EUR/USD Forecast: Sellers about to retake control

EUR/USD Current price: 1.0795

- The United States Producer Price Index shrank by more than expected in May.

- European Central Bank officials cool down hopes for additional rate cuts.

- EUR/USD’s near-term picture suggests bears could soon take control.

The EUR/USD pair trades around the 1.0800 mark ahead of Wall Street’s opening and after peaking at 1.0851 in the previous American session. Financial markets cooled down after United States (US) first-tier events shook the boards on Wednesday. The country published the May Consumer Price Index (CPI), which showed price pressures eased in the month more than anticipated. The news spurred optimism and put the US Dollar into a selling spiral, which lasted until the Federal Reserve (Fed) announced its monetary policy decision.

The central bank kept interest rates unchanged, floating in a 5.25%-5.50% range, as widely anticipated. The accompanying statement showed policymakers remain worried about inflation, as also reflected by the Summary of Economic Projections (SEP). Officials upwardly revised their inflation projections and maintained growth-related ones unchanged. On potential rate cuts, the vote was pretty much split between one and two interest rate cuts before year-end. The US Dollar trimmed part of its intraday losses with the news.

As the new day began, equities turned south. Most Asian and European indexes stand in the red, leading to uneven losses among US futures. Meanwhile, European Central Bank (ECB) Governing Council member Madis Muller hit the wires and noted inflation could temporarily accelerate again, adding that rates will probably stay above average for some time and that it is too early to say when the next rate cut may happen.

Also, ECB policymaker Bostjan Vasle said the central bank would make data-dependent decisions and remarked additional rate cuts are possible if the baseline scenario holds. He also noted there’s a risk that the disinflation process could slow down while the wage momentum is still relatively strong.

Data-wise, Germany released the May Wholesale Price Index, which rose 0.1% MoM and fell by 0.7% from a year earlier. Also, Eurozone Industrial Production fell in April, missing expectations. Across the pond, the US released Initial Jobless Claims for the week ended June 7, which unexpectedly rose to 224K, much worse than the 225K expected.

Additionally, the May Producer Price Index (PPI)contracted by 0.2% MoM and rose 2.2% YoY, below the previous figures and market expectations. The news put pressure on the USD, helping EUR/USD recover from an intraday low of 1.0780.

EUR/USD short-term technical outlook

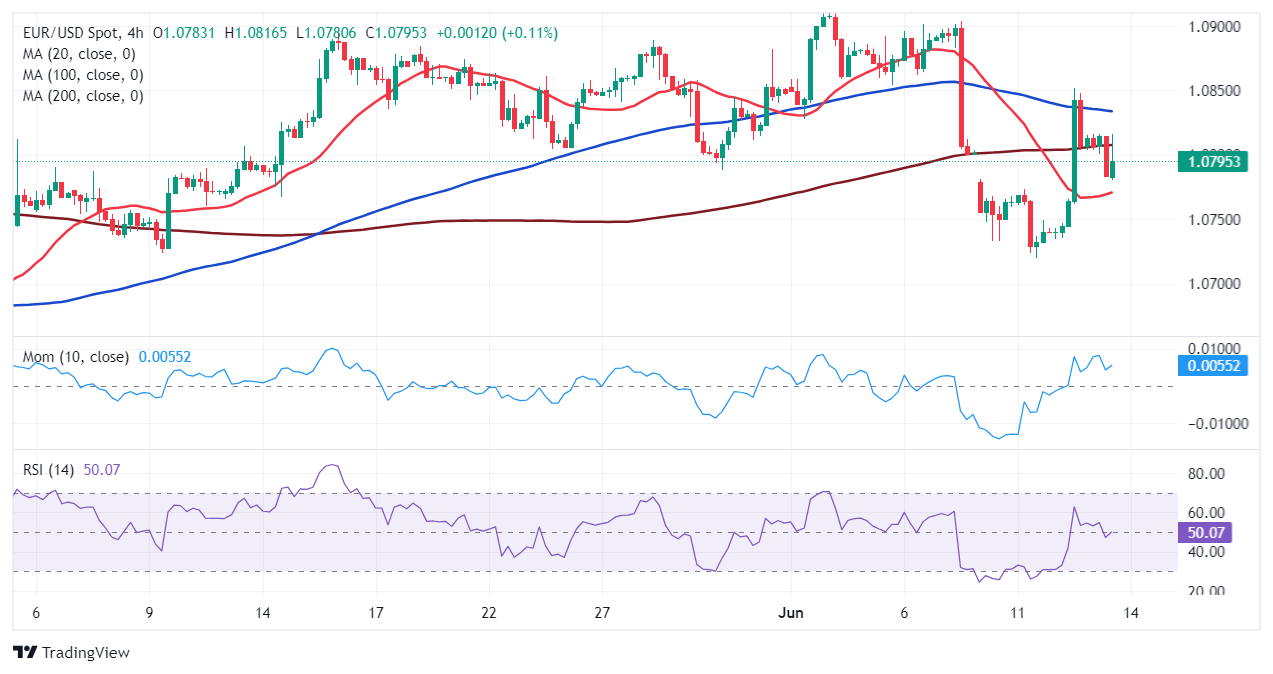

Technically speaking, EUR/USD seems poised to extend its slump. In the daily chart, the pair struggles with a directionless 100 Simple Moving Average (SMA), while the 20 SMA gains downward traction above the current level. Technical indicators, in the meantime, topped around their midlines and slowly grind lower, in line with mounting selling interest. EUR/USD met intraday buyers at 1.0780, with the level reinforced by a flat 200 SMA.

In the near term, and according to the 4-hour chart, the pair presents a neutral-to-bearish stance. It stands mid-way between directionless 20 and 100 SMAs, with the shorter one standing a few pips below the intraday low. At the same time, the Momentum indicator slides towards its midline, while the Relative Strength Index (RSI) indicator challenges its 50 level, supporting another leg south without confirming it just yet.

Support levels: 1.0780 1.0745 1.0710

Resistance levels: 1.0840 1.0885 1.0920

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.