EUR/USD Forecast: Sellers could take action with a drop below 1.0200

- EUR/USD has turned south amid risk aversion on Tuesday.

- 1.0200 aligns as key technical support for the pair.

- Markets keep a close eye on geopolitical developments.

EUR/USD has reversed its direction following Monday's rally and declined toward 1.0200 during the European trading hours on Tuesday. The pair could extend its slide if 1.0200 support fails and markets participants will keep a close eye on geopolitical development.

Markets have turned risk-averse ad safe haven flows started to dominate the action early Tuesday on reports suggesting that US House of Representatives Speaker Nancy Pelosi was planning to visit Taiwan. According to the latest headlines, Pelosi's delegation is expected to arrive in Taiwan at 1420 GMT.

In response, “There will be serious consequences if she insists on making the visit," Chinese foreign ministry spokesperson Zhao Lijian said. Chinese news outlets also reported that Taiwan would face "disastrous consequences" and that the US would pay the price for undermining China's interests.

Reflecting the negative impact of these developments on market mood, US stock index futures are down between 0.4% and 0.7%.

In case investors continue to seek refuge, the dollar should be able to continue to outperform its rivals. The US economic docket will feature JOLTS Job Openings data for June but the risk perception is likely to remain the primary market driver.

On the other hand, a positive shift in sentiment with a de-escalation of China-US tensions could help EUR/USD regather its bullish momentum.

EUR/USD Technical Analysis

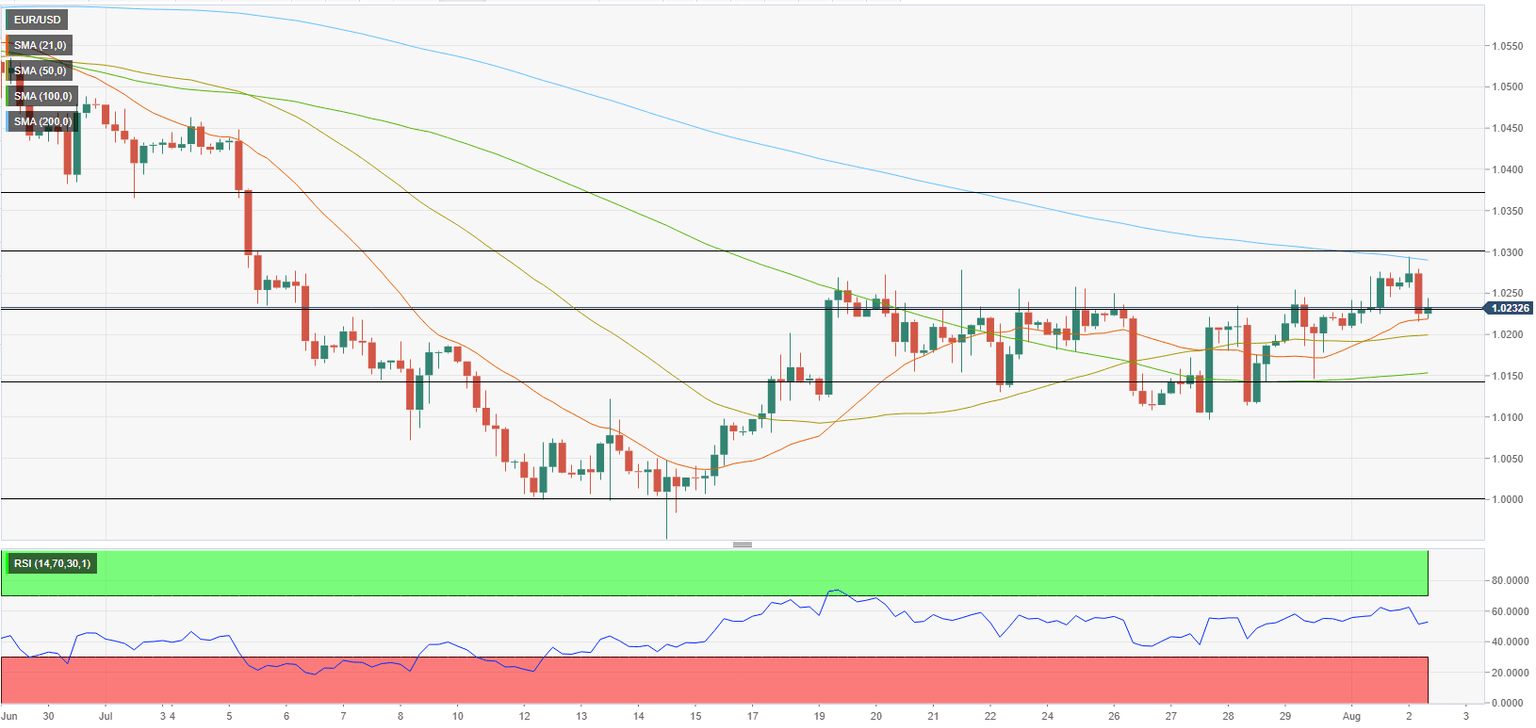

EUR/USD was last seen trading near 1.0230, where the Fibonacci 38.2% retracement level of the latest downtrend is located. If buyers fail to reclaim that level, 1.0200 (psychological level, 50-period SMA on the four-hour chart) aligns as key support ahead of 1.0150 (Fibonacci 23.6% retracement, 100-period SMA).

On the upside, 1.0300 (psychological level, Fibonacci 50% retracement, 200-period SMA) forms significant resistance ahead of 1.0370 (Fibonacci 61.8% retracement).

In the meantime, the Relative Strength Index (RSI) indicator has retreated toward 50 with the latest decline, suggesting that bulls remain hesitant to bet on further euro strength.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.