EUR/USD Forecast: Painful advance within range

EUR/USD Current Price: 1.1300

- Currencies continue to ignore data, the focus remains on coronavirus-related headlines.

- The US government announced a plan to impose tariffs on French imports for up to $1.3 billion.

- EUR/USD has stabilized at the upper end of its latest range, lacks momentum to break higher.

The EUR/USD pair finished Friday at around 1.1300, posting a modest advance for a third consecutive week. Currencies continued to trade on the heels of coronavirus-related data amid the absence of relevant macroeconomic news. The market’s sentiment was sour amid record new cases in the US, which reported roughly 70,000 new contagions in a day for three days in-a-row. The mood improved after Gilead reported that its drug, remdesivir, can reduce the risk of mortality in COVID-19 patients by 62% when compared with the standard of care. However, the company also noted that these findings need to be confirmed. Nevertheless, it was enough to push equities higher and the greenback lower.

Weighing on the American dollar, the US Bureau of Labor Statistics announced that the Producer Price Index fell by 0.8% in the year to June, while the core reading came in at 0.1%, both well below the market’s expectations. Late on Friday, the US government announced tariffs of 25% on French imports valued at $1.3 billion in response to France’s digital services tax but would hold off on implementing them for up to 180 days. The news could have a negative impact on financial markets, mainly considering the economic calendar has nothing to offer this Monday.

EUR/USD short-term technical outlook

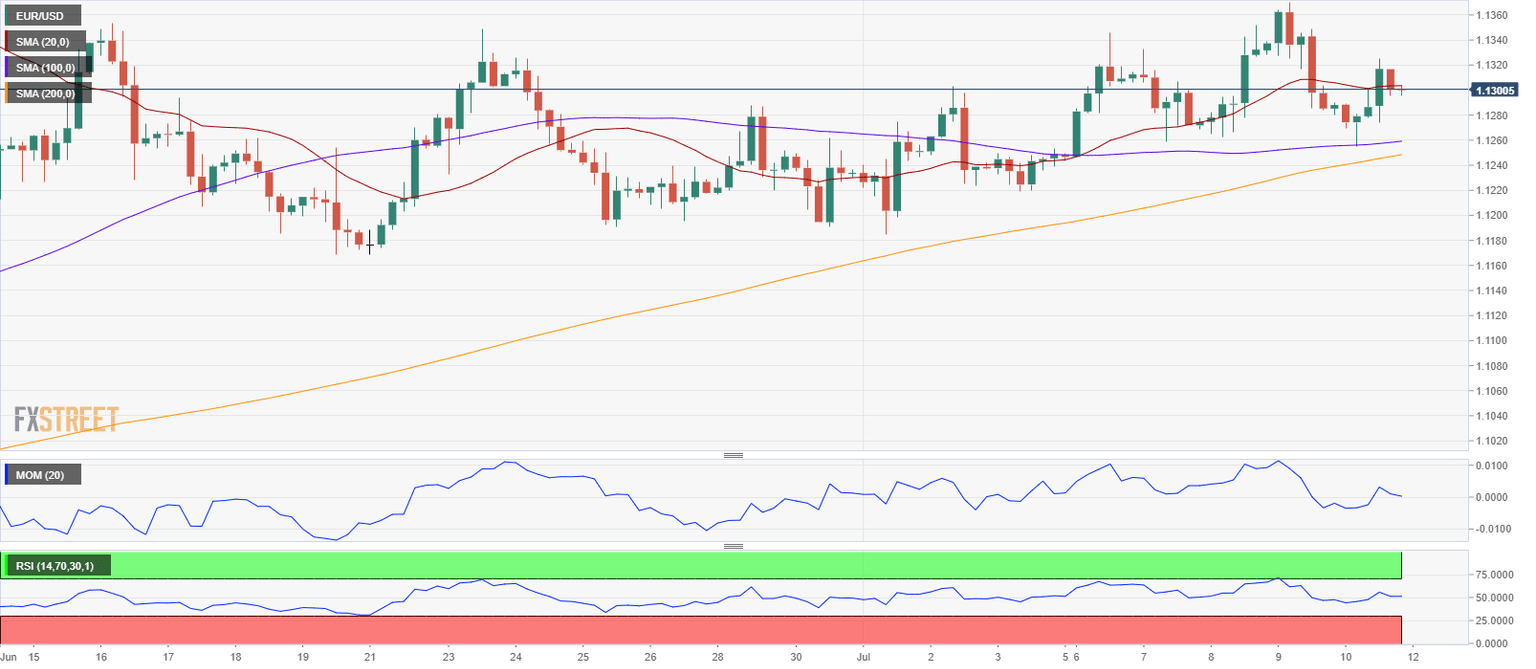

The EUR/USD pair stabilized at higher levels last week, but still lacks the momentum needed to extend its gains. It met buyers at around 1.1270, a Fibonacci support level, but was unable to clear the 1.1340/50 region, quickly retreating after briefly surpassing it. The pair is neutral in the daily chart, as the 20 SMA remains flat a few pips below the mentioned Fibonacci support, while technical indicators keep hovering around their midlines. In the shorter-term, and according to the 4-hour chart, it also offers a neutral stance, struggling with a directionless 20 SMA yet above the larger ones, and as technical indicators remain stuck to neutral readings.

Support levels: 1.1270 1.1220 1.1170

Resistance levels: 1.1345 1.1390 1.1425

View Live Chart for the EUR/USD

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.