EUR/USD Forecast: Mrs Lagarde’s debut could shake the foundations

- The dollar recovered modestly with an upbeat NFP report, trouble persists.

- Mrs. Christine Lagarde will debut as ECB’s Chief next Thursday.

- EUR/USD without room to extend gains past 1.1100 according to sentiment.

The EUR/USD pair finally woke up and surged to a fresh 4-week high of 1.1115, although it gave up most of its gains after a positive surprise in US employment data. Speculative interest was on its toes for most of the week, tired on the encouraging comments without real progress related to the US-China trade relationship.

Volume returned on Monday, as US President Trump kick-started the week brandishing levies left and right. South American and the EU suffered from actual levies or menaces, as he announced immediate tariffs on base metals’ imports coming from Brazil and Argentina, and threatened France with tariffs up to 100% over France’s new digital services tax.

US authorities, Trump included, tried to pour some cold water mid-week, as Wall Street collapsed, but their efforts fell short of reversing the negative market’s mood. Fears that the trade war is escalating globally will keep on dominating investors.

US employment data just enough to halt the slump

The American dollar suffered further with the release of the official November ISM PMI as the manufacturing index came down to 48.1, while the non-manufacturing index fell to 53.9, both missing the market’s expectations and below the previous ones.

It managed to recover some ground as the Nonfarm Payroll report showed that the US added 266K new jobs in November, much better than the 180K expected. The unemployment rate fell to 3.5% a five-decade low. Wages were mixed, up by just 0.2% in the month, but gaining 3.1% in the year, slightly better than the 3.0% expected. The report gave the dollar a lift, more on profit-taking ahead of the weekend than triggering actual dollar’s strength.

Things weren’t good enough in the EU to boost the shared currency, as modest upward revisions to Markit PMI were offset by poor Retail Sales, down by 0.6% in October, and Q3 GDP confirmed at a modest 0.2%. Furthermore, Industrial Production and Factory Orders in Germany continued to fall in October, indicating a dismal start of Q4 in the Union’s largest economy.

The upcoming week will bring US inflation data, although the star of the week will be Mrs. Christine Lagarde, making her debut as the ECB Chief. She has been extremely political ahead of this day, refraining from making comments about the monetary policy. Next Thursday, she should set the central bank’s course for the next four years. The market would rush to price in whatever she proposes, and wide moves are expected in the EUR.

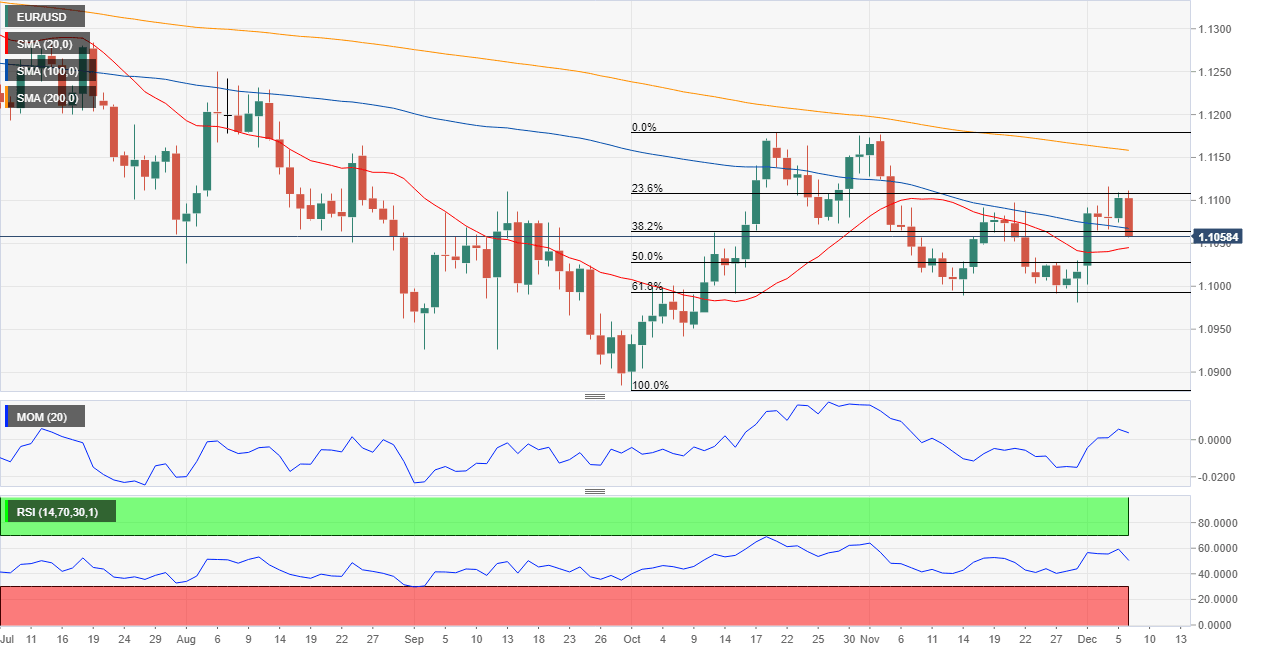

EUR/USD technical outlook

The EUR/USD pair is trading in the 1.1060 price zone, with the modest recovery falling short of anticipating further gains. In the weekly chart, the pair is struggling around a bearish 20 SMA, while technical indicators head higher, but around their midlines. The 100 and 200 SMA remain way above the current level, indicating that the long-term bearish trend remains in place.

In the daily chart, the pair faltered around the 23.6% retracement of its October rally, now pressuring the 38.2% retracement of the same rally at 1.1065, the immediate support. A bearish 100 DMA converges with this last, and as the 20 DMA heads higher below it. Technical indicators have turned firmly lower, with the Momentum entering negative ground, and the RSI now at around 50, both skewing the risk toward the downside. The next bearish target comes at 1.0990, with a break below this last unlikely at the time being.

EUR/USD sentiment poll

The FXStreet Forecast Poll shows that the bullish sentiment extends into the upcoming week, but bears took over afterward. The pair, however, is seen on average around the 1.1000 level in the three time-frame under study, with the lack of clear targets probably exacerbated by the trade war uncertainty and the upcoming ECB’s monetary policy meeting.

The Overview chart shows that the moving average is firmly bullish in a weekly perspective, but the quarterly one is neutral. Furthermore, most targets in this last accumulate below the current level at around 1.0900.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.