EUR/USD Forecast: Uncertainty ultimately benefiting the dollar

EUR/USD Current Price: 1.1005

- The coronavirus crisis continues to alter the global economic situation.

- Focus shifts to the US official march ISM Manufacturing PMI.

- EUR/USD depressed below 1.1000, yet unable to find a clear directional strength.

The American dollar extended its advance throughout the first half of the day but gave up during the last trading session. The EUR/USD pair fell to 1.0926, from where it bounced to recover the 1.1000 threshold ending the day around this last. The market’s sentiment remained depressed amid the COVID-19 pandemic taking its toll on global economic growth. The number of cases around the globe keeps rising, with the number of cases in the US above 160,000. New York is the most hit city, reporting over 1,500 deaths in the last 24 hours. Meanwhile, the situation in Europe keeps worsening, with little hopes of a soon-to-come peak in Italy and Spain. The world´s largest economies are heading or already in recession, and there’s nothing they can do about it at this time. Uncertainty remains high leaving major currencies without a clear trend.

March preliminary inflation in the EU came in at 0.7% YoY, while the core reading resulted at 1.0%, below the previous and the expected. German Gross Domestic Product was reported at 0.4% in Q4, confirming the economy was fragile ahead of the current crisis. In the US, the CB Consumer Confidence Index slumped to 120 in March from 132.6 in February, better, however than the 110 expected. This Wednesday, Markit will publish the final versions of March Manufacturing PMI for most major economies. More relevant, the US will release the official ISM Manufacturing PMI for the same month, foreseen at 45 from 50.1 in the previous month.

EUR/USD short-term technical outlook

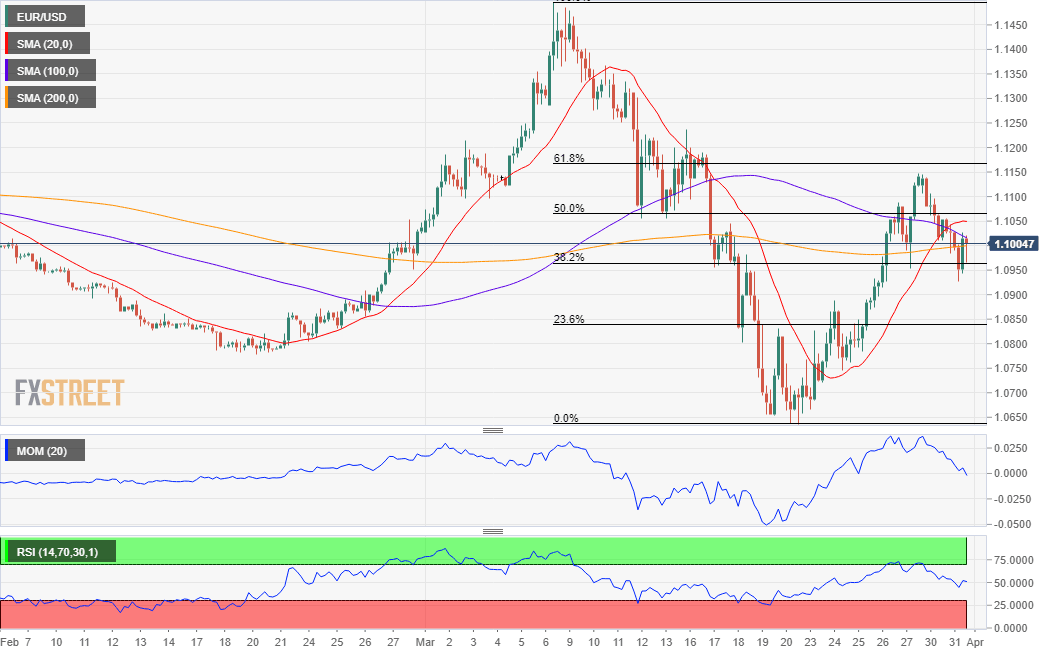

The EUR/USD pair has briefly pierced the 38.2% retracement of its March slump but recovered above it. In the 4-hour chart, it is currently trading within a congestion of moving averages, unable to advance beyond the 20 and 100 SMA, both converging around 1.1030. Technical indicators have turned higher within neutral readings, losing their bearish strength but far from signaling further gains ahead. It seems unlikely that the pair could find a certain direction and maintain it, but so far the potential of a steeper decline remains limited by a static support area at 1.0920.

Support levels: 1.0950 1.0920 1.0880

Resistance levels: 1.1030 1.1060 1.1100

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.