EUR/USD Forecast: Immediately to the upside comes 1.0900

- EUR/USD’s upside momentum faltered ahead of 1.0900.

- The ECB is seen keeping its rates unchanged this week.

- Investors’ focus now shifts to US CPI and FOMC Minutes.

EUR/USD traded slightly on the defensive despite hitting new multi-week tops in the 1.0885–1.0890 band earlier in the session, always against the backdrop of another uneventful session and vacillating price action in the Greenback.

Meanwhile, diminishing yields on both sides of the ocean accompanied humble losses in spot amidst an unchanged monetary policy framework, firm conviction that the ECB will hold its hand at its event later in the week, and increasing prudence ahead of the release of the US CPI and the FOMC Minutes, both due on Wednesday.

On this note, both the Federal Reserve (Fed) and the European Central Bank (ECB) are expected to initiate easing cycles, possibly starting in June. However, the pace of subsequent interest rate cuts may differ, potentially resulting in divergent strategies between the two central banks. Nevertheless, it is anticipated that the ECB will not significantly trail behind the Fed.

Regarding the Fed, N. Kashkari (Minneapolis) contended that potential rate cuts for the current year are at risk if inflation remains stagnant, whereas A. Goolsbee (Chicago) emphasized the need for the Fed to consider the effects of a restrictive policy stance, and FOMC Governor M. Bowman remarked that efforts to reduce inflation have hit a roadblock.

So far, according to the FedWatch Tool provided by CME Group, the likelihood of a rate cut in June has remained just above 56%.

Looking ahead, the relatively subdued fundamentals of the eurozone, coupled with the increasing probability of a "soft landing" for the US economy, reinforce expectations of a stronger Dollar in the medium term, particularly as both the ECB and the Fed may introduce easing measures almost simultaneously. In such a scenario, EUR/USD could undergo a more pronounced decline, initially targeting its year-to-date low around 1.0700 before potentially revisiting the lows observed in late October 2023 or early November below 1.0500.

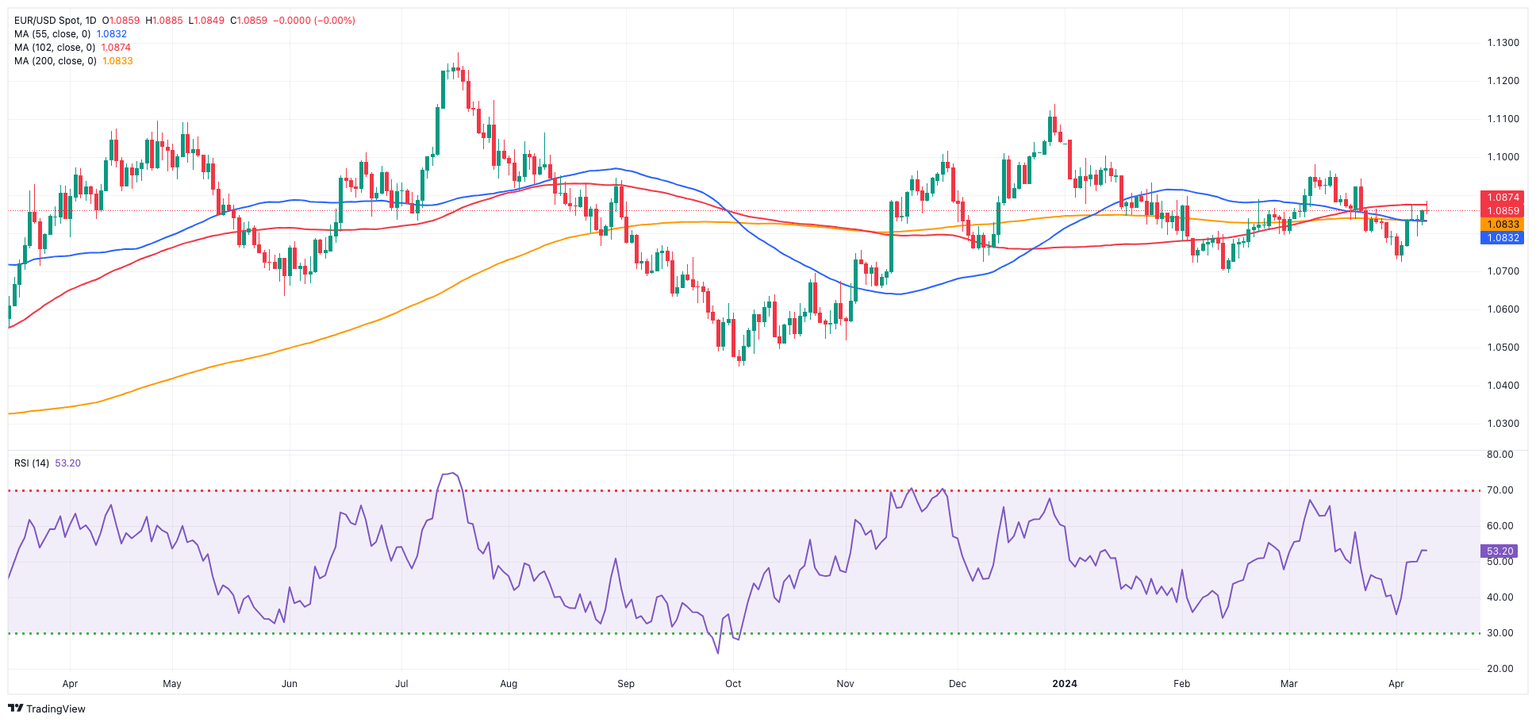

EUR/USD daily chart

EUR/USD short-term technical outlook

On the upside, EUR/USD is expected to face initial resistance at the so-far April peak of 1.0885 (April 9) ahead of the March high of 1.0981 (March 8), and the weekly peak of 1.0998 (January 11), which precedes the psychological barrier of 1.1000. Further advances from here may result in a test of the December 2023 high of 1.1139 (December 28).

On the flip side, immediate contention emerges at the critical 200-day SMA at 1.0832 prior to the April low of 1.0724 (April 2) and the 2024 low of 1.0694 (February 14). Down from here comes the November 2023 low of 1.0516 (November 1), followed by the weekly low of 1.0495 (October 13, 2023), the 2023 bottom of 1.0448 (October 3), and the round milestone of 1.0400.

The 4-hour chart shows that the bullish tone remains in place for the time being. Next on the upside comes 1.0885 ahead of 1.0942. In the other direction, the next ] downward barrier appears to be the 100-SMA and 55-SMA of 1.0828 and 1.0809, respectively, ahead of 1.0791. The Moving Average Convergence Divergence (MACD) maintained the positive stance, but the Relative Strength Index (RSI) deflated to around 55.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.