 and 1.1179, the pair has pierced the 23.6% retracement, with the next Fibonacci support at 1.1065, and immediate and relevant support, as below it, the pair could re-visit 1.1000 and even break below it, toward the 1.0920/40 price zone.

To the upside, the pair has resistance at 1.1120, although only beyond 1.1180, the pair has chances of advancing with a bit more conviction.

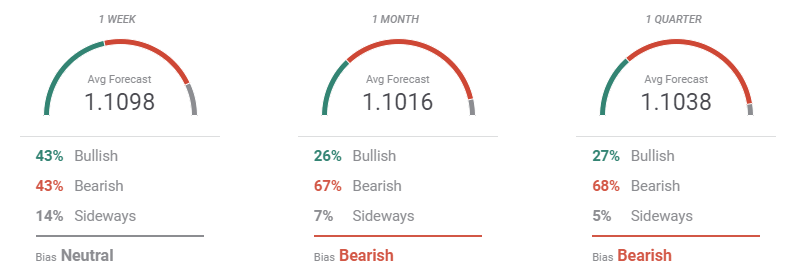

EUR/USD sentiment poll

The FXStreet Forecast Poll suggest that the market is ready to resume dollar’s buying. The weekly perspective is neutral as the pair is seen on average at 1.1098, although bears take over in the monthly and quarterly views, with the pair seen well below the current level in the Overview chart, which also shows, with a few exceptions, that most traders expected the pair to fall below the 1.1000 figure.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.