EUR/USD Forecast: Sellers could take action if 1.0500 support fails

- EUR/USD has reversed its direction following Tuesday's decisive rebound.

- The greenback holds its ground on Wednesday with the risk rally losing its steam.

- 1.0500 aligns as key support level in the near term.

EUR/USD has lost its bullish momentum after having closed the previous three trading days in positive territory. The pair is edging lower toward 1.0500 and sellers could come back in play in case that level fails.

Hawkish comments from European Central Bank (ECB) officials provided a boost to the shared currency on Tuesday. ECB Governing Council member Klaas Knot argued that a 50 basis points rate hike should not be excluded if data in the next few months suggest that inflation is broadening and accumulating. Similarly, ECB's Mario Centeno reiterated that the normalization of the monetary policy was desired and had to happen.

In addition to the renewed euro strength, the broad-based selling pressure surrounding the dollar allowed EUR/USD to extend its rally. With global stocks posting strong gains on Tuesday, the US Dollar Index posted its largest one day decline, 0.85%, in two weeks.

Nevertheless, the cautious market mood and rising US Treasury bond yields help the greenback hold its ground mid-week, causing EUR/USD to stay under bearish pressure.

There won't be any high-impact data releases in the remainder of the day and the risk perception is likely to remain the primary market driver. Eurostat will release the inflation data for April but the market reaction should remain muted due to the fact that it will be a revision to the flash estimate, which showed that the HICP was 7.5% on a yearly basis.

In case Wall Street's main indexes fall sharply after the opening bell, EUR/USD could stretch its daily slide in the second half of the day.

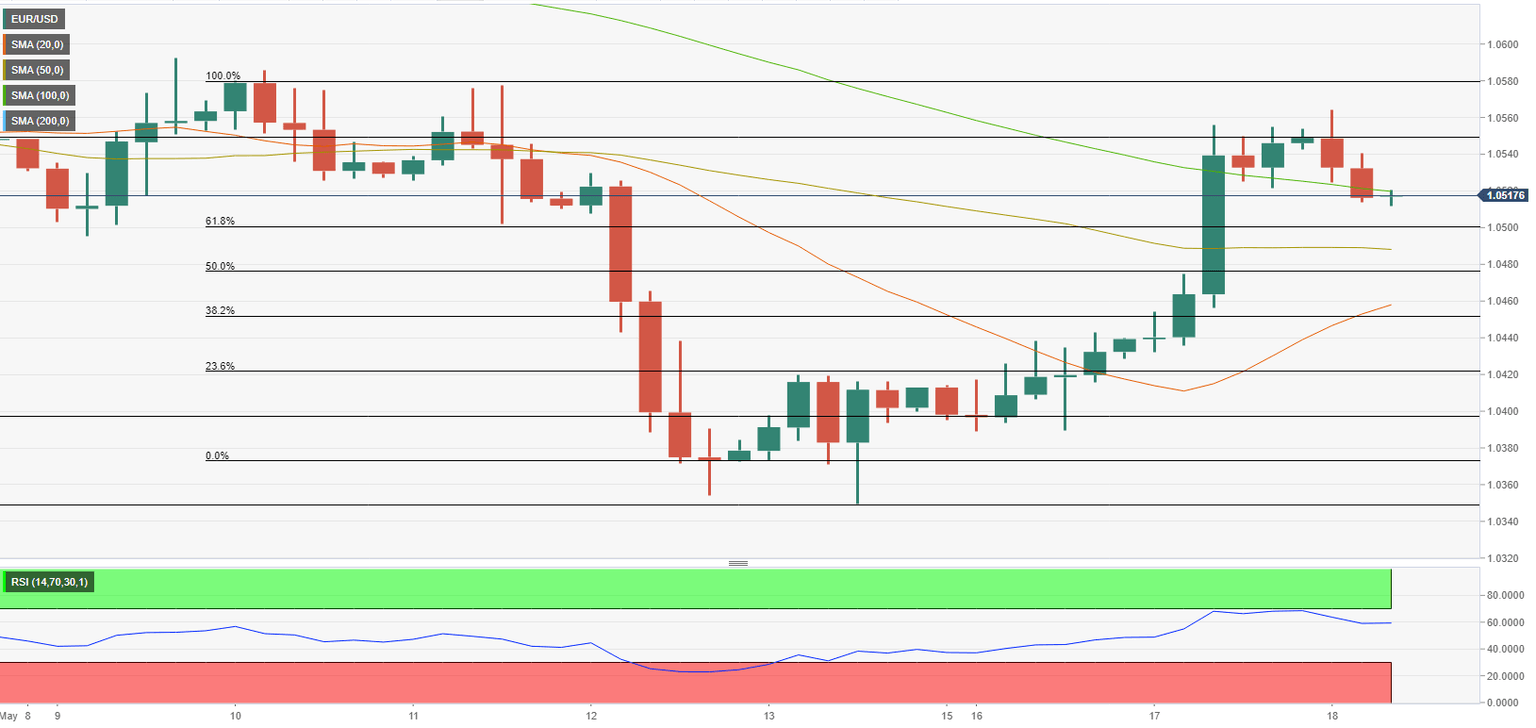

EUR/USD Technical Analysis

EUR/USD is currently testing the 100-period SMA on the four-hour chart, which is currently located at 1.0520. In case the pair starts using that level as resistance, it might test 1.0500 (psychological level, Fibonacci 61.8% retracement of the latest decline). A four-hour close below that level could be seen as a bearish development and open the door for additional losses toward 1.0480 (Fibonacci 50% retracement) and 1.0450 (Fibonacci 38.2% retracement).

On the upside, static resistance seems to have formed at 1.0550. The pair needs to clear that hurdle to target the next static level at 1.0580 and 1.0600 (psychological level) afterwards.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.