EUR/USD Forecast: Under pressure, support at 1.2125

EUR/USD Current Price: 1.2156

- The market’s mood improves, but investors maintain a cautious stance.

- The focus remains on fiscal stimulus hopes and soaring Treasury yields.

- EUR/USD is technically bearish, the corrective decline could continue.

The EUR/USD pair consolidates around 1.2150 this Tuesday, near the weekly low set at 1.2131. Demand for the greenback recedes as the market mood improves, although a caution stance persists. Equities struggle to post substantial gains, although US indexes are poised to open in the green. On the other hand, US Treasury yields keep advancing to fresh multi-month highs amid hopes for more fiscal stimulus.

A light macroeconomic calendar maintains major pair ranging. The EU didn’t publish relevant data, while the US is offering minor figures. So far the country published the December NFIB Business Optimism Index, which contracted from 101.4 to 95.9, missing the market’s expectations. The attention during the American afternoon will be on a couple of Fed’s speakers.

EUR/USD short-term technical outlook

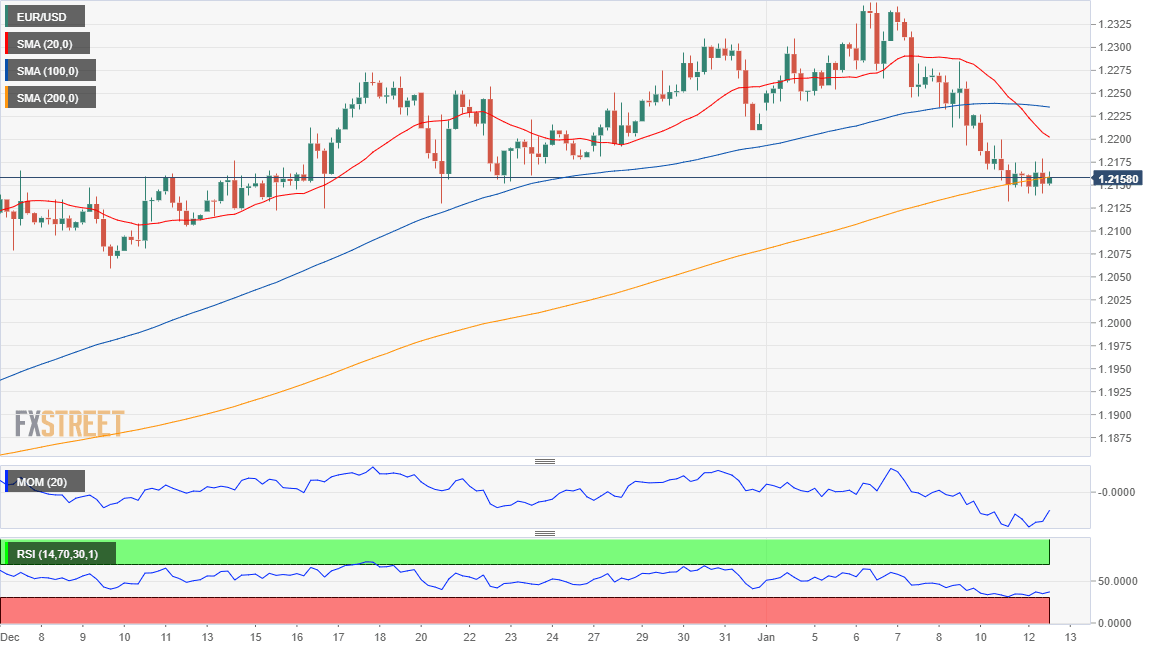

The EUR/USD pair is at risk of extending its decline, according to intraday technical readings. In the 4-hour chart, it is struggling around a mildly bullish 200 SMA, but below the 20 and 100 SMAs, with the shorter one accelerating south below the larger one. Technical indicators remain within negative levels, lacking directional strength. Chances of a steeper decline will increase on a break below 1.2125, the immediate support level.

Support levels: 1.2125 1.2080 1.2040

Resistance levels: 1.2165 1.2210 1.2250

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.