EUR/USD Forecast: US Dollar takes modest advantage of risk aversion

EUR/USD Current price: 1.0852

- Encouraging European data fell short of underpinning the Euro.

- Financial markets turn their eyes to the FOMC Meeting Minutes.

- EUR/USD keeps trading within limited ranges, could extend its slide in the near term.

The EUR/USD pair hovered around the 1.0850 mark for a second consecutive day on Tuesday, with the US Dollar ticking higher amid a souring market mood. Still, the pair refused to leave its comfort zone, as data and policymakers' words were insufficient to convince speculative interest.

News coming from Europe was generally encouraging, as Germany released the April Producer Price Index (PPI), which contracted by 3.3% YoY against expectations of a 3.2% slide. On a monthly basis, the PPI advanced 0.2%, matching expectations and the March figure. Additionally, the EU unveiled the March Current Account, which posted a wider-than-anticipated seasonally adjusted surplus of €35.8 billion, while the Trade Balance for the same month rose to €17.3 billion.

The United States (US) macroeconomic calendar had nothing to offer but another batch of Federal Reserve (Fed) speakers, which repeated well-known messages. If something, market participants took clues from stocks, with Asian and European markets closing in the red but American indexes posting modest gains.

On Wednesday, the focus will be on the Federal Open Market Committee (FOMC) and the Minutes of the latest central bank meeting. Investors will look for signs of clarity over the timing of a potential rate cut.

EUR/USD short-term technical outlook

From a technical point of view, the EUR/USD pair daily chart shows the pair comfortable above all its moving averages, with a firmly 20 Simple Moving Average (SMA) approaching a flat 200 SMA from below. Technical indicators, in the meantime, continue to retreat from their weekly peaks but hold well into positive ground and are far from suggesting increasing selling interest.

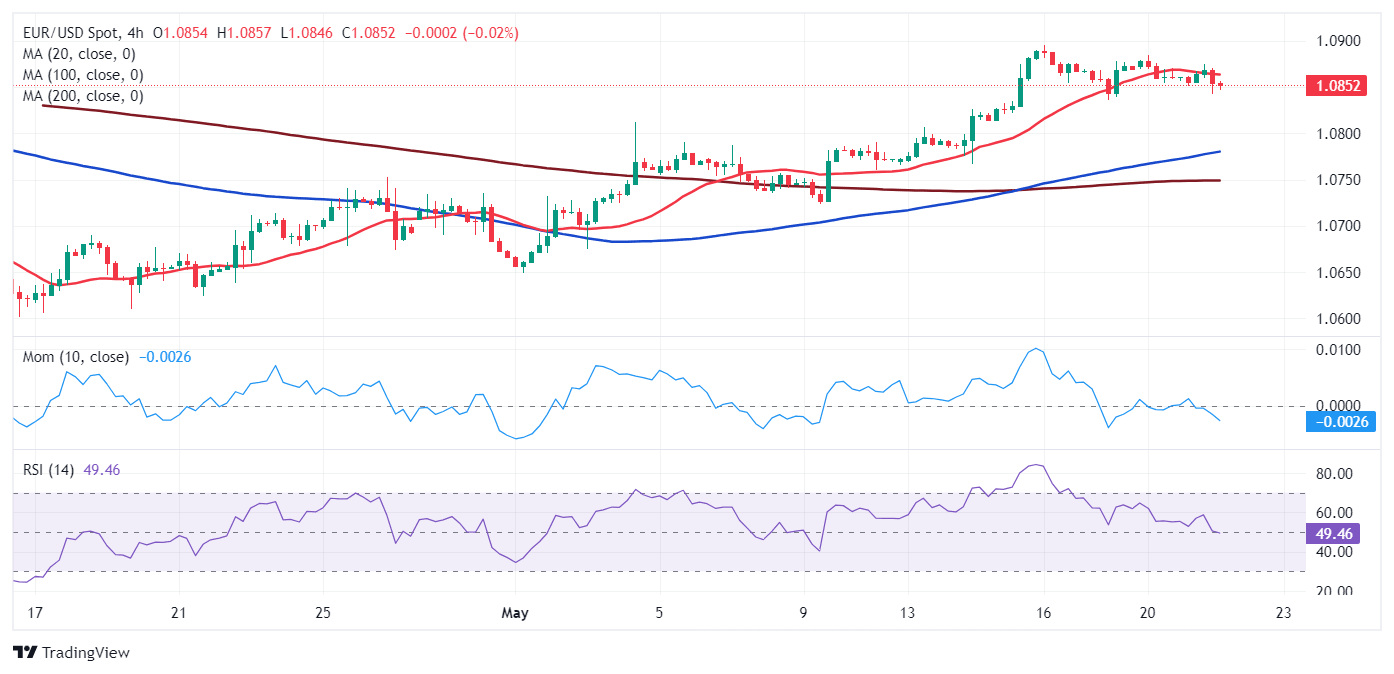

The 4-hour chart shows the EUR/USD pair is technically neutral, with a bearish tilt. The pair develops below its 20 SMA, which lost directional strength but remains above the longer ones. Finally, the Momentum indicator hovers directionless around its 100 level, while the Relative Strength Index (RSI) indicator heads marginally lower at around 49, anticipating a leg lower without confirming it.

Support levels: 1.0830 1.0795 1.0750

Resistance levels: 1.0890 1.0920 1.0960

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.