EUR/USD Forecast: Underpinned by rising equities

EUR/USD Current Price: 1.1709

- The dollar gave up early gains as the presidential race shows tight results.

- The US ADP Survey indicated a slower-than-anticipated pace of job creation in October.

- EUR/USD intrinsically bullish, needs to overcome the daily high at 1.1770.

The EUR/USD pair peaked at 1.1770 and then fell to 1.1602 during Asian trading hours and as the results of the US presidential election began arriving. The greenback is now under pressure and equities trimmed intraday losses as the presidential race tightens. Georgia, Michigan, Nevada, North Carolina, Pennsylvania and Wisconsin are yet to finalize counting ballots.

US elections overshadow everything else, although worth mention that Markit published the final versions of October Services PMIs, which were upwardly revised in most of the EU. The German index printed at 49.5 from 47.3, while the Union index improved from 46.2 to 46.9. As for the US, the country just released the ADP survey, which showed a slower than expected pace of job creation in October. The private sector added 365K new positions, far below the 650K expected and the previous 753K.

EUR/USD short-term technical outlook

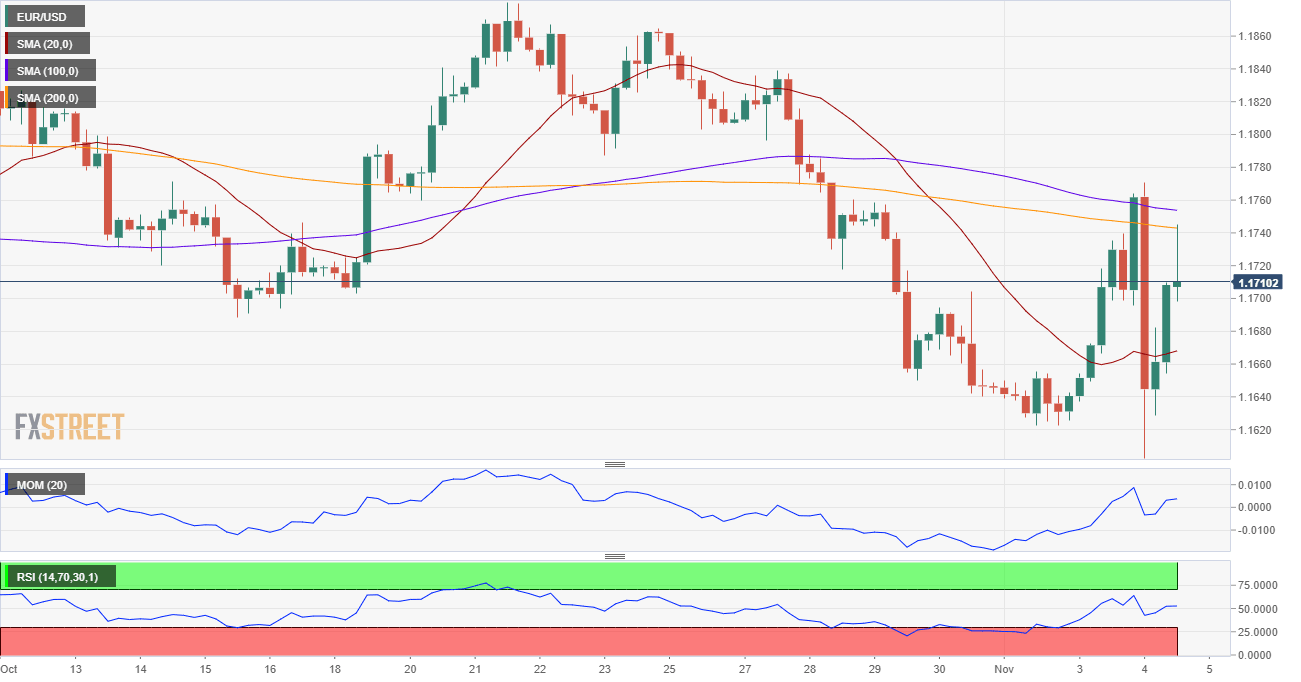

The EUR/USD pair is at the upper half of its daily range, trading around 1.1710. The bullish potential for the pair would remain limited as long as it trades below 1.1770, the daily high. The 4-hour chart shows that the 100 and 200 SMA converge around the mentioned high, reinforcing the static resistance level. At the same time, it is trading above its 20 SMA, which retains a modest bullish slope. Technical indicators, in the mentioned time-frame, maintain their bullish slopes within positive levels.

Support levels: 1.1690 1.1645 1.1600

Resistance levels: 1.1770 1.1820 1.1870

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.