EUR/USD Forecast: The bearish tone remains unchanged

- EUR/USD flirted once again with the 2024 lows on Thursday.

- Fed officials pushed back rate cut bets.

- ECB’s Lagarde speaks again on Friday.

The selling bias in EUR/USD remained well in place on Thursday, retreating once again to the area of YTD lows near 1.0840, although it managed to regain some balance afterwards.

The continuation of the uptrend in the greenback was again propped up by firmer readings from US weekly results from the labour market and a healthy rebound in the Philly Fed Manufacturing Index.

The USD Index (DXY) kept its bullish note intact and was further supported by comments from R. Bostic (Atlanta), who expressed his willingness to initiate rate cuts before July if there is "convincing" evidence of inflation slowing down more rapidly than expected. He reiterated that the baseline plan is for rate reductions to begin in the third quarter but emphasized the need for caution to avoid cutting too early and risking a resurgence of demand and price pressures. Given the uncertainty, he suggested that it would be unwise for the Fed to commit to any specific approach at this point.

In the meantime, the probability of a rate cut by the Fed in March hovers around 55%, according to CME Group’s FedWatch Tool.

It is worth remembering that ECB President C. Lagarde suggested a probable reduction of the bank’s rates at some point in the summer.

Still around the ECB, the central bank published its Accounts of the December meeting, noting the trajectory of interest rates aligns with reaching the inflation target in the second half of 2025, accompanied by a decline in inflation and a consistent shift in wages. Members also expressed increased confidence in attaining the 2% inflation target, though they emphasize the need for caution, considering the possibility of inflation picking up in the short term.

Looking at the money markets, US yields retreated marginally on the short end of the curve vs. the continuation of the recent upward bias on the belly and the long end. In Germany, further gains saw 10-year bund yields rise past 2.30%.

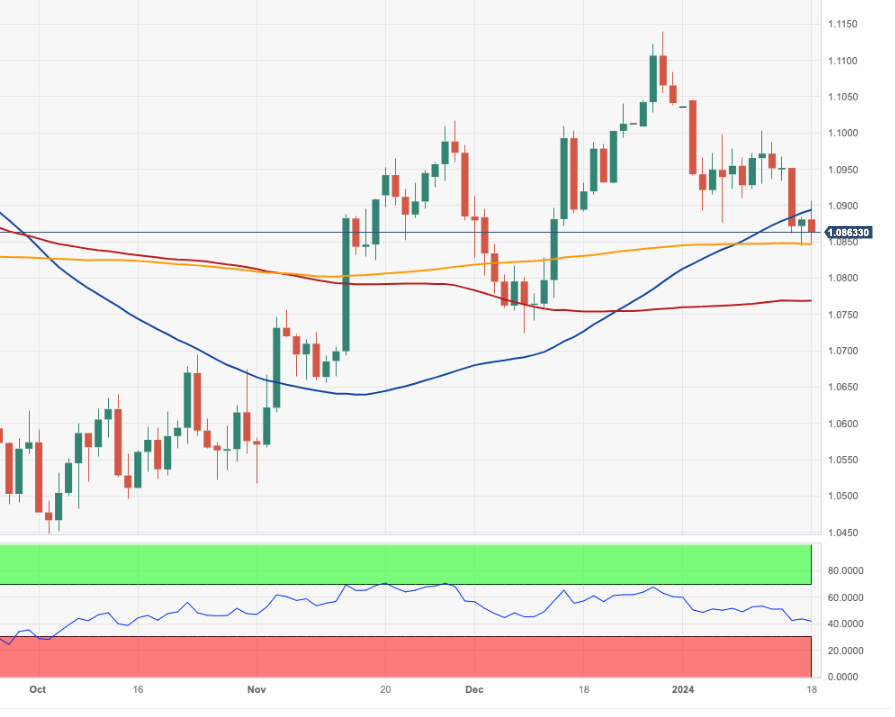

EUR/USD daily chart

EUR/USD short-term technical outlook

Immediately to the downside for EUR/USD is the 2024 low of 1.0844 (January 17), which coincides with the key 200-day SMA. If this area is lost, a challenge of the December 2023 low of 1.0723 (December 8) may appear ahead of the weekly low of 1.0495 (October 13, 2023), followed by the October 2023 low of 1.0448 (October 3) and the round level of 1.0400. A sustained breach of the 200-day SMA is projected to change the outlook for the pair to negative. On the upside, surpassing the weekly high of 1.0998 (January 5, 11) might encourage the pair to revisit the December 2023 peak of 1.1139 (December 28).

The 4-hour chart currently shows a potential near-term rebound. The collapse of 1.0844 should not see any notable support levels until 1.0723. The MACD is likewise in the negative zone, while the RSI has risen to the vicinity of the 40 zone. In the case of a bullish effort, the 200-SMA at 1.0919 provides immediate resistance, followed by the 100-SMA at 1.0963, ahead of 1.0998.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.