EUR/USD Forecast: Next on the upside comes 1.1000

- EUR/USD advanced to fresh tops past 1.0900 the figure.

- The US Dollar accelerated its decline following the BoJ's intervention.

- The EBC is anticipated to keep its rates on hold on Thursday.

The offered stance in the US Dollar (USD) picked up extra pace on Wednesday on the back of another suspected intervention by the BoJ to support the Japanese yen early in the session.

In this context, the USD Index breached the 104.00 support quite convincingly, while EUR/USD marched further north to fresh four-month highs near 1.0950.

The mixed price action occurred amidst persistent demand for bonds in the US and German money markets, leading to a further decline in yields across various maturities on both sides of the ocean.

Meanwhile, the macroeconomic landscape remained stable. Investors generally expect the European Central Bank (ECB) to keep its policy rate unchanged at its meeting on Thursday, though markets still anticipate two additional cuts by the end of the year.

In contrast, there is ongoing debate among investors about whether the Fed will implement one, two (or three?) rate cuts this year, despite the Fed's current projection of a single cut, likely in December.

On this, the CME Group's FedWatch Tool sees the probability of lower rates at the September 18 meeting around 98%, while another rate cut is fully priced in by year-end.

Underpinning the above, some Federal Reserve (Fed) rate setters, including New York's John Williams and Board Governor Christopher Waller, said the central bank is "getting closer" to decreasing interest rates, while Richmond's Thomas Barkin stated that the United States is on the "back end" of inflation.

Meanwhile, economic recovery prospects in the Eurozone, along with signs of cooling in key US economic indicators, may mitigate the ongoing disparity regarding monetary policy between the Fed and the ECB, and occasionally support the pair in the near future. This view has regained momentum amid rising expectations of rate cuts by the Fed.

Looking ahead, upcoming US data, Fedspeak, and the ECB meeting will likely be key drivers of the pair’s price action in the short term.

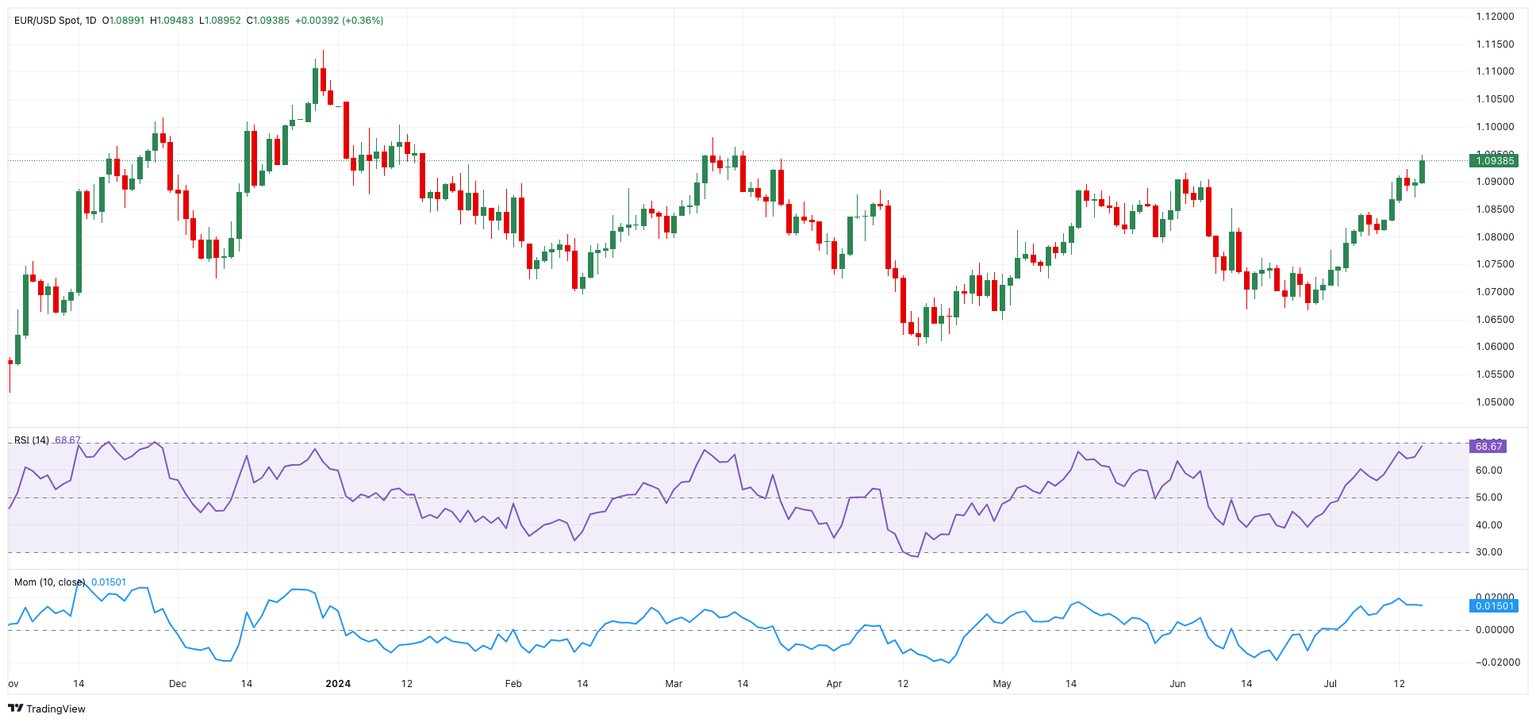

EUR/USD daily chart

EUR/USD short-term technical outlook

EUR/USD seen facing the next upward obstacle at 1.0948 (July 17), followed by the March top of 1.0981 (March 8) and the psychological 1.1000 level.

If bears grab control, spot may test the 200-day SMA of 1.0808 before falling to the June low of 1.0666 (June 26). The loss of the May low of 1.0649 (May 1) leads to the 2024 bottom of 1.0601 (April 16).

Looking at the bigger picture, it appears that additional gains are on the way if the critical 200-day SMA is consistently surpassed.

So far, on the 4-hour chart, the uptrend appears quite solid for the time being. That said, the initial resistance is 1.0948, before 1.0981 and 1.1000. On the other side, the 55-SMA at 1.0861 is first, followed by the 200-SMA at 1.0791, and finally 1.0709. The relative strength index (RSI) climbed to approximately 68.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.