EUR/USD Forecast: Near-term bearish outlook stays intact

- EUR/USD has gone into a consolidation phase below 1.0900.

- ECB policymakers reportedly see only one or two more rate increases.

- Markets await EU first-quarter GDP and US Retail Sales data.

EUR/USD has been moving sideways below 1.0900 early Tuesday after having registered small recovery gains on Monday. The pair's near-term technical outlook points to a lack of buyer interest.

Citing Eurosystem sources, MNI reported on Monday that the European Central Bank (ECB) was most likely to raise key rates once or twice more in this tightening cycle. Meanwhile, the European Commission announced that it revised the 2023 inflation forecast higher to 5.8% from 5.6% previously. As markets try to figure out whether the ECB is closing in on the end of rate hikes, the Euro is having a difficult time gathering strength.

Later in the session, Eurostat is expected to report a quarterly expansion of 0.1% in the Eurozone Gross Domestic Product (GDP) in the first quarter. In case this data comes in in negative territory, the Euro is likely to come under renewed bearish pressure with markets leaning toward a less hawkish ECB outlook.

In the second half of the day, Retail Sales data for April will be featured in the US economic docket. Following a 0.6% contraction in March, Retail Sales are forecast to increase 0.7% in April. Investors have been growing increasingly concerned over a slowdown in the US economy and the US Dollar (USD) could struggle to find demand if this report fails to show a healthy consumer activity and vice versa.

Market participants will also pay close attention to comments from Federal Reserve (Fed) officials. Atlanta Federal Reserve President Raphael Bostic told Bloomberg on Monday that, if he were voting now, he would vote to hold rates in June. On the other hand, Richmond Fed President Thomas Barking told the Financial Times that there was no barrier to raise rates further if inflation were to persist or accelerate. Markets are largely convinced that the Fed will leave its policy rate unchanged in June, hence the potential negative impact of dovish Fedspeak on the USD's performance should remain short-lived.

EUR/USD Technical Analysis

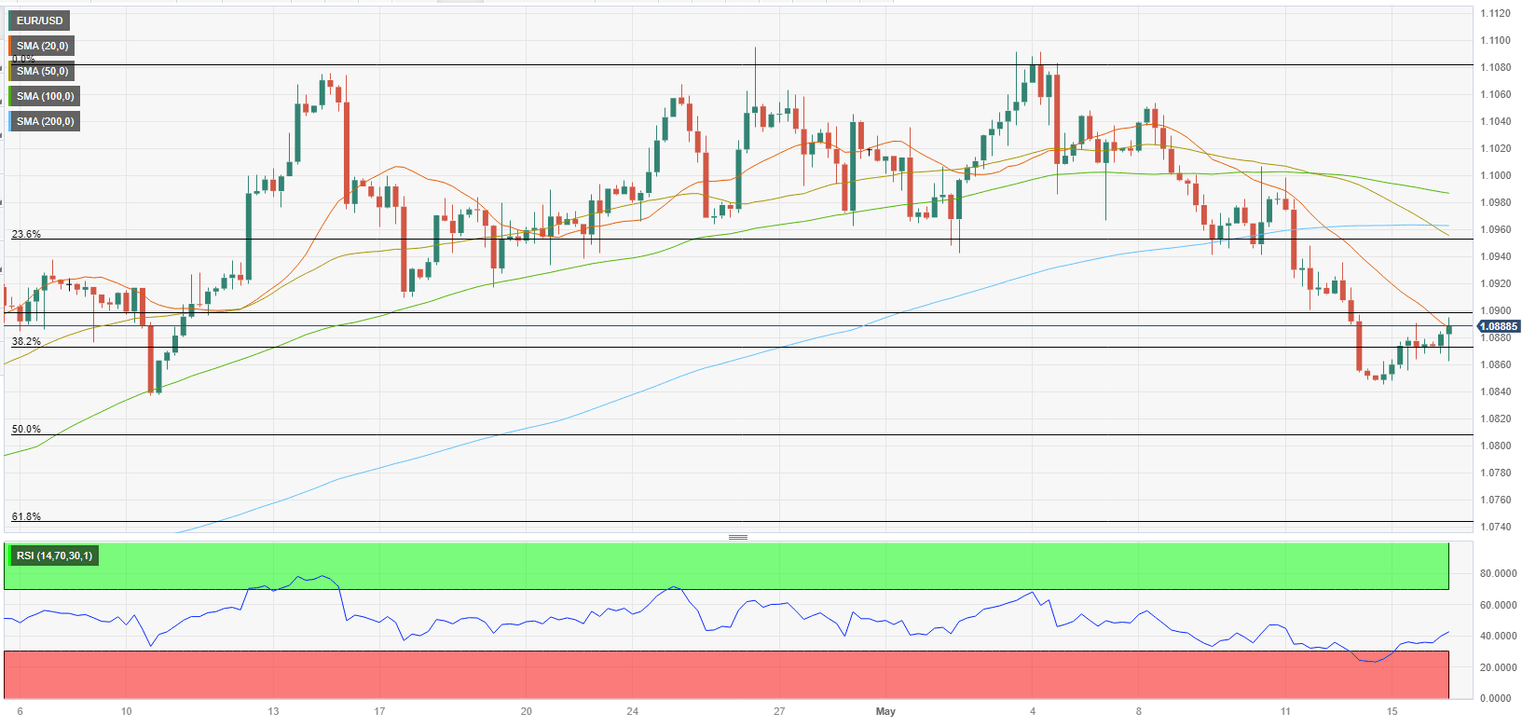

Despite the latest rebound, the Relative Strength Index (RSI) indicator on the four-hour chart stays below 50, suggesting that EUR/USD is staging a technical correction rather than starting a new leg higher. 1.0900 (psychological level, static level) aligns as immediate resistance for the pair ahead of 1.0950 (Fibonacci 23.6% retracement of the latest uptrend, 200-period Simple Moving Average (SMA) and 1.0990/1.1000 (100-period SMA, psychological level).

On the downside, a four-hour close below 1.0870 (Fibonacci 38.2% retracement) could attract sellers. In that scenario, EUR/USD could face interim support at 1.0850 (static level) before extending its slide toward 1.0800.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.