EUR/USD Forecast: There is decent support near 1.0700

- EUR/USD traded with decent gains and revisited 1.0780.

- Germany’s flash CPI confirmed disinflationary pressures remain in place.

- The US Dollar gave away part of its recent sharp uptick.

The noticeable drop in the Greenback prompted a similarly decent advance in EUR/USD, which managed to revisit the 1.0780 zone after bottoming out near 1.0720, or two-month lows, early on Tuesday.

Price action in spot, in the meantime, were accompanied by mixed developments in US yields, vs. a meaningful bounce in German 10-year bund yields, while the monetary policy framework stayed unchanged.

Regarding monetary policy, both the Federal Reserve (Fed) and the European Central Bank (ECB) are expected to begin easing cycles, possibly starting in June. However, the pace of subsequent interest rate cuts may differ, leading to potentially divergent strategies between the two central banks. Nonetheless, it is anticipated that the ECB will not significantly lag behind the Fed.

According to the FedWatch Tool offered by CME Group, the likelihood of a rate cut in June hovered around 62%.

Around a potential ECB rate cut, and prior to the release of flash inflation figures in the euro bloc on Wednesday, advanced CPI in Germany showed further disinflationary pressures during March after the CPI rose by 2.2% over the last twelve months (from 2.5%).

On the other side, Cleveland Fed President L. Mester said on Tuesday that she still sees the Fed cutting its interest rates later in the year.

Looking at the medium-term horizon, the relatively subdued fundamentals of the euro area, along with the growing likelihood of a "soft landing" for the US economy, reinforce expectations of a stronger Dollar in the medium term, especially as both the ECB and the Fed potentially implement their easing measures almost simultaneously. In such a scenario, EUR/USD could undergo a more significant correction, initially targeting its year-to-date low around 1.0700 before potentially revisiting the lows observed in late October 2023 or early November near the 1.0500 level.

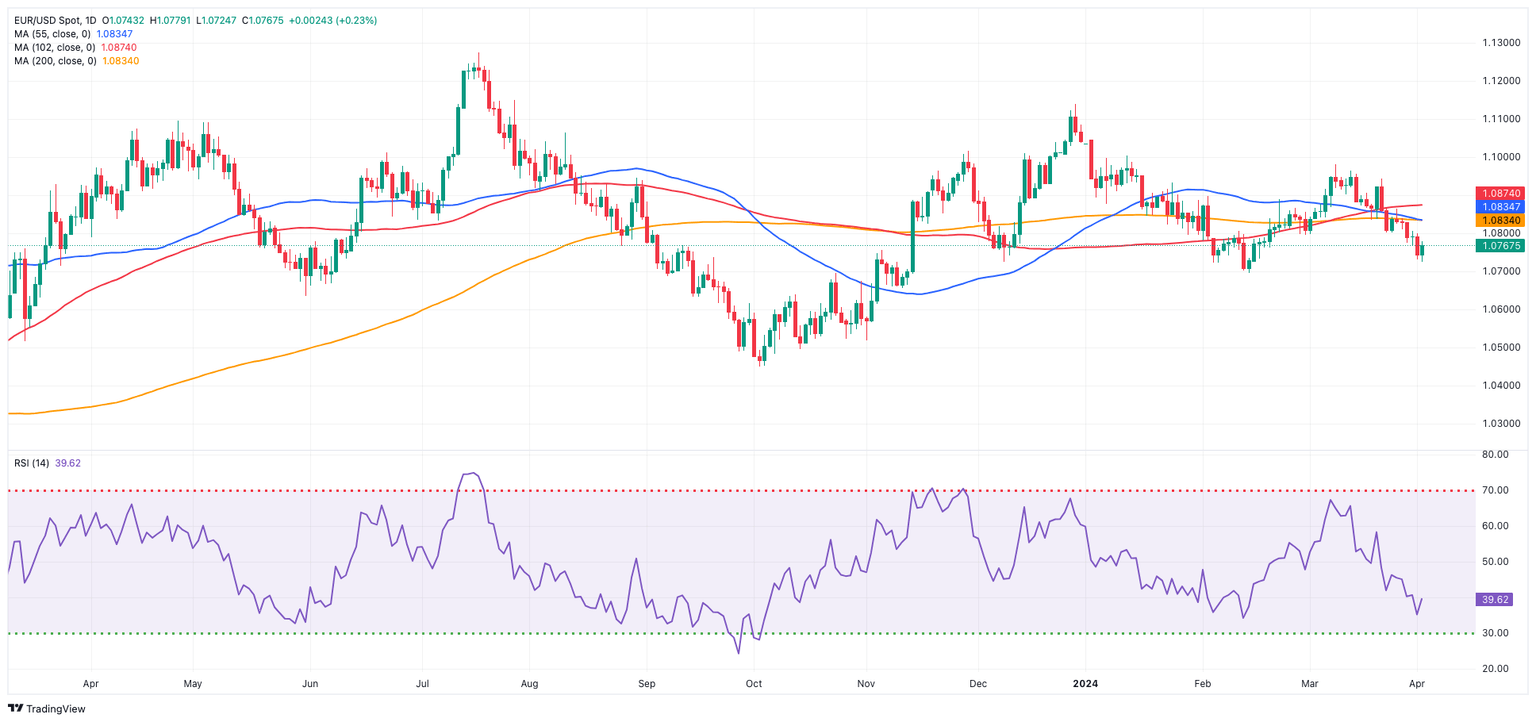

EUR/USD daily chart

EUR/USD short-term technical outlook

On the upside, EUR/USD is projected to encounter early resistance at the key 200-day SMA at 1.0833 ahead of the interim 100-day SMA at 1.0875. The surpass of this region exposes the March high of 1.0981 (March 8), then the weekly top of 1.0998 (January 11) and the psychological barrier of 1.1000. Further advances from here might lead to a December 2023 peak of 1.1139 (December 28).

On the downside, another test of the so-far April low of 1.0724 (April 2) should not be ruled out ahead of the 2024 low of 1.0694 (February 14). Down from here emerges the November 2023 low of 1.0516 (November 1), seconded by the weekly low of 1.0495 (October 13, 2023), the 2023 bottom of 1.0448 (October 3), and the round level of 1.0400.

The 4-hour chart shows a significant bounce from recent lows near 1.0720. The initial level of resistance is 1.0779, ahead of the 55-SMA of 1.0817 and the 200-SMA of 1.0845. In the other direction, the next visible downward barrier looks to be 1.0724, followed by 1.0694 and 1.0656. The Moving Average Convergence Divergence (MACD) remained negative, with the Relative Strength Index (RSI) climbing past 45.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.