EUR/USD Forecast: Next bearish target aligns at 0.9650

- EUR/USD has gone into a consolidation phase near 0.9700 following Monday's slide.

- The pair needs to stabilize above 0.9720 to shake off the bearish pressure.

- The dollar benefits from rising yields and safe-haven flows.

EUR/USD has managed to stage a modest recovery after having declined to its lowest level in more than 10 days at 0.9673 earlier in the day. The technical outlook suggests that the pair is likely to suffer additional losses unless it stabilizes above 0.9720.

Reports claiming that Germany would back joint EU debt to help finance costs to tackle the energy crisis helped the shared currency stay resilient against the dollar during the American trading hours on Monday. With a German government official telling Reuters that they had no intentions of agreeing to a joint EU debt, however, EUR/USD turned south toward the end of the day.

Meanwhile, US Treasury bond yields continued to push higher following the three-day weekend and the dollar preserved its strength early Tuesday.

There won't be any high-impact macroeconomic data releases on Tuesday and the risk perception could continue to impact EUR/USD's movements. The Euro Stoxx 600 Index is down 0.75% in the early European session and US stock index futures are losing between 0.55% and 0.65%. In case there is an improvement in market mood in the second half of the day, the pair could gather recovery momentum. So far, it looks like safe-haven flows are likely to continue to dominate the financial markets.

At 1600 GMT, Cleveland Fed President Loretta Mester, who said last week that the Fed will not be cutting rates in 2023, will speak on the economic outlook and the monetary policy.

EUR/USD Technical Analysis

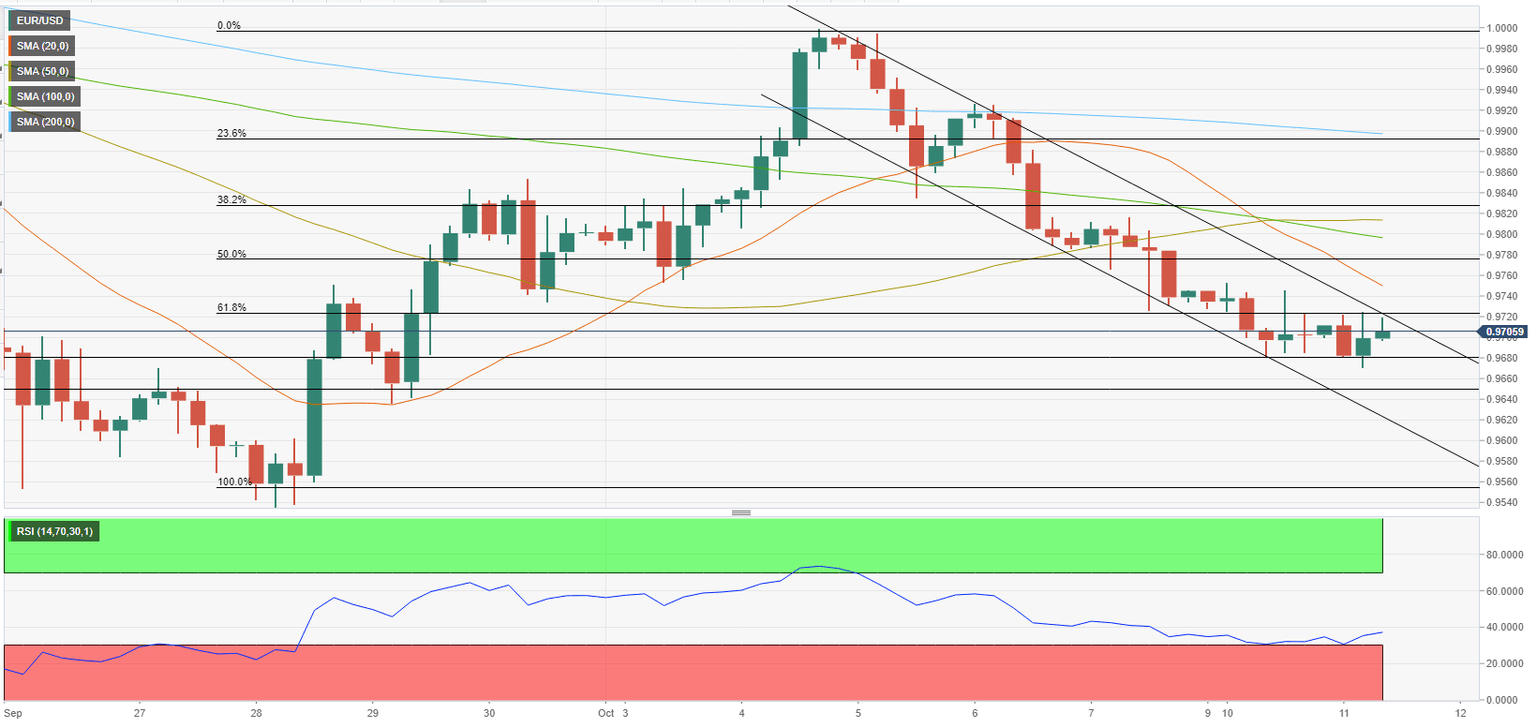

Despite the latest rebound, EUR/USD trades within the descending channel coming from October 4 and the Relative Strength Index (RSI) indicator on the four-hour chart stays below 50, suggesting that the bearish bias stays intact. If the pair rises above 0.9720 (Fibonacci 61.8% retracement of the latest uptrend, upper-limit of the descending channel) and starts using that level as support, it could extend its recovery toward 0.9750 (20-period SMA) and 0.9780 (Fibonacci 50% retracement).

On the downside, interim support seems to have formed at 0.9680 before 0.9650 (static level). A four-hour close below the latter could open the door for additional losses toward 0.9600 (psychological level).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.