The EUR/USD pair ticked higher at the start of a new trading week though lacked any strong follow-through amid a rather mixed and quiet price action. Trading was a bit subdued on the back of a bank holiday in the US and absent relevant market moving economic releases. The initially climbed to the 1.1400 neighborhood and then erased a major part of the early modest gains to finally settle just a few pips above two-week lows, set on Friday. A modest US Dollar uptick, supported by some fresh safe-haven flows, turned out to be one of the key factors prompting some fresh selling at higher levels.

Worries over global growth reemerged after the International Monetary Fund (IMF) lowered its global growth forecast for 2019 to the weakest in three years, citing a larger-than-expected slowdown in China and the Euro-zone. The downgrade came after China reported its slowest quarterly economic growth since 2009 and the weakest annual growth rate since 1990, and prompted investors to move into traditional safe-haven currencies. The greenback held steady near two-week tops through the Asian session on Tuesday and seemed rather unaffected by the partial US government shutdown/dovish Fed expectations.

Today's economic docket features the release of German ZEW economic sentiment for January but the key focus will remain on the latest ECB monetary policy update on Thursday. The European Central Bank is expected to turn a bit more dovish in wake of softer incoming economic data, which would make the shared currency less attractive and might trigger a fresh leg of the bearish slide in the near-term.

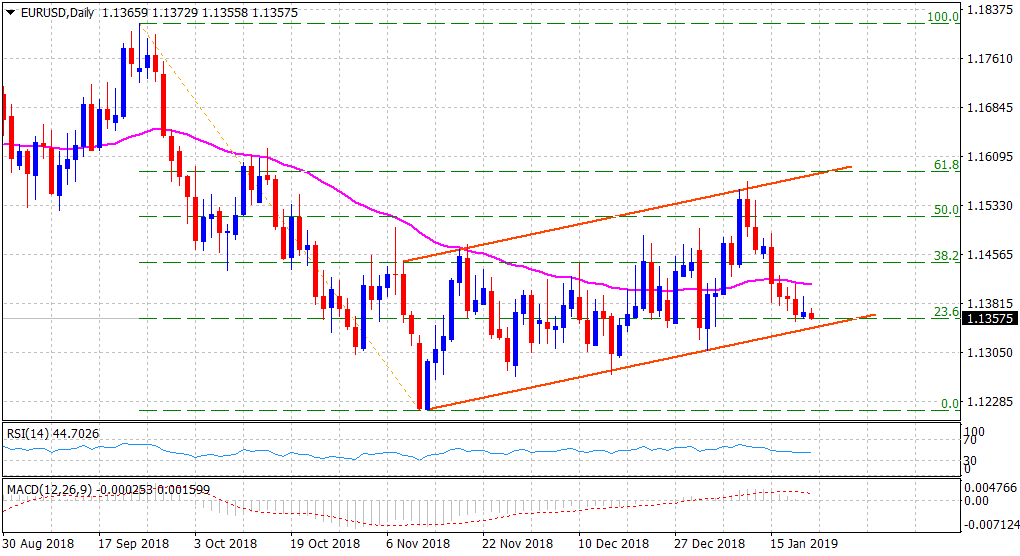

From a technical perspective, nothing seems to have changed for the pair, with bears still awaiting a decisive break through the 1.1350-40 confluence support - comprising of 23.6% Fibonacci retracement level of the 1.1815-1.1216 downfall and the lower end of a short-term ascending trend-channel formation on the daily chart. Below the mentioned support the pair is likely to extend the recent bearish trajectory and weaken further below the 1.1300 handle, towards retesting multi-month lows support around the 1.1215 region.

On the flip side, the 1.1400 handle now seems to have emerged as an immediate resistance, which if cleared might trigger a short-covering bounce towards 38.2% Fibonacci retracement level resistance, near the 1.1445-50 zone but seems more likely to remain capped near the 1.1470-75 region.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD drops to near 1.0600, awaits US inflation data

The EUR/USD pair remains under pressure on Wednesday, holding steady just above the 1.0600 level during Asian trading hours. This would mark the fourth consecutive day of losses for the Euro, as the pair continues to face downward momentum.

GBP/USD falls to near 1.2750 ahead of BoE Mann speech

GBP/USD extends its losing streak for the fourth successive session, trading around 1.2740 during the Asian hours on Wednesday. This downside of the pair is attributed to a stronger US Dollar amid optimism around the Trump trades.

Gold price sticks to gains above $2,600 amid some repositioning ahead of US CPI

Gold price staged a notable recovery from a nearly two-month low touched on Tuesday. Elevated US bond yields and a bullish USD might cap gains for the non-yielding XAU/USD. Traders now look forward to the crucial US consumer inflation figures for a fresh impetus.

US CPI data preview: Inflation expected to rebound for first time in seven months

The US Consumer Price Index is set to rise 2.6% YoY in October, faster than September’s 2.4% increase. Annual core CPI inflation is expected to remain at 3.3% in October. The inflation data could significantly impact the market’s pricing of the Fed’s interest rate outlook and the US Dollar value.

Five fundamentals: Fallout from the US election, inflation, and a timely speech from Powell stand out Premium

What a week – the US election lived up to their hype, at least when it comes to market volatility. There is no time to rest, with politics, geopolitics, and economic data promising more volatility ahead.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.