EUR/USD Forecast: Sellers struggle to retake control

- EUR/USD holds steady above 1.0800 following Thursday's volatile action.

- Near-term technical outlook suggests that buyers remain interested.

- The US economic docket will not offer any high-impact data releases.

EUR/USD reversed its direction after climbing toward 1.0900 on Thursday and closed the day virtually unchanged below 1.0850. The pair holds steady above 1.0800 in the European morning on Friday and the technical picture does not point to a buildup of bearish momentum.

The positive shift seen in risk mood caused the US Dollar (USD) to weaken against its rivals in the first half of the day on Thursday. The data from the US, however, helped the US Treasury bond yields edge higher and supported the currency.

The number of first-time applications for unemployment benefits declined to its lowest level since early January at 201,000 in the week ending February 17, down from 213,000 in the previous week. Additionally, S&P Global Composite PMI came in at 51.4 in February's advanced estimate. Although this reading was lower than January's 52, it showed that the private sector's economic activity remained in the expansion territory.

Later in the European session, IFO will release the findings of the German business sentiment survey. Several European Central Bank (ECB) policymakers are scheduled to speak as well. The US economic docket will not offer any high-tier data releases.

Following Thursday's risk rally, US stock index futures trade little changed early Friday. In case safe-haven flows return to markets after Wall Street's opening bell, EUR/USD could find it difficult to gather bullish momentum ahead of the weekend. On the other hand, an extension of the risk rally could help the pair regain traction.

EUR/USD Technical Analysis

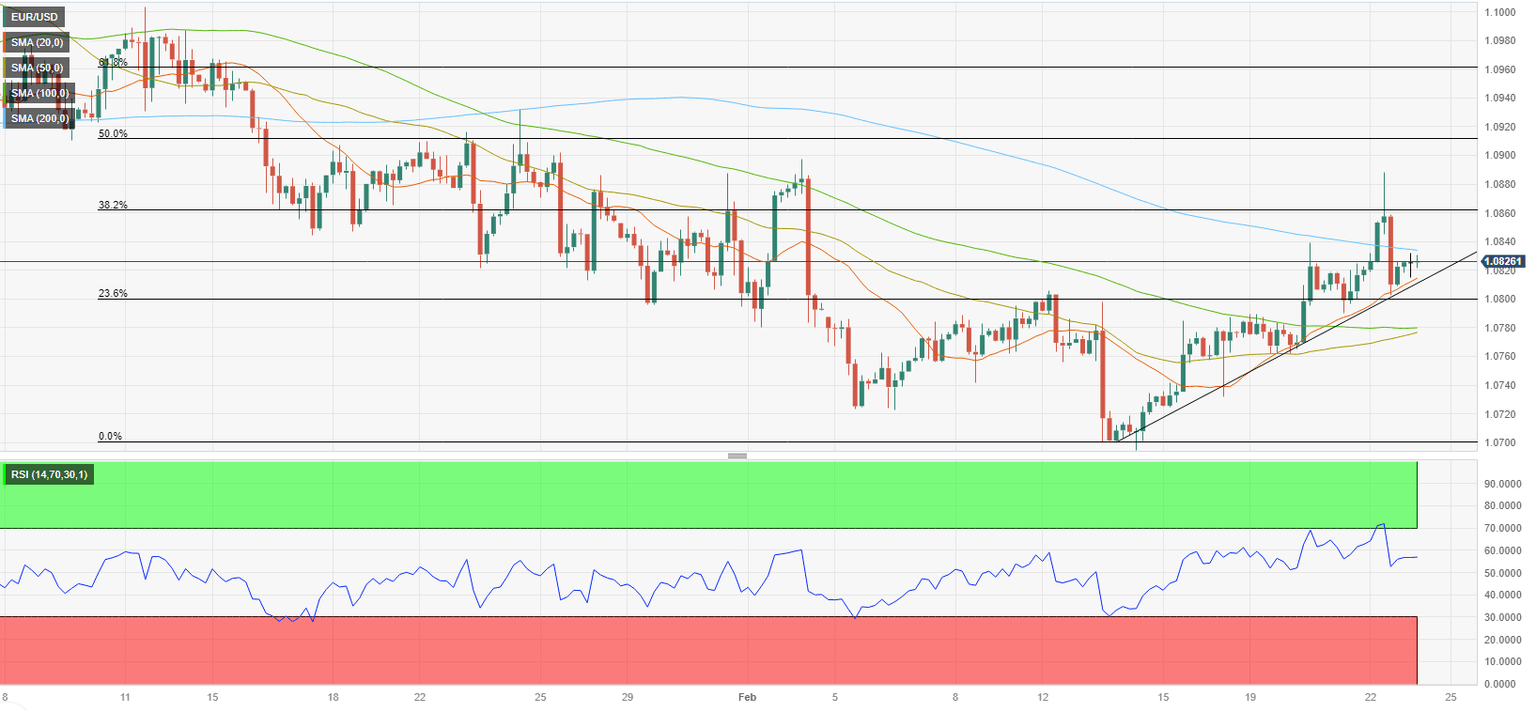

EUR/USD retreated below the 200-period Simple Moving Average (SMA), currently located at 1.0830, on the 4-hour chart and closed the last 4 4-hour candles below that level. On an encouraging note for the bulls, the pair holds above the ascending trend line and the Relative Strength Index (RSI) indicator stays above 50.

If EUR/USD manages to climb above 1.0830 and confirm that level as support, 1.0860 (Fibonacci 38.2% retracement of the latest downtrend) could be seen as the next bullish target ahead of 1.0900-1.0910 (psychological level, Fibonacci 50% retracement).

On the downside, 1.0820 (ascending trend line) aligns as immediate support before 1.0800 (psychological level, Fibonacci 23.6% retracement) and 1.0780 (100-period SMA, 50-period SMA).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.