EUR/USD Forecast: Near-term direction hinges on the Fed

- EUR/USD manages to reclaim the area above 1.0800.

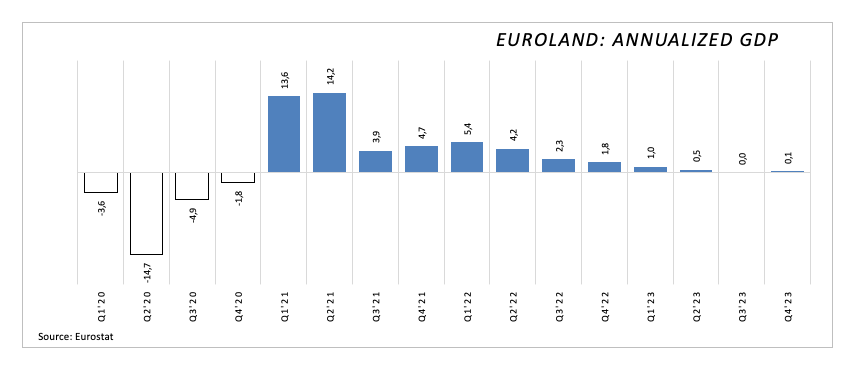

- Euro area economy avoided a technical recession in Q4.

- Investors’ focus now shift to the FOMC event on Wednesday.

The ongoing consolidation in the US dollar seems to have reignited some bullish moves around EUR/USD, prompting it to advance past 1.0850 and leave behind a negative start of the week, which saw spot pierce the 1.0800 support for the first time since mid-December.

Apart from the dynamics of the US dollar, market participants kept a prudent approach ahead of the upcoming FOMC meeting on January 31, where the Federal Reserve is widely anticipated to keep its Fed Funds Target Range (FFTR) unchanged at 5.25%–5.50%. However, investor discussions are shifting towards the timing of a potential rate cut, as recent data from key US fundamentals supports the view of a resilient economy. This is prompting speculation that the central bank may delay a potential rate reduction, likely in May from the previously considered March.

According to CME Group’s FedWatch Tool, the probability of a rate cut in March has decreased to nearly 40%, while the likelihood of a cut in May is close to 55%.

Other than the FOMC event, the publication of the US Nonfarm Payrolls towards the end of the week is also propping up the steady cautiousness among market participants as the week enters its equator.

In the meantime, and looking at the ECB, President Lagarde's dovish communication seems to be restraining the price movement of the single currency. At the bank’s event last week, she reiterated the ECB's commitment to data dependence and emphasized her earlier statements on interest rates, including the potential for a rate cut in the summer. Lagarde highlighted downside risks to growth and expressed optimism that any wage increases would be absorbed by profits. She also noted a consensus among decision-makers that it is premature to discuss implementing rate cuts.

Within the ECB, Board member Centeno surprised everybody on Monday by advocating for interest rate cuts sooner rather than later, deviating from his usual dovish stance. In the same vein, he argued that there were no adverse effects from higher wages and suggested that the ECB should support the region's economic growth.

On the domestic data space, flash Q4 GDP figures in the broader euro area showed the bloc’s economy expanded marginally by 0.1% YoY and came in flat vs. the previous quarter. Despite the prints coming in above initial estimates, they are still quite far from being encouraging, to say the least.

EUR/USD daily chart

EUR/USD short-term technical outlook

If sellers regain the upper hand, EUR/USD might revisit the 2024 low of 1.0795 (January 29), ahead of the temporary 100-day SMA at 1.0778 before dropping to the December 2023 low of 1.0723 (December 8). The breach of this level should not get significant support until the weekly low of 1.0495 (October 13, 2023), which precedes the October 2023 low of 1.0448 (October 3) and the round level of 1.0400.

The pair's outlook is predicted to turn bearish if it consistently clears the important 200-day SMA (1.0841).

On the upside, spot must break above the weekly peak of 1.0932 (January 24) in order to reach the next weekly high of 1.0998 (January 11), which reinforces the psychological 1.1000 region. Additional gains from here might pave the way for a potential test of the December high of 1.1139 (December 28).

The four-hour chart paints a dismal picture for the pair. South of 1.0795, 1.0723 is aligned before 1.0656. Bullish attempts, on the other hand, may aim a challenge at 1.0932 before 1.0998. The MACD remains slightly negative, and the RSI managed to get some traction and poke with 48.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.