EUR/USD Forecast: Key support area holds ahead of German inflation data

- EUR/USD holds steady above 1.0800 after posting losses on Monday.

- June Consumer Price Index data from Germany will be watched closely by investors.

- The pair faces key support area at 1.0800-1.0810.

EUR/USD came under renewed bearish pressure on Monday and fell to its weakest level in three weeks near 1.0800. Although the pair managed to erase a small portion of its losses, it is having a tough time gathering recovery momentum ahead of Tuesday's key macroeconomic data releases.

Euro PRICE This week

The table below shows the percentage change of Euro (EUR) against listed major currencies this week. Euro was the weakest against the New Zealand Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.31% | 0.08% | 0.67% | 0.10% | -0.09% | -0.09% | 0.32% | |

| EUR | -0.31% | -0.26% | 0.35% | -0.18% | -0.36% | -0.40% | 0.03% | |

| GBP | -0.08% | 0.26% | 0.58% | 0.05% | -0.10% | -0.13% | 0.29% | |

| JPY | -0.67% | -0.35% | -0.58% | -0.58% | -0.73% | -0.75% | -0.30% | |

| CAD | -0.10% | 0.18% | -0.05% | 0.58% | -0.17% | -0.22% | 0.23% | |

| AUD | 0.09% | 0.36% | 0.10% | 0.73% | 0.17% | -0.01% | 0.39% | |

| NZD | 0.09% | 0.40% | 0.13% | 0.75% | 0.22% | 0.01% | 0.43% | |

| CHF | -0.32% | -0.03% | -0.29% | 0.30% | -0.23% | -0.39% | -0.43% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

The cautious mood at the beginning of the week helped the US Dollar (USD) stay resilient against its major rivals. In the second half of the day, the mixed action seen in Wall Street allowed the USD to preserve its strength and limited EUR/USD's rebound.

Early Tuesday, the data from Germany showed that the Gross Domestic Product contracted at an annual rate of 0.1% in the second quarter. This reading, however, failed to trigger a noticeable market reaction.

Germany's Destatis will release Consumer Price Index (CPI) data for July later in the session. Investors expect the CPI to rise 0.2% on a monthly basis following the 0.1% increase recorded in June. A stronger-than-forecast monthly CPI reading could help the Euro find demand with the immediate reaction. Nevertheless, investors could refrain from taking large positions based on this data alone, especially ahead of the Federal Reserve's monetary policy announcements on Wednesday.

On Tuesday, the US economic docket will feature Conference Board's Consumer Confidence data for July and JOLTS Job Openings for June. If there is a significant increase in job openings, the USD could hold its ground and weigh on EUR/USD.

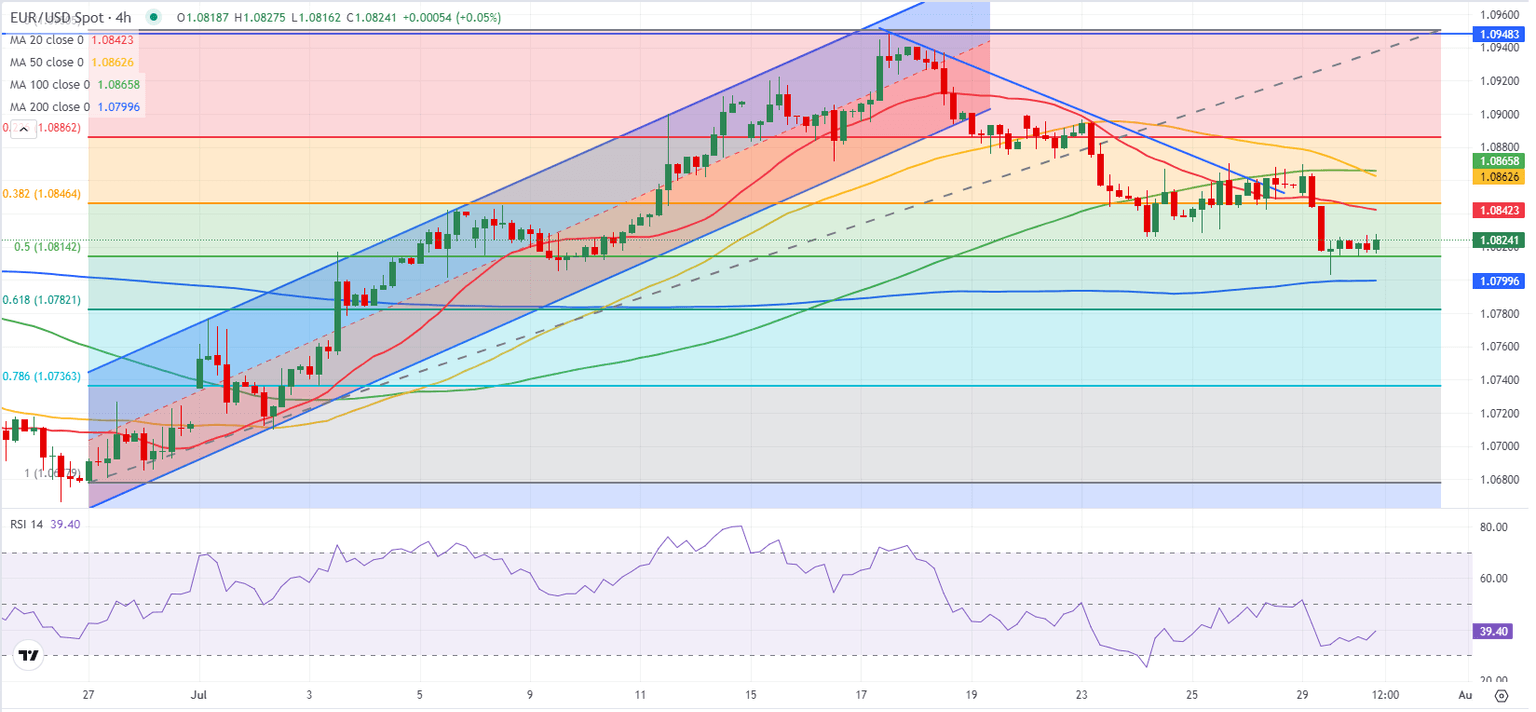

EUR/USD Technical Analysis

The Relative Strength Index (RSI) indicator on the 4-hour chart stays well below 50 despite edging slightly higher in the European morning on Tuesday.

EUR/USD holds above the 1.0800-1.0810 support area, where the 100-day and the 200-day SMAs are located. If this support fails, 1.0740 (Fibonacci 78.6% retracement of the latest uptrend) could be seen as next bearish target before 1.0700 (psychological level, static level).

On the upside, first resistance aligns at 1.0840 (Fibonacci 38.2% retracement) ahead of 1.0860 (100-period SMA) and 1.0880 (Fibonacci 23.6% retracement).

GDP FAQs

A country’s Gross Domestic Product (GDP) measures the rate of growth of its economy over a given period of time, usually a quarter. The most reliable figures are those that compare GDP to the previous quarter e.g Q2 of 2023 vs Q1 of 2023, or to the same period in the previous year, e.g Q2 of 2023 vs Q2 of 2022. Annualized quarterly GDP figures extrapolate the growth rate of the quarter as if it were constant for the rest of the year. These can be misleading, however, if temporary shocks impact growth in one quarter but are unlikely to last all year – such as happened in the first quarter of 2020 at the outbreak of the covid pandemic, when growth plummeted.

A higher GDP result is generally positive for a nation’s currency as it reflects a growing economy, which is more likely to produce goods and services that can be exported, as well as attracting higher foreign investment. By the same token, when GDP falls it is usually negative for the currency. When an economy grows people tend to spend more, which leads to inflation. The country’s central bank then has to put up interest rates to combat the inflation with the side effect of attracting more capital inflows from global investors, thus helping the local currency appreciate.

When an economy grows and GDP is rising, people tend to spend more which leads to inflation. The country’s central bank then has to put up interest rates to combat the inflation. Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold versus placing the money in a cash deposit account. Therefore, a higher GDP growth rate is usually a bearish factor for Gold price.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.