- EUR/USD has hit the highest in four weeks amid market optimism.

- Concerns about the EU fund, US jobless claims and coronavirus cases are all eyed.

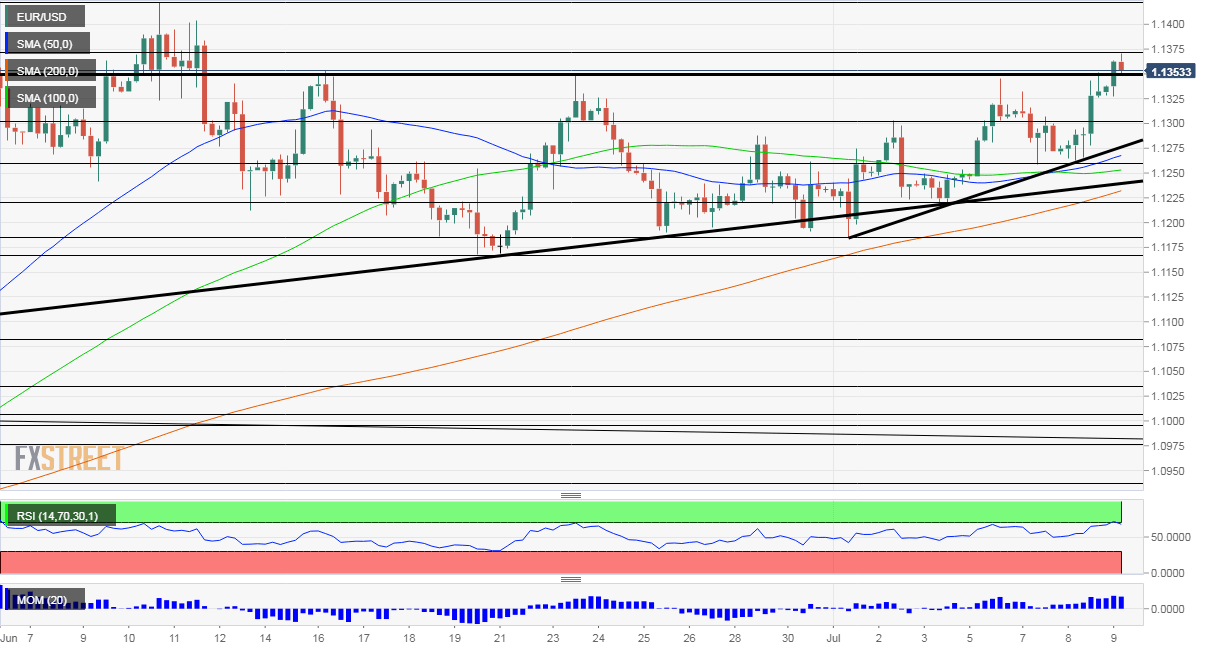

- Thursday's four-hour chart is pointing to overbought conditions.

Investors seem to have fixed rose-tinted glasses to their faces – or see the shining glass half full. The increase in global stocks has pushed the safe-haven dollar down, allowing EUR/USD to reach the highest since June 11.

Massive efforts to find a cure or a vaccine to COVID-19 are partly behind the most recent upswing. Emergent BioSolutions from Maryland is working on a plasma-based drug that will help protect healthcare workers from the disease. Moderna from Massachusets is advancing in its vaccine efforts – and there are dozens of attempts to tackle the illness, from America's Novavax to Oxford's Jenner Institute and up to China and Japan.

Equity bulls are also benefiting from the ongoing support by the Federal Reserve, which continues pumping liquidity via its bond-buying scheme. Can that continue without fiscal support? Lawmakers in Washington have yet to announce a new relief/stimulus package.

Optimism may also come from the administration's push to reopen schools – against the advice of the Center for Disease Control. Investors seem to be shrugging off worrying coronavirus figures – somewhat similar to the attitude in February.

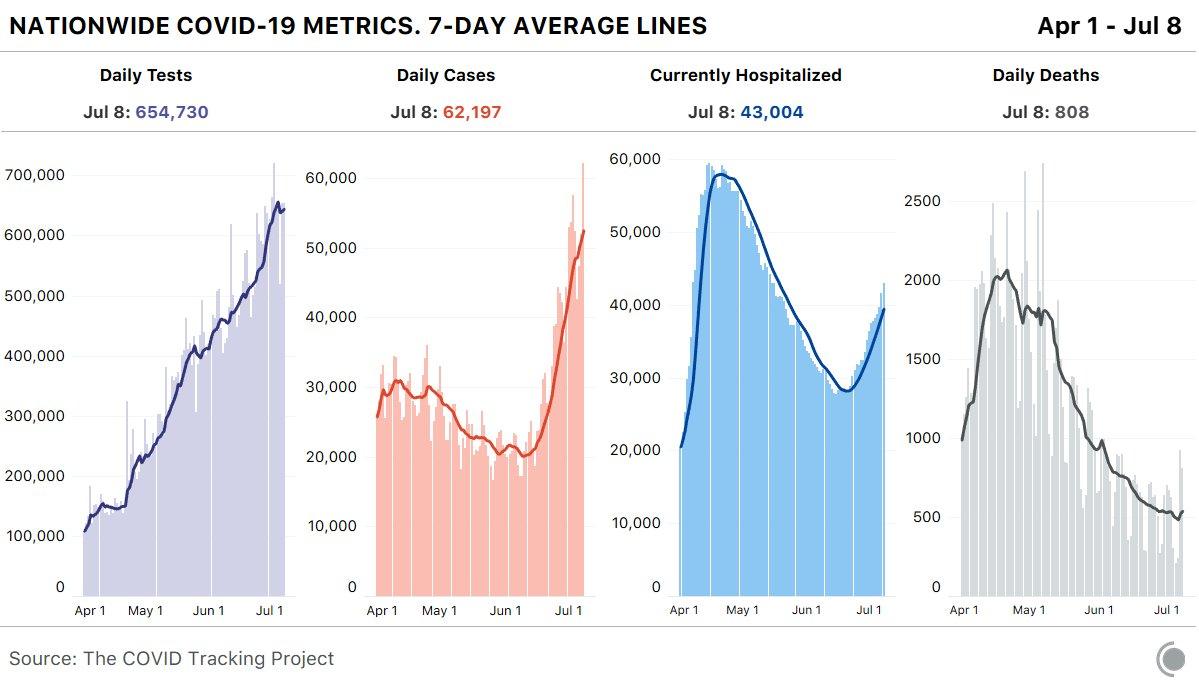

America's case count officially topped three million, with a record 59,000 daily infections reported on Wednesday. The positive test rate remains above 10% in several states – with laboratories overwhelmed in Arizona and other places. Moreover, hospitalizations are on the rise and even deaths – which were on a downtrend – began accelerating.

Source:

Our daily update is published. New records for cases, and a top-5 day for tests. Patients currently hospitalized jumped to over 43,000, about the levels of mid-May.

— The COVID Tracking Project (@COVID19Tracking) July 8, 2020

States reported more than 800 new deaths. The 7-day average is creeping back up. pic.twitter.com/b2IvB4RH7r

Figures from Florida, California, Texas, and other states will be closely watched as well as an update on the labor market. Weekly jobless claims are set to hold up above one million in the week ending on July 3 while continuing claims for the previous week could also remain stubbornly high, near 20 million.

See US Jobless Claims: Employment is up, why are claims not down?

The encouraging Non-Farm Payrolls report for June – which showed an increase of 4.8 million jobs – is based on data from the first half of the month, just before cases began surging.

In the old continent, leaders have yet to agree on the EU Fund, with the clock ticking toward the first face-to-face summit next week. German Chancellor Angela Merkel – who devised the plan with French President Emmanuel Macron – urged countries to seize the moment and act. The "Frugal Four" are reluctant to sign off on a program that includes grants to member states they see as profligate.

Roberto Gualtieri, Italy's finance minister, suggested his battered country may tap the bailout fund – insisting there is no stigma in doing so. Spreads between Italian and German ten-year bond yields remain depressed around 160 basis points.

Christine Lagarde, President of the European Central Bank, has also called on governments to act, yet she has lowered her expectations for an imminent announcement. The ECB will announce its decision next week.

See European Central Bank Preview: EUR/USD depends on Lagarde's fearless nudging of the Frugal Four

Overall, the eurozone currently enjoys several advantages over the US, yet a change in the market mood – stemming from US concerns – may boost the safe-haven dollar.

EUR/USD Technical Analysis

The Relative Strength Index on the four-hour chart is above 70, pointing to overbought conditions – and implying a downward correction. However, momentum remains positive and the currency pair is trading above the 50, 100, and 200 Simple Moving Averages.

Resistance is at 1.1370, the daily high, followed by 1.1420, a high point in early June. Further up, 1.1495 awaits EUR/USD.

Support is at 1.1350, the former triple top, followed by the round 1.13 level, which worked as resistance in early July. Further down, 1.1260 is next.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD turns lower below 1.0350 after German data

EUR/USD comes under mild selling pressure and eases below 1.0350 in the European session on Wednesday. The pair bears the brunt of an unexpected slowdown in the German manufacturing sector, as the nation's Retail Sales data fail to inspire the Euro. Focus shifts to US ADP data and Fed Minutes.

GBP/USD stays defensive below 1.2500 ahead of key US data, Fed Minutes

GBP/USD stays defensive below 1.2500 in the European trading hours on Wednesday, undermined by a risk-off market sentiment and elevated US Treasury bond yields on increased hawkish Fed bets. Traders look to US data, Fedspeak and FOMC Minutes for fresh trading impulse.

Gold eyes US ADP report and Fed Minutes for next push higher

Gold price is consolidating the previous rebound near $2,650 early Wednesday, awaiting the US ADP jobs report and the Minutes of the US Federal Reserve December meeting for the next leg higher.

DOGE and SHIB traders book profits at the top

Dogecoin and Shiba Inu prices broke below their key support levels on Wednesday after declining more than 9% the previous day. On-chain data provider Santiments Network Realized Profit/Loss indicator shows massive spikes in these dog-theme memecoins, indicating traders realize profits.

Five fundamentals for the week: Nonfarm Payrolls to keep traders on edge in first full week of 2025 Premium

Did the US economy enjoy a strong finish to 2024? That is the question in the first full week of trading in 2025. The all-important NFP stand out, but a look at the Federal Reserve and the Chinese economy is also of interest.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.