EUR/USD Forecast: Optimism underpins the Euro

EUR/USD Current Price: 1.0606

- German inflation rose less than anticipated in October, Q3 GDP beat expectations.

- European Central Bank is far from considering rate cuts as hikes remain on the table.

- EUR/USD is poised to extend gains, needs to break through 1.0640.

The EUR/USD pair trades marginally higher on Monday as investors gear up for a batch of first-tier events while assessing Middle East developments. On Friday, financial markets were optimistic amid Qatar´s diplomatic intervention in the Israel-Hamas war. Israel launched its military operation on the Gaza Strip over the weekend, but the cautious approach fell short of triggering safe-haven demand, weighing on the US Dollar.

Meanwhile, encouraging European data underpinned the Euro. Germany released the preliminary estimate of the Q3 Gross Domestic Product (GDP), which showed the economy contracted at an annualized pace of 0.1% in the three months to September, better than the 0.3% decline anticipated by market players. At the same time, the Euro Zone Economic Sentiment Indicator resulted at -17.9 in October, matching the previous reading and expectations.

European Central Bank Governing Council member Peter Kazimir was on the wires, saying it’s too early to consider the rate hike cycle is over, as policymakers can not assure the job is done. Also, he made a point about rate cuts, noting that bets happening in the first half of next year are entirely misplaced.

Finally, Germany unveiled the preliminary estimate of the October Harmonized Index of Consumer Prices (HICP), confirmed at 3% YoY, easing from 4.3% in September and below the 3.6% anticipated. The United States (US) macroeconomic calendar will only offer the October Dallas Fed Manufacturing Business Index, previously at -18.1.

EUR/USD short-term technical outlook

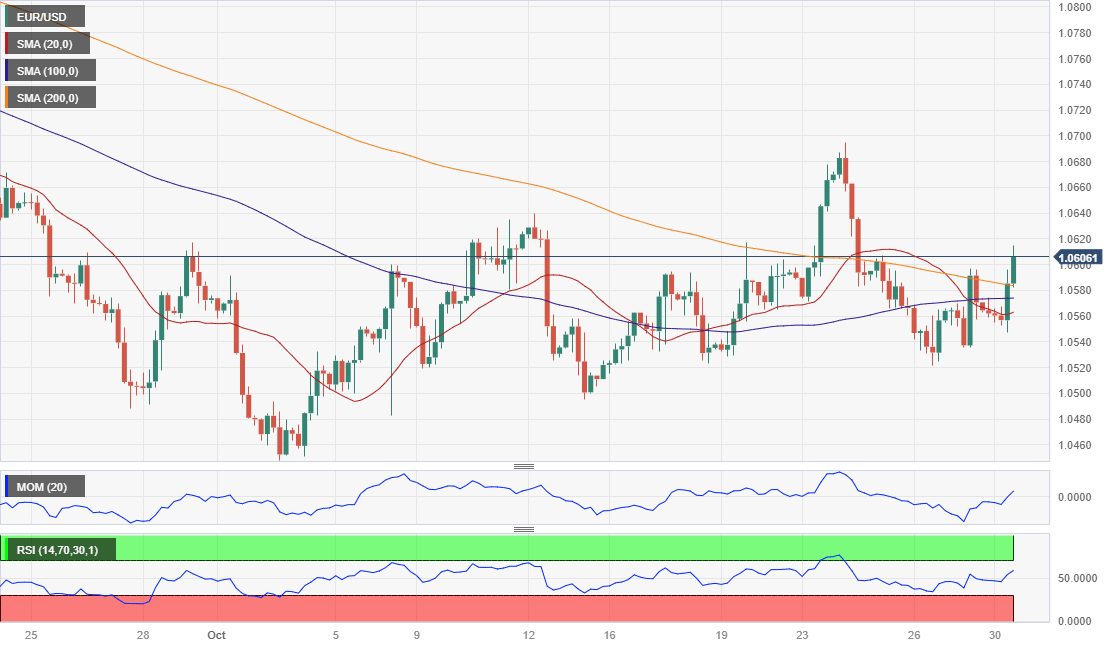

The EUR/USD pair is neutral, according to technical readings in the daily chart, although the risk skews to the upside. A flat 20 Simple Moving Average (SMA) provides near-term support at around 1.0565, while the 100 and 200 SMAs converge around 1.0810. Technical indicators, in the meantime, gain upward traction around their midlines as EUR/USD accelerates north above the 1.0600 mark.

The 4-hour chart favors an upward continuation as the pair develops above all its moving averages, although the 20 SMA remains below the longer ones. Finally, technical indicators consolidate well above their midlines without signs of bullish exhaustion. A strong static resistance level comes at 1.0650, the level to surpass to confirm a bullish extension in the upcoming sessions.

Support levels: 1.0565 1.0520 1.0485

Resistance levels: 1.0640 1.0690 1.0725

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.