EUR/USD Forecast: Key levels for next breakout defined

- EUR/USD has gone into a consolidation phase on Thursday.

- Dollar struggles to gather strength amid falling yields.

- Focus shifts to US GDP and Pending Home Sales data.

EUR/USD has managed to stage a rebound after having tested the 1.0660 level on Wednesday but failed to reclaim 1.0700. The near-term technical picture doesn't provide any directional clues as markets await the next catalyst.

On Wednesday, European Central Bank (ECB) Governing Council member Klaas Knot noted that a 50 basis points rate hike in July was on the table, adding that inflation expectations were "at the upper limit of being well-anchored." The shared currency, however, struggled to capitalize on these remarks as comments from ECB policymakers point to dissent over the size of the July rate hike.

On the other hand, the minutes of the FOMC's May meeting revealed that many participants judged that inflation risks were skewed to the upside. Furthermore, the publication showed that a number of policymakers thought it would be appropriate for the Fed to consider sales of mortgage-backed securities. Although the hawkish tone of the statement helps the dollar stay resilient against its peers, falling US Treasury bond yields don't allow it to gather strength. As of writing, the benchmark 10-year US Treasury bond yield was down 1% on the day at 2.72%.

In the second half of the day, the US Bureau of Economic Analysis will release its second estimate for the first-quarter GDP growth. The print is unlikely to diverge from the first estimate and trigger a market reaction.

Market participants will pay close attention to the Pending Home Sales data from the US, which is forecast to show a 2% contraction on a monthly basis in April. Earlier in the week, the disappointing New Home Sales data triggered a flight to safety and a similar reaction could be witnessed if Pending Home Sales come in worse than expected. Investors grow increasingly concerned about the negative impact of rising interest rates on the housing market and a negative shift in risk sentiment could weigh on EUR/USD in the second half of the day. Nevertheless, the dollar might find it difficult to gather bullish momentum unless the US yields rebound.

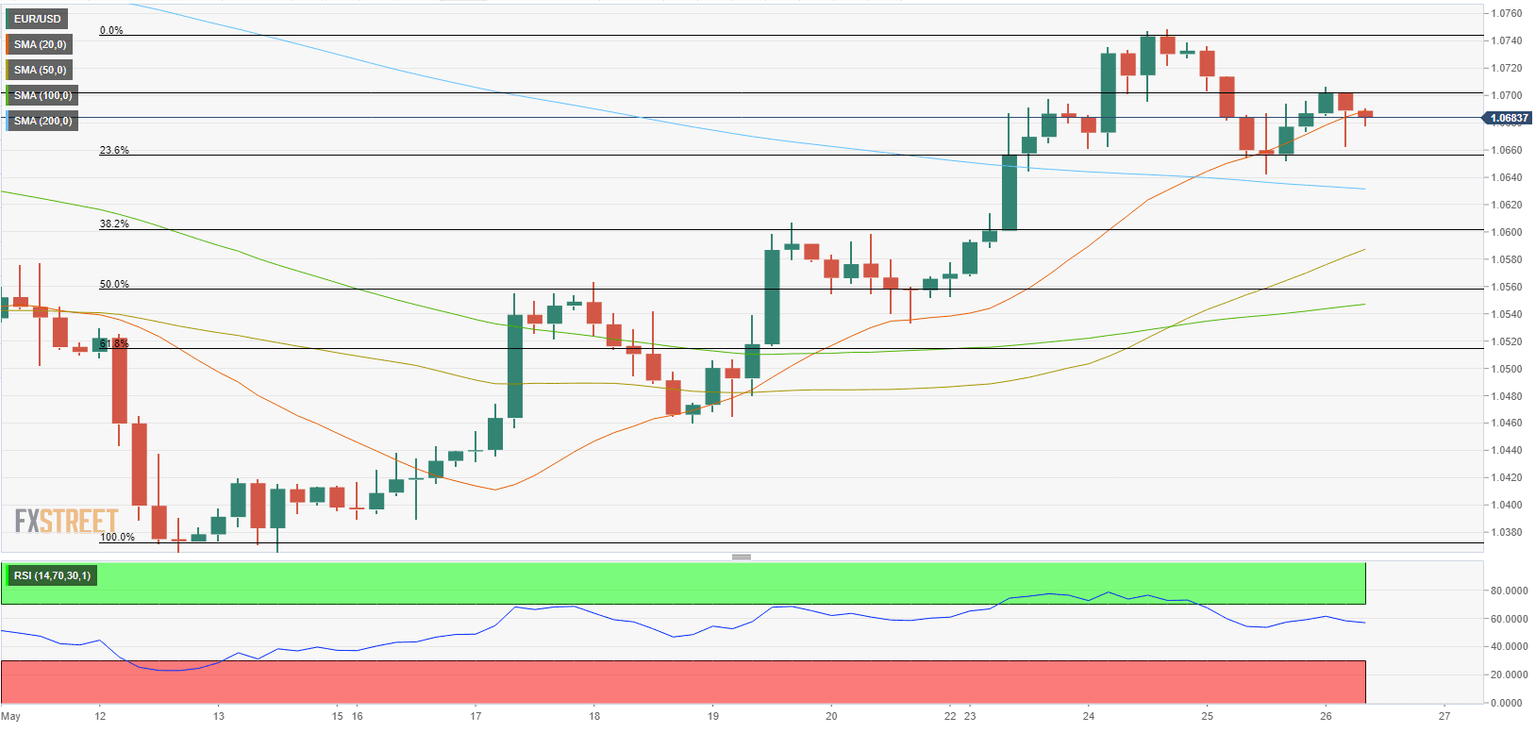

EUR/USD Technical Analysis

EUR/USD is likely to continue to fluctuate within the 1.0740 (the end of the latest uptrend)-1.0630 (200-period SMA on the four-hour chart) range in the near term. The next significant action could be triggered once the pair breaks out of this channel.

With a drop below 1.0630, EUR/USD could push lower toward 1.0600 (Fibonacci 38.2% retracement) and 1.0570 (50-period SMA).

On the flip side, 1.0700 (psychological level) aligns as interim resistance ahead of 1.0740. A daily close above the latter could be seen as a significant bullish development and open the door for additional gains toward 1.0800 (psychological level).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.