EUR/USD Forecast: Sellers gain ground, aim to break the 1.0800 mark

EUR/USD Current price: 1.0818

- Stock markets trade mixed ahead of Wall Street’s opening, with US futures ticking higher.

- The Eurozone reported March Consumer Confidence remained steady at -14.9.

- EUR/USD bearish case became more evident in the near term.

The EUR/USD pair trades with a softer tone on Wednesday, hovering around the 1.0820 mark and still confined to a tight intraday range. Financial markets lack a catalyst these days, as the macroeconomic calendar has nothing relevant to offer until next Friday when the United States (US) will release the Personal Consumption Expenditures (PCE) Price Index, the Federal Reserve (Fed) favorite inflation gauge.

Investors took some clues from stock markets, although activity there has also been restricted. Wall Street closed Tuesday with losses, although futures suggest a positive opening later today. Meanwhile, Asian and European indexes traded mixed, not far from their opening levels.

News from the Eurozone had no impact on the Euro, as March Consumer Confidence, as measured by the European Commission, was -14.9, matching February’s reading. Across the pond, the US published MBA Mortgage Applications, down 0.7% in the week ended March 22. A couple of Fed speakers will hit the wires during the American afternoon and may provide hints on their rate-cut outlook.

EUR/USD short-term technical outlook

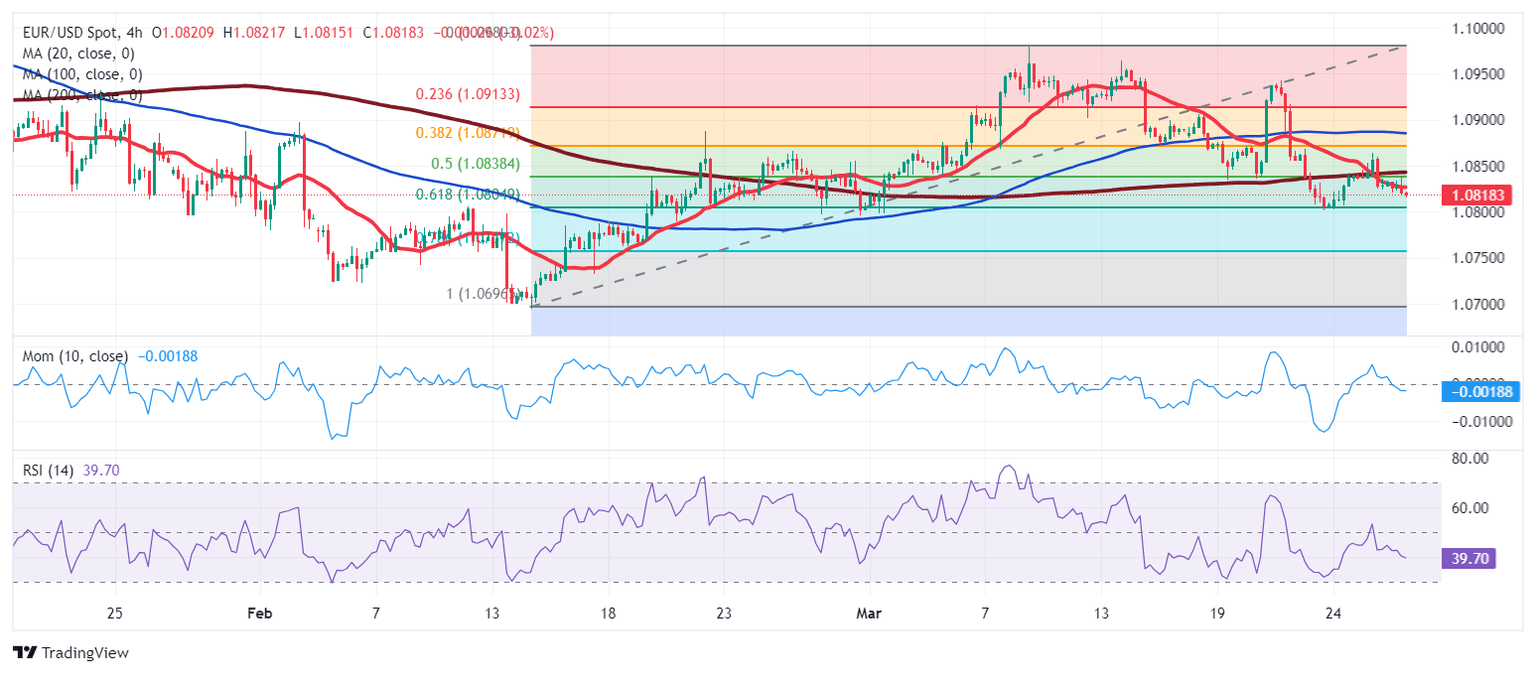

The EUR/USD pair nears its weekly low ahead of Wall Street’s opening, and the daily chart shows an increased bearish potential. Sellers rejected intraday advances at around the 50% Fibonacci retracement of the 1.0694/1.0981 rally at 1.0835, with the level reinforced by a directionless 200 Simple Moving Average (SMA). Meanwhile, the 20 and 100 SMAs hover around the 38.2% retracement of the same rally at 1.0870, the level to clear to see EUR/USD gaining upward traction. Finally, the daily chart shows technical indicators heading firmly lower within negative levels and at fresh multi-week lows, in line with a bearish breakout of the 1.0800 threshold.

Technical readings in the 4-hour chart also confirm a bearish extension, as EUR/USD is unable to gain upward traction beyond a bearish 20 SMA. Upticks beyond it are being quickly reverted ahead of the longer moving averages, which, anyway, lack directional strength. Technical indicators, in the meantime, have turned south. The Momentum indicator is crossing its midline into negative territory, still within neutral levels, while the Relative Strength Index (RSI) indicator aims south at around 39.

Support levels: 1.0795 1.0750 1.0710

Resistance levels: 1.0835 1.0870 1.0920

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.