- EUR/USD has been moving higher as ECB speakers reiterate their comfort with the euro's value.

- The resumption of a COVID-19 vaccine trial is outweighing rising cases in the old continent.

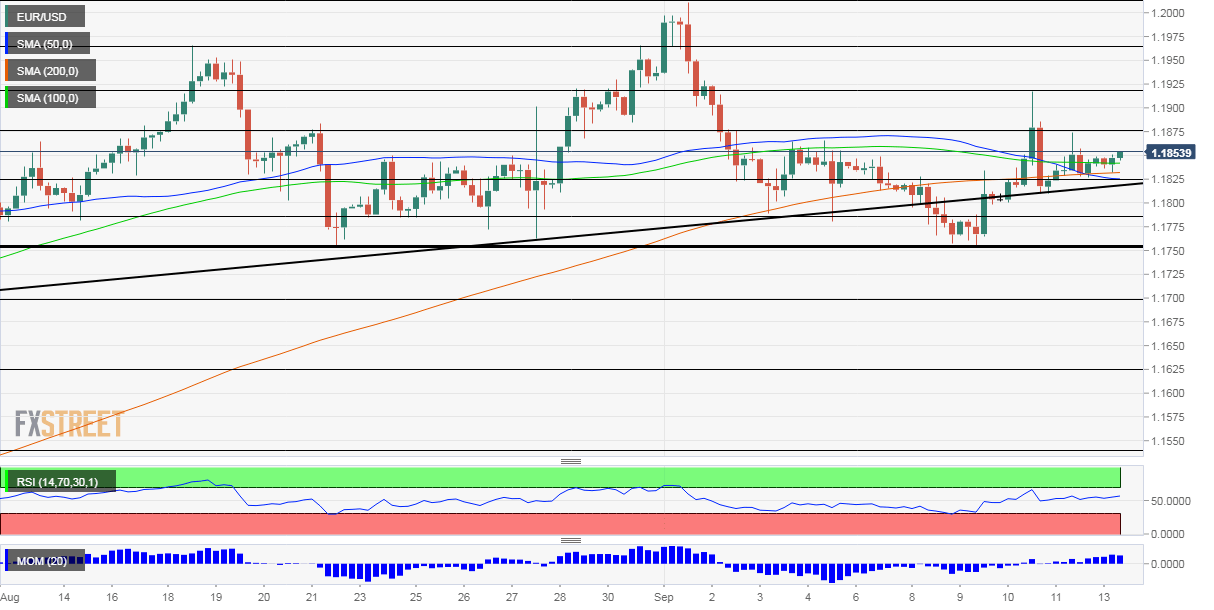

- Monday's four-hour chart is painting a bullish picture.

"We do not target the exchange rate" – Several members of the European Central Bank have echoed Christine Lagarde, President of the ECB, over the weekend. While officials from Vice President Luis de Guindos to Chief Economist Philip Lane said the euro's value impacts inflation, their lax approach is seen by some as a "license to rise."

Goldman Sachs went as far as saying EUR/USD's fair value is 1.30, citing the ECB's acceptance of a higher rate as one of the reasons for seeing it rise.

The world's most popular currency pair is trading 1.1850, gaining ground in response to Thursday's decision by the bank and also as the safe-haven dollar loses ground on fresh optimism about a coronavirus vaccine.

AstraZeneca and the University of Oxford announced that their COVID-19 immunization project – considered one of the world's most advanced – will resume in the UK. The Phase 3 trial was halted after one of the participants fell ill. Pfizer, a larger pharma firm, hopes to be able to supply doses of a vaccine by year-end.

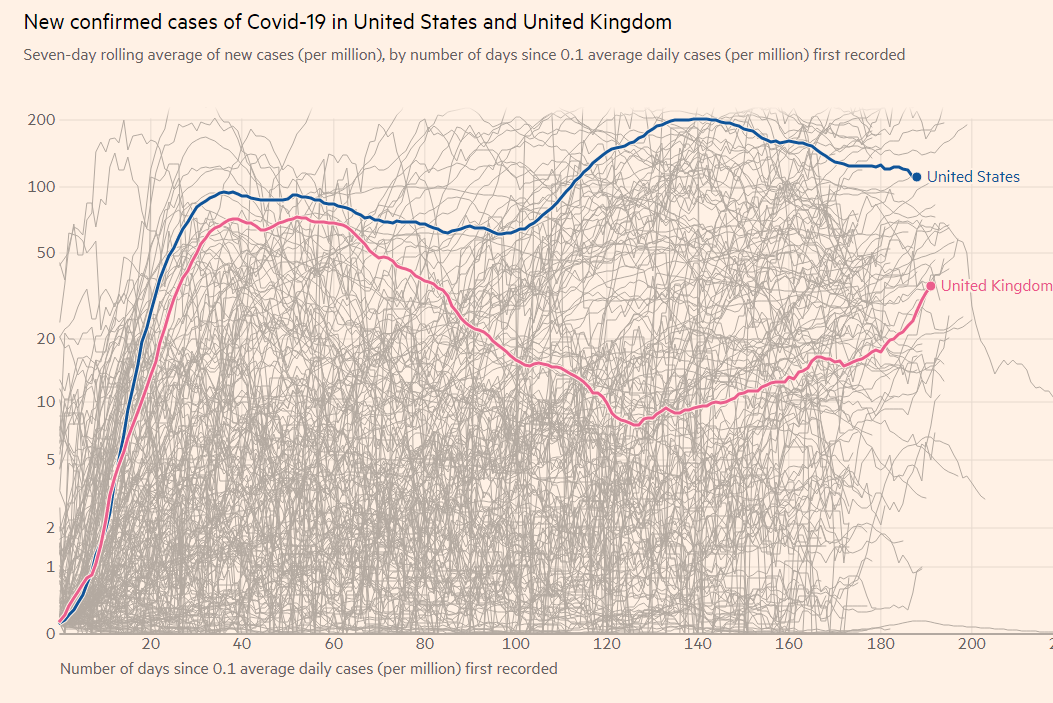

Investors seem to be shrugging off the rise in coronavirus infections across the old continent. Spain, France, and Austria have been standing out in news reports. While cases are increasing, deaths remain at low levels and health systems are coping so far.

Source: FT

Falling COVID-19 infections and mortalities in the US are set to contribute to a "no-change" decision by the Federal Reserve later this week. The world's most powerful central bank announced a long-term dovish policy shift – prioritizing full employment at the expense of higher inflation.

America's Consumer Price Index figures came out above expectations in August, but are unlikely to move the needle for markets. Investors are also eyeing retail sales statistics due out on Wednesday, the same day as the Fed.

Overall, markets are upbeat after a turbulent week, and without surprisingly depressing news, Monday's session could see further EUR/USD gains.

EUR/USD Technical Analysis

Euro/dollar has moved above the 100 Simple Moving Average on the four-hour chart after advancing above the 50 and 200 SMAs earlier on. Momentum remains to the upside and the currency pair is holding above the uptrend support line it recaptured.

All in all, bulls are in control.

Some resistance awaits at 1.1875, which was a swing high late last week. The next level to watch is 1.1920, the post-ECB peak, followed by 1.1965 and 1.2010.

Support is at 1.1820, which was a cushion late last week and where the 50 SMA hits the price. The next level is 1.1780, a support line from early September, followed by 1.1750, a double-top formed in recent weeks.

More Lagarde gives the euro some legs, but the rabbit hole is near – how central banks move currencies

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD consolidates its recent substantial gains to over one-week high

AUD/USD holds steady above the 0.6300 mark during the Asian session on Tuesday and remains close to a one-and-half-week top touched the previous day. The USD finds some support following the recent sell-off and caps the pair near the 100-day SMA amid the escalating US-China trade war.

USD/JPY trades with positive bias above 143.00; upside potential seems limited

USD/JPY gains some positive traction on Tuesday and now seems to have snapped a three day losing streak to a multi-month low touched last week. The upbeat market mood undermines the safe-haven JPY and lends support amid a modest USD uptick.

Gold price holds steady above $3,200; remains close to all-time peak

Gold price trades above the $3,200 mark following the previous day's modest pullback from a fresh record high as the escalating US-China trade war continues to underpin the safe-haven bullion. Moreover, the Fed rate cut bets lend support to the XAU/USD.

Solana ETF to debut in Canada after approval from regulators

Solana ETF will go live in Canada this week after the Ontario Securities Commission greenlighted applications from Purpose, Evolve, CI and 3iQ. The products will allow staking, enabling investors to earn yield on their holdings.

Is a recession looming?

Wall Street skyrockets after Trump announces tariff delay. But gains remain limited as Trade War with China continues. Recession odds have eased, but investors remain fearful. The worst may not be over, deeper market wounds still possible.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.