EUR/USD Forecast: Lower lows on coronavirus concerns

EUR/USD Current Price: 1.1830

- ECB’s President Christine Lagarde called for “priority” fiscal support.

- US jobless claims deteriorated in the week ended November 13.

- EUR/USD at risk of falling. although lacking directional momentum.

The EUR/USD pair fell to 1.1815 this Thursday, as the day started with speculative interest rushing into safety. Market talks suggesting a no-deal between the UK and the EU fueled the dismal mood triggered by news that New York was closing schools amid the accelerating speed of new coronavirus contagions. The pair bounced from the mentioned low as equities pared losses but holds below 1.1850.

The EU published the September Current Account, which posted a seasonally adjusted surplus of €25.2 billion, below the market’s expectations. Meanwhile, ECB’s President Christine Lagarde offered a speech, reiterating the central bank will extend its monetary stimulus in December. Like its US counterpart, Lagarde said that fiscal support should be a priority.

The US has just published Initial Jobless Claims for the week ended November 13. The report showed that 742K people filled for unemployment, worse than anticipated. The country also published the Philadelphia Fed Manufacturing Survey, which came in at 26.3, better than the 22 expected. Pending for release is the October Existing Home Sales report.

EUR/USD short-term technical outlook

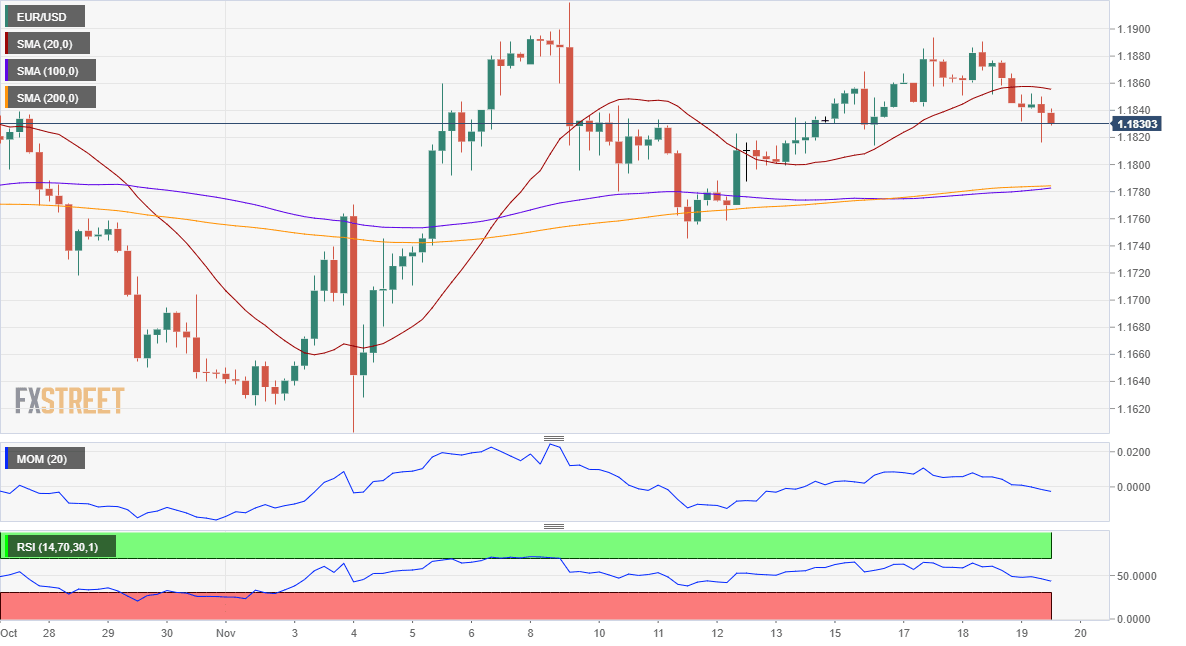

The EUR/USD pair is under selling pressure, trading near the mentioned daily low. The 4-hour chart shows that it’s extending its decline below a flat 20 SMA, while technical indicators hover within negative levels. Technical readings indicate little directional interest at the time being, with the bearish case becoming firmer on a break below the 1.1800 figure.

Support levels: 1.1845 1.1800 1.1760

Resistance levels: 1.1890 1.1920 1.1960

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.