EUR/USD Forecast: Next on the upside comes the 200-day SMA

- EUR/USD started the week on a positive note.

- The focus now shifts to Powell and key US data releases.

- Attention will also be on the second round of French elections.

The small uptick in the US Dollar (USD) caused the USD Index (DXY) to print humble gains and remain close to the 106.00 zone at the beginning of the week.

That said, the modest advance in the Greenback prompted EUR/USD to give away part of the strong earlier advance to multi-day peaks near 1.0780 as investors continued to digest the results from the French election on June 30.

Looking at the broader picture, the macroeconomic situation on both sides of the Atlantic remained stable, with the European Central Bank (ECB) considering further rate cuts beyond the summer amidst market expectations of two more rate cuts later in the year.

In contrast, market participants maintained their debate on whether the Federal Reserve (Fed) would implement one or two rate cuts this year, despite the Committee predicting just one cut, likely in December, at the June 12 meeting.

It's worth noting that the ongoing move higher in the US Dollar is partly in response to hawkish comments from Fed officials, while the widening monetary policy gap between the Fed and other major central banks also contributed to the euro's decline.

The CME Group's FedWatch Tool indicates a probability of around 65% for lower interest rates in September versus a nearly 93% chance at the December 18 meeting.

In the short term, the recent ECB rate cut, compared to the Fed's decision to maintain rates, has widened the policy gap between the two central banks, potentially leading to further weakness in EUR/USD.

However, the Eurozone's emerging economic recovery and perceived weakening of US fundamentals are expected to reduce this disparity, potentially providing occasional support for the pair in the near future.

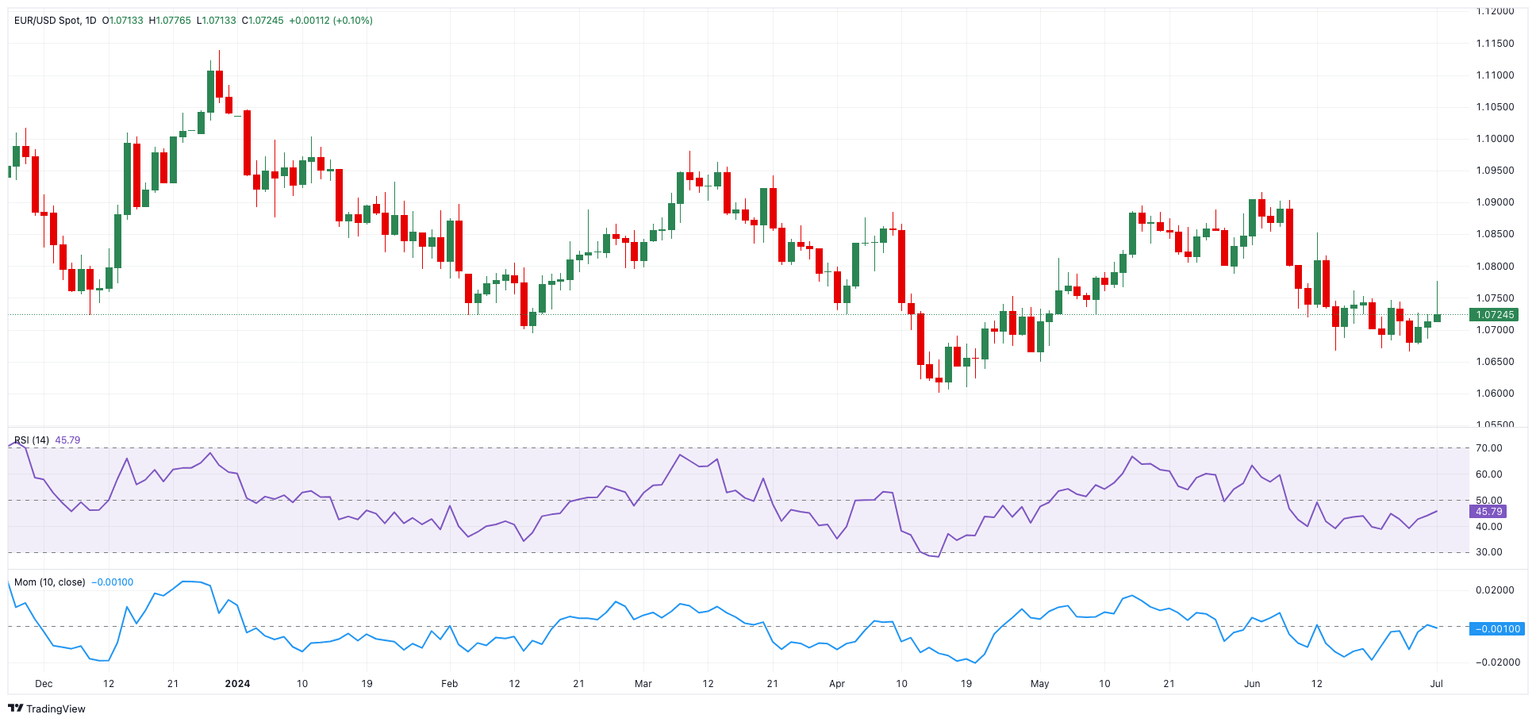

EUR/USD daily chart

EUR/USD short-term technical outlook

If bears hold control, EUR/USD may retest its June low of 1.0666 (June 26), then the May low of 1.0649 (May 1), and finally the 2024 bottom of 1.0601 (April 16).

Meanwhile, bouts of strength may put the pair on track to revisit the 200-day SMA at 1.0790, prior to the weekly high of 1.0852 (June 12) and the June top of 1.0916 (June 4). The breakout of this level might bring the March peak of 1.0981 (March 8) back into focus, ahead of the weekly high of 1.0998 (January 11) and the psychological 1.1000 yardstick.

So far, the 4-hour chart indicates some loss of impetus in the early bullish attempt. The initial resistance is 1.0776, followed by 1.0794. The initial support is at 1.0666, ahead of 1.0649 and 1.0601. The Relative Strength Index (RSI) slipped back to around 52.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.