EUR/USD Forecast: Immediately to the upside comes 1.0880

- EUR/USD regained balance well past the 1.0800 barrier.

- The ECB is largely expected to keep rates unchanged.

- Investors’ attention now shifts to US CPI data.

Another downturn in the US Dollar (USD) prompted a decent upward surge in EUR/USD, once again revisiting the 1.0860 region at the beginning of the week.

Simultaneously, the positive session in US yields across different maturity periods and German 10-year bund yields accompanied the movement in the pair, always amidst an unchanged monetary policy framework.

In the meantime, both the Federal Reserve (Fed) and the European Central Bank (ECB) are expected to embark on easing cycles, potentially starting in June. However, the pace of subsequent interest rate cuts may differ, potentially leading to divergent strategies between the two central banks. Nevertheless, it is anticipated that the ECB will not significantly lag behind the Fed.

According to the FedWatch Tool provided by CME Group, the likelihood of a rate cut in June retreated to approximately 51%, up from nearly 62% a week ago.

Regarding the ECB, the Accounts from its March 6-7 meeting published last week revealed an increasing sense of confidence among policymakers regarding the trajectory of inflation towards their 2% target, bolstering the case for implementing interest rate cuts.

Looking ahead, the relatively subdued fundamentals of the eurozone, coupled with the growing probability of a "soft landing" for the US economy, reinforce expectations of a stronger Dollar in the medium term, especially as both the ECB and the Fed may introduce easing measures almost simultaneously.

In such a scenario, EUR/USD could undergo a more pronounced decline, initially targeting its year-to-date low around 1.0700 before potentially revisiting the lows observed in late October 2023 or early November below 1.0500.

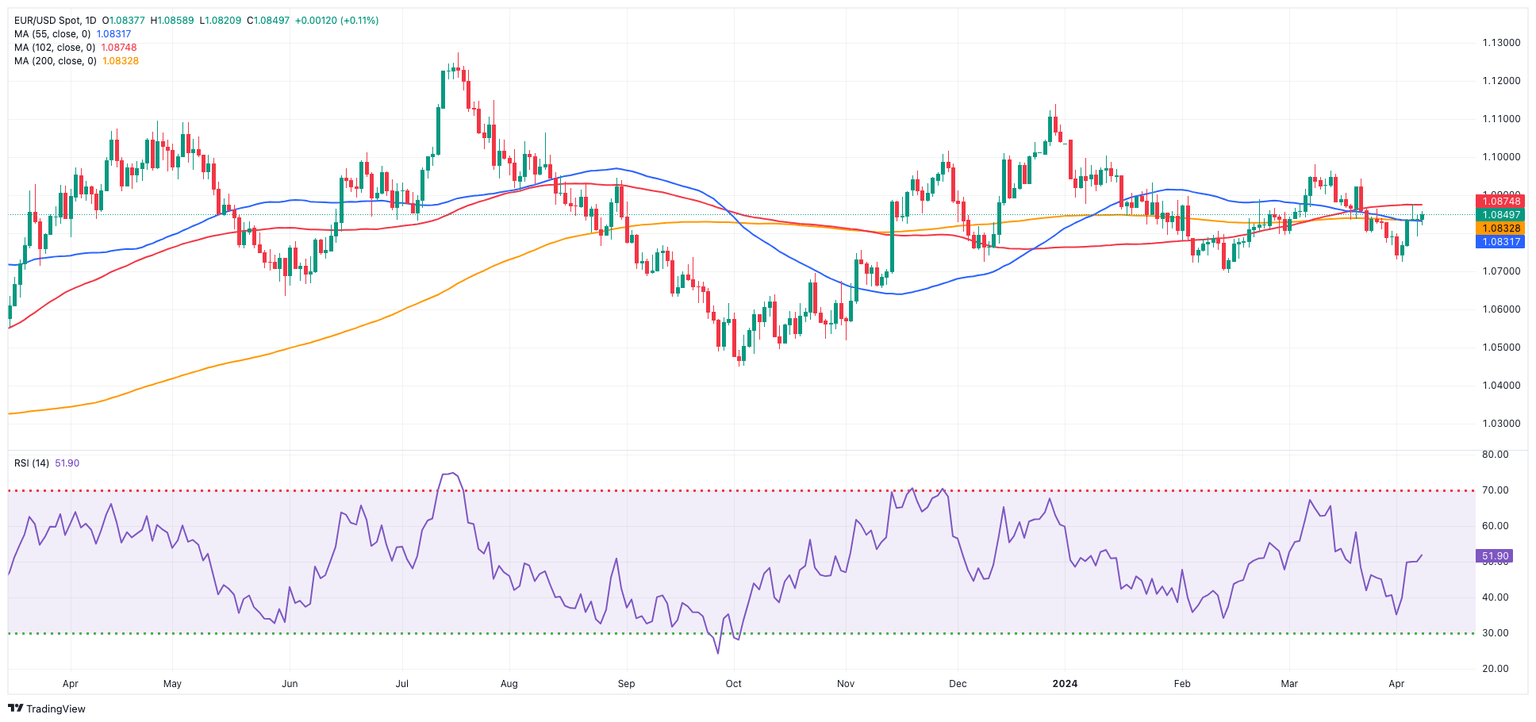

EUR/USD daily chart

EUR/USD short-term technical outlook

On the upside, the EUR/USD is expected to face initial resistance at the March high of 1.0981 (March 8), followed by the weekly top of 1.0998 (January 11) and the psychological barrier of 1.1000. Further advances from here may result in a December 2023 peak of 1.1139 (December 28).

On the other hand, another test of the April low of 1.0724 (April 2) and the 2024 low of 1.0694 (February 14) cannot be ruled out. The low in November 2023 is 1.0516 (November 1), followed by the weekly low of 1.0495 (October 13, 2023), the 2023 bottom of 1.0448 (October 3), and the round milestone of 1.0400.

The 4-hour chart shows the resumption of the upward bias. That said, the pair initially targets 1.0876 ahead of 1.0942. In the other direction, the next clear downward barrier appears to be 1.0724, followed by 1.0694 and 1.0656. The Moving Average Convergence Divergence (MACD) maintained the positive stance, and the Relative Strength Index (RSI) rose to around 61.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.