EUR/USD Forecast: Optimism weighs on the US Dollar

EUR/USD Current price: 1.0895

- Stock markets lead the way as earnings reports beat expectations, fueling risk appetite.

- Investors remain cautious ahead of first-tier events scheduled for Thursday.

- EUR/USD trades with a better tone, but buyers are unlikely to maintain the pressure.

The EUR/USD pair flirts with the 1.0900 threshold ahead of Wall Street’s opening as a better market mood plays against the US Dollar. Still, the pair trades within familiar levels as significant events loom and speculative interest saves its fire for after clearer clues.

The Euro advances despite tepid local data. “Business activity in the euro area fell at the slowest rate for six months in January,” according to the preliminary Producer Manager Index (PMI) survey conducted by the Hamburg Commercial Bank (HCOB), with the official report clarifying “downturns persists in both manufacturing and service sectors amid further falls in new business.”

In Germany, the Manufacturing PMI printed at 45.4, while the services index posted at 47.6. For the Eurozone, the Services PMI came in at 48.4, worse than the previous 48.8, while the manufacturing index improved to 46.6 from 44.4 in December. Later in the day, S&P Global will publish the January United States (US) preliminary PMIs, with manufacturing output expected to remain in expansionary territory.

The cautious stance will likely be dropped on Thursday, when the European Central Bank (ECB) will announce its decision on monetary policy, while the US will unveil the preliminary estimate of the Q4 Gross Domestic Product (GDP).

EUR/USD short-term technical outlook

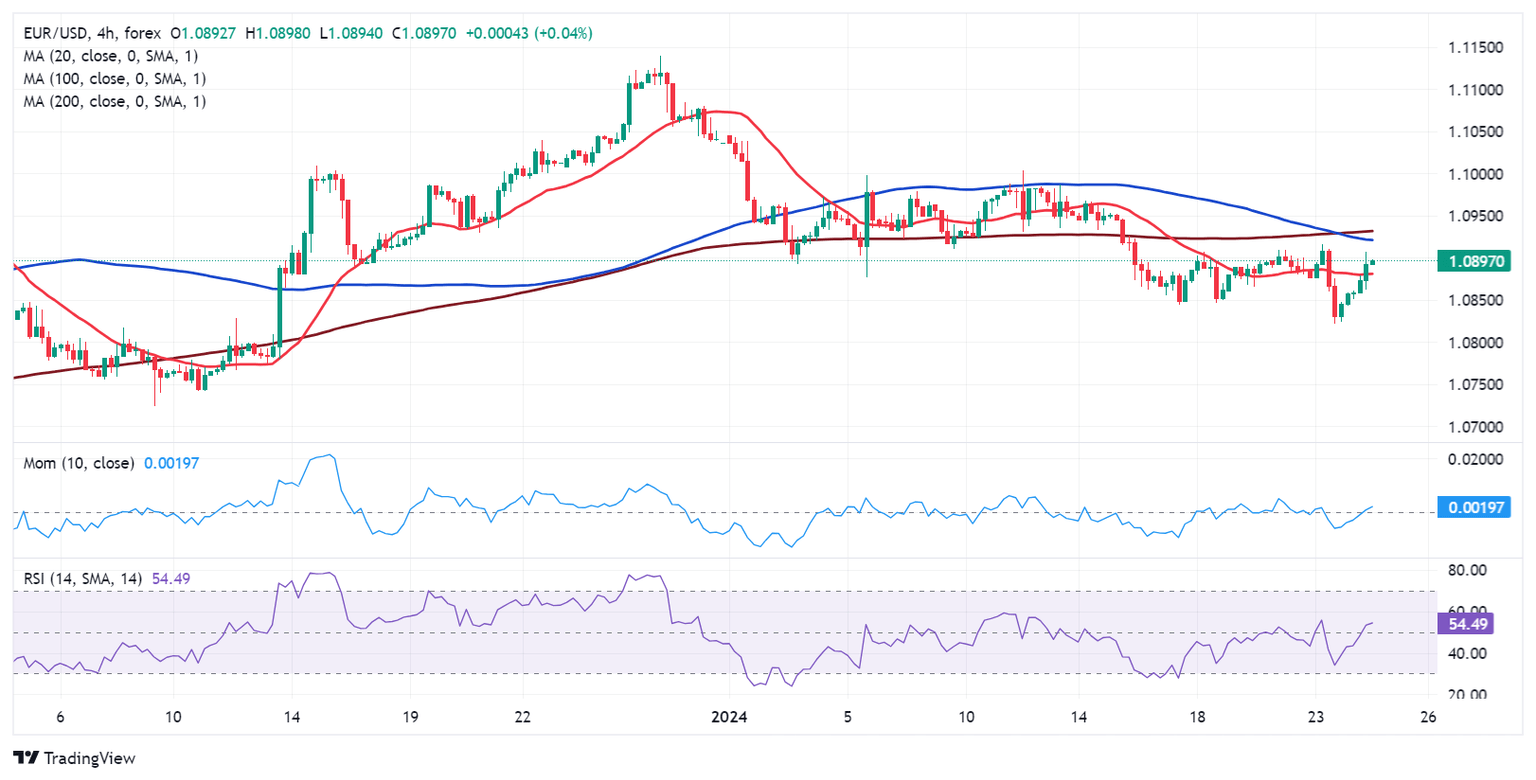

The EUR/USD pair has trimmed its weekly losses but remains below the peak set on Tuesday at 1.0916. The daily chart shows it bounced once again from around a flat 200 Simple Moving Average (SMA), providing dynamic support around 1.0845. At the same time, the 20 SMA maintains its firmly bearish slope above the current level, developing at around 1.0945. Finally, technical indicators remain within negative levels without clear directional strength.

The near-term picture is neutral. Technical indicators in the 4-hour chart have turned flat at around their midlines, suggesting easing buying interest. At the same time, EUR/USD recovered above a flat 20 SMA but trades below the 100 and 200 SMAs, both converging at around 1.0930. Overall, the risk of a steeper recovery seems limited, while a break below 1.0845 should trigger stops and anticipate another leg south.

Support levels: 1.0845 1.0800 1.0760

Resistance levels: 1.0890 1.0945 1.0980

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.