EUR/USD Forecast: Improving risk mood could help Euro limit its losses

- EUR/USD edges lower but holds above 1.0700 on Thursday.

- The US Dollar could struggle to gather strength if risk flows dominate the markets.

- Next key support for the pair is located at 1.0670.

EUR/USD stays under modest bearish pressure and declines toward 1.0700 after posting small gains in the first three days of the week. The near-term technical outlook points to a bearish tilt but the pair could find support in case risk flows dominate the action in financial markets in the second half of the day.

Following the Juneteenth holiday on Wednesday, the US economic docket will feature Housing Starts and Building Permits data for May on Thursday. The US Department of Labor will also release the weekly Initial Jobless Claims data.

The number of first-time applications for unemployment benefits rose sharply to 242,000 in the week ending June 8. Markets expect this number to decline to 235,000 in the week ending June 15. In case the data arrives at or above 240,000, investors could see this as a sign of loosening conditions in the labor market and make it difficult for the US Dollar (USD) to find demand. On the other hand, a reading below 220,000 could suggest that the previous increase was due to temporary factors and help the USD stay resilient against its rivals.

In the second half of the day, investors will pay close attention to comments from Federal Reserve (Fed) policymakers and the market mood. If Fed officials voice a preference to wait until the end of the year to lower the policy rate, EUR/USD could come under renewed bearish pressure.

At the time of press, S&P Futures and Nasdaq Futures were up 0.4% and 0.6%, respectively. A bullish opening in Wall Street could limit the USD's gains and allow EUR/USD to find a foot hold.

EUR/USD Technical Analysis

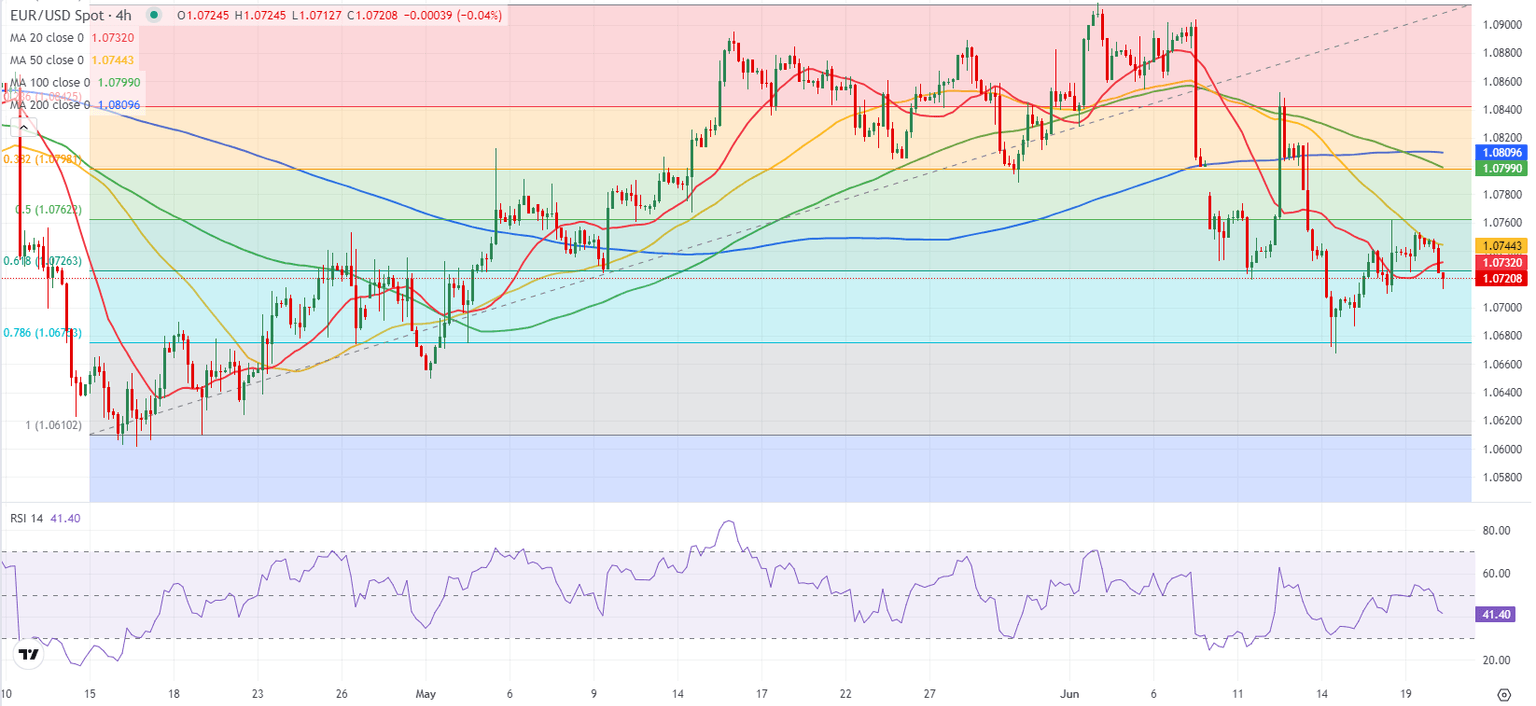

The Relative Strength Index (RSI) indicator on the 4-hour chart declined below 50, reflecting a lack of buyer interest. On the downside, immediate support is located at 1.0700 (psychological level, static level) before 1.0670 (Fibonacci 78.6% retracement of the latest uptrend) and 1.0600 (beginning point of the uptrend).

1.0730, where the Fibonacci 61.8% retracement of the latest uptrend is located, could be seen as first resistance ahead of 1.0760 (Fibonacci 50% retracement) and 1.0800 (Fibonacci 38.2% retracement).

(This story was corrected at 09:12 GMT to say that 1.0730 could be seen as first resistance, not support.)

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.