EUR/USD Forecast: Upbeat US Retail Sales failed to boost the mood

EUR/USD Current Price: 1.0921

- Chinese woes continue to undermine the market mood.

- United States Retail Sales improved by more than anticipated in July.

- EUR/USD maintains its bearish tone, aiming for a definite break of 1.0900.

The EUR/USD pair posted a modest advance throughout the first half of Tuesday, raising to 1.0944 during London trading hours. Financial markets traded choppily amid a bank holiday in most European countries, while sentiment remained on the back foot.

Concerns were once again linked to China, as the local central bank unexpectedly cut rates on Tuesday in another attempt to revive the economy. The announcement was made following a row of dismal Chinese data, as Industrial Production rose a modest 3.7% YoY in July, while Retail Sales in the same period increased by 2.5%, both missing the market expectations and below June readings. The decision weighed on the market mood, boosting fears of contagion.

Meanwhile, government bonds decrease, pushing yields sharply higher. The yield on the 10-year United States (US) Treasury note reached a multi-month high of 4.239%, while the 2-year note offered as much as 4.988%.

Data-wise, Germany unveiled the August ZEW Survey on Economic Sentiment, which improved to -12.3 from the previous -14.7. For the Eurozone, the indicator printed at -5.5, better than the precedent -12.2. The US, on the other hand, published July Retail Sales, which rose 0.7% MoM, beating expectations. The country also released the NY Empire State Manufacturing Index, down to -19 in August from 1.1 in July, and July Import and Export Price Indexes, which resulted upbeat. The US Dollar advanced with the news as Wall Street extended its pre-opening slump, while government bond yields surged past the aforementioned peaks.

EUR/USD short-term technical outlook

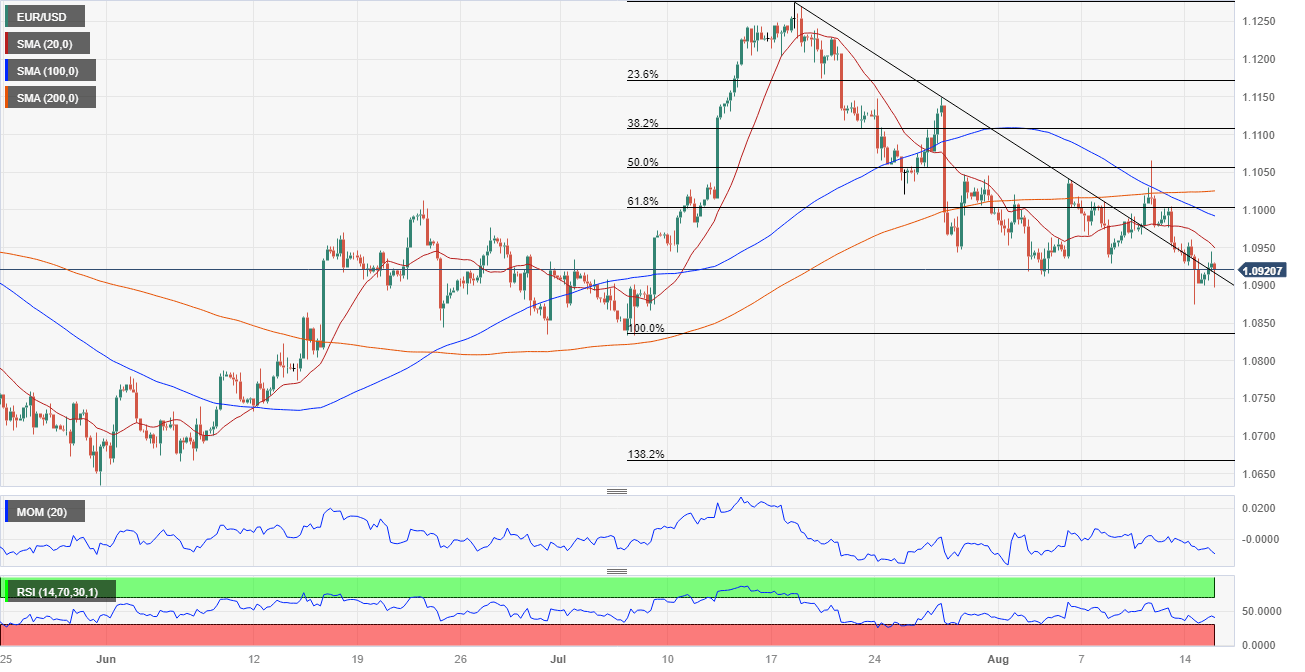

From a technical perspective, the EUR/USD pair has room to extend its slump. The daily chart indicates that the upward potential remains well-limited as the pair keeps battling to overcome a daily descendant trend line coming from 1.1275 while it develops below the critical 1.1000 mark. Furthermore, sellers are now aligned around the 100 Simple Moving Average (SMA), while the 20 SMA accelerates its slide above the longer one. Finally, the Momentum indicator gains downward traction below its midline, while the Relative Strength Index (RSI) indicator extends its consolidation around 40, skewing the risk to the downside.

For the near term, and according to the 4-hour chart, bears retain the lead. The pair develops below all its moving averages, with the 20 SMA accelerating south below the longer ones. Technical indicators, in the meantime, turned lower within negative levels, anticipating another leg lower.

Support levels: 1.0870 1.0825 1.0790

Resistance levels: 1.0960 1.1005 1.1055

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.