- EUR/USD has been on as markets focus on the vaccine-led recovery.

- US Durable Goods Orders and virus news are set to dominate trading.

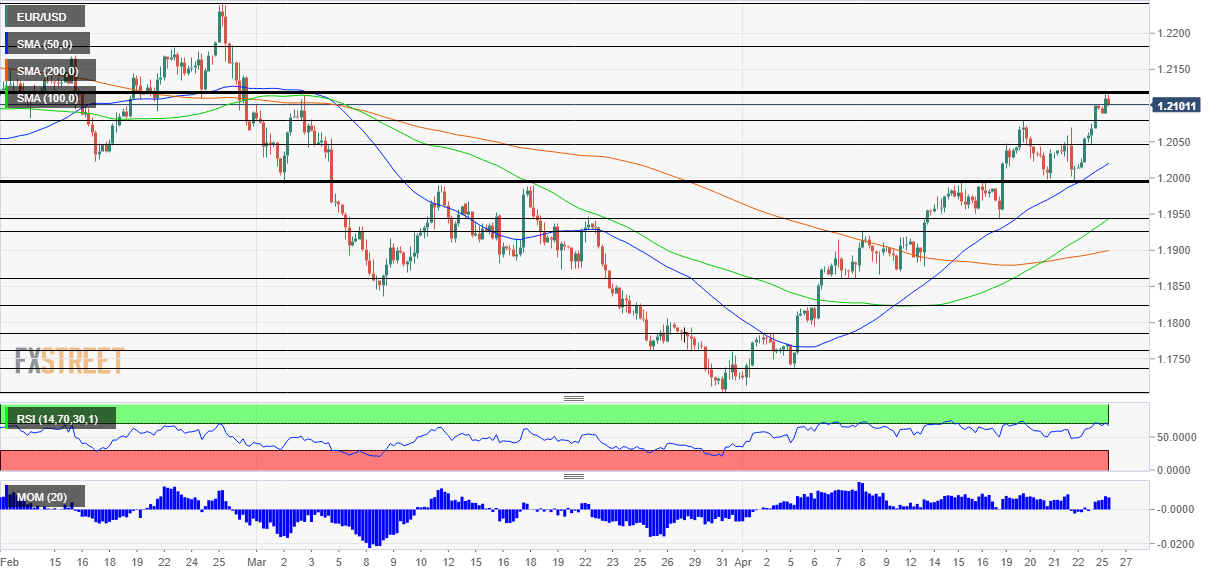

- Monday's four-hour chart is showing the currency pair is on the verge of overbought conditions.

US dollars are coming to Europe – the EU is set to welcome vaccinated American tourists in the summer, which is just around the corner. Apart from having a positive direct effect on EUR/USD, the potential revival of the old continent's tourism sector is one of the reasons the euro is on the rising.

Monday's loosening of restrictions in Italy and France is another positive development. More importantly, the pace of inoculations has substantially picked up in Europe with another acceleration on the cards during the remainder of April and throughout May. Roughly 42% of Americans have received at least one jab, and the rate is only half across the pond – but picking up much-needed steam.

The European Central Bank's cautiously optimistic message on Thursday – upgrading its risk assessment to balanced instead of to the downside – is another boost to the euro.

See ECB Analysis: Lagarde offers four subtle changes that may send the euro higher

Broader markets are also favoring additional EUR/USD gains. The safe-haven dollar is on the back foot as investors refocus on recovery rather than on India's horrific COVID-19 crisis, which has implications well beyond South Asia. The US, the UK, and other countries are sending support to Delhi and Mumbai as infections set daily records, partially in self-interest to prevent a slowdown that may come back to haunt developed economies.

The focus is later set to shift to US Durable Goods Orders. Investment has probably picked up in March after a drop in February. The 2.5% expected pickup in the headline figure and the projected 1.5% rise in Nondefense ex Aircraft – aka "core of the core" – feed into Thursday's all-important growth figures.

The Federal Reserve is also eyeing the data. The world's most powerful central bank is set to leave its policy unchanged on Wednesday, but to take stock of the surge in US economic activity and perhaps begin signaling a decrease in its massive bond-buying. Printing fewer dollars would boost the greenback. However, at least on Monday, the notion of ongoing fed support is weighing on the currency.

Overall, fundamentals point to extended gains for EUR/USD.

EUR/USD Technical Analysis

Euro/dollar is trending higher since late March, as the four-hour chart shows. On its way up, the currency pair topped the early-March peak of 1.2110 and hit a new high of 1.2116 – a level last seen in late February.

Momentum is to the upside and the Relative Strength Index (RSI) is just under 70. If this indicator tops that level, it would enter overbought conditions and signal a correction. However, bulls currently remain in control.

Above 1.2116, the next levels to watch are 1.2170 and 1.2250.

Support awaits at the previous April peak of 1.2180, followed by the battle line of 1.2050 and then by the psychological barrier of 1.20.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD recovers above 0.6200 after an early dip

Wall Street shrugged off fears ahead of the close and trimmed Trump-inspired losses, helping AUD in its way up. Australia will release in the Asian session November Retail Sales and Exports and Import figures for the same month.

EUR/USD hovers around 1.0320 after another moved American session

The EUR/USD pair trades around 1.0320 after falling to 1.0275. Employment data, a cautious Federal Reserve, and President-elect Donald Trump tariffs shook financial boards and kept investors in cautious mode.

XAU/USD holds on to gains around $2,660

Gold price retains risk-inspired gains. The benchmark 10-year US Treasury bond yield holds at its highest level since late April near 4.7%, limiting XAU/USD directional strength. US markets will remain closed on Thursday.

Crypto Today: BTC drops 3% despite $52M ETF inflows as Chainlink launches Ripple’s RLUSD

Mega-cap assets like XRP and exchange tokens BNB and BGB showcased resilience, defying broader market weakness spurred by an ongoing liquidation event that wiped over $150 billion from global crypto market capitalization in the past 24 hours.

Bitcoin edges below $96,000, wiping over leveraged traders

Bitcoin's price continues to edge lower, trading below the $96,000 level on Wednesday after declining more than 5% the previous day. The recent price decline has triggered a wave of liquidations across the crypto market, resulting in $694.11 million in total liquidations in the last 24 hours.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.