- EUR/USD has been pressured despite Mid-East calm.

- Upbeat German figures fail to counter USD strength.

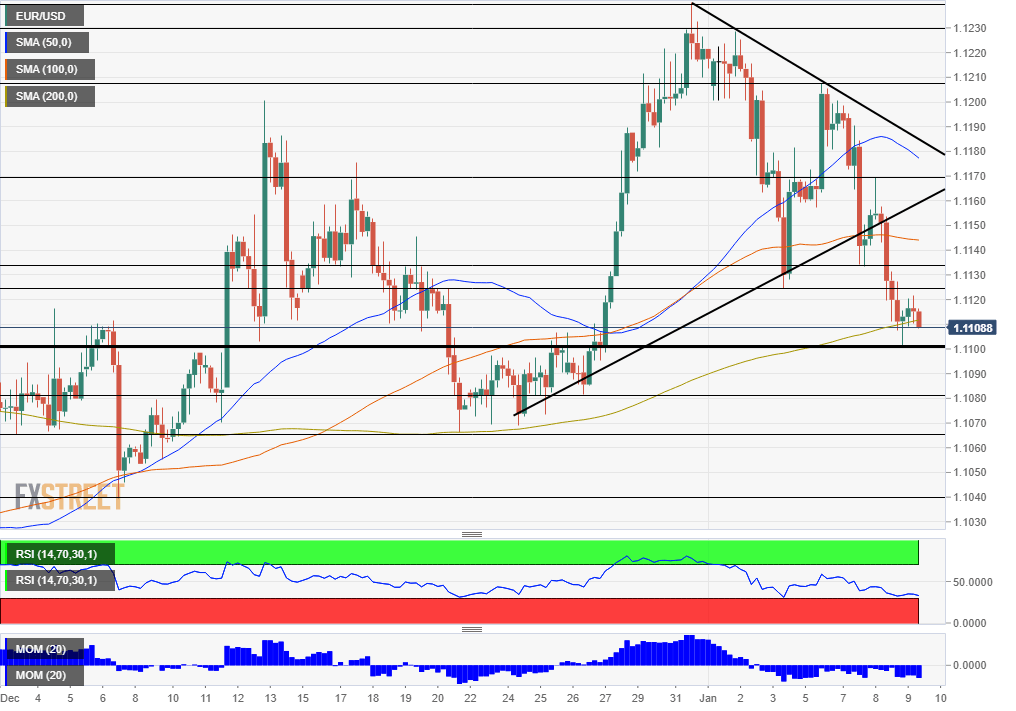

- Thursday's chart is bearish after the pair fell below the wedge.

King Dollar reigns supreme – rising despite the significant easing of Mid-East anxiety. Safe-haven assets such as gold and the yen lost ground, but the greenback held its ground.

President Donald Trump has refrained from calling for a military response to Iran's attack on American bases in Iraq. While he pledged more sanctions on Tehran, the president also offered an olive branch and called for new talks. Several Katyusha missiles fell on Baghdad's fortified "Green Zone" on Wednesday. The incident – like the Iranian attack – probably ended without any damage.

The dollar is supported by US data. ADP's private-sector jobs report showed a gain of 202,000 positions in December – better than expected and on top of an upward revision for November. Together with the upbeat ISM Non-Manufacturing Purchasing Managers' Index, the mood around the world's largest economy is positive. Investors are already eyeing Friday's Non-Farm Payrolls report with elevated expectations.

China confirmed that Vice Premier Liu He will lead a delegation to Washington early next week to sign the Phase One of the trade deal. Investors are eager to see the details of the accord – trying to understand if this is only a temporary calm in the trade war or the dawn of a new relationship.

Back to normal?

In the old continent, German Industrial Production beat expectations with an increase of 1.1% in November. The euro's failure to take advantage of the news and recover is telling – the common currency is exposing its weakness.

Eurozone unemployment rate and US jobless claims are of interest later in the day, but central bankers may steal the show. John Williams, President of the New York branch of the Federal Reserve, is one of several Fed speakers. Williams recently downplayed the chances of seeing higher inflation anytime soon – a dovish message – and markets will want to see if he reiterates this stance.

Jens Weidmann, President of the German central bank, will talk late in the day and may reaffirm his hawkish stance. The recent rise in headline inflation – to 1.3% yearly – may embolden Weidmann to call for refraining from additional stimulus.

Assuming no new hostilities, the Mid-East calm may allow for a return to normal market reactions – central bankers being the main market movers.

EUR/USD Technical Analysis

Euro/dollar has dropped below the wedge, or triangle, that had accompanied it in the past week. The currency pair also fell below the 100 Simple Moving Average on the four-hour chart and is struggling to hold onto the 200 SMA. Moreover, momentum is to the downside.

Overall, bears are in control.

Significant support awaits at 1.11, which is the daily low and a round number. The next line to watch is 1.1080, a stepping stone on the way up around Christmas. It is followed by 1.1065, a support line from that time. It is followed by 1.1040, which dates back to early December, and then by 1.10.

Resistance awaits at 1.1125, which was a swing low last week. It is followed by 1.1135, a support line seen earlier this week, and then by 1.1170, a swing high. 1.1205 and 1.1230 are next.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD stays in daily range slightly below 1.0900

EUR/USD continues to move up and down in a narrow band slightly below 1.0900 in the second half of the day on Monday. The modest improvement seen in risk mood makes it difficult for the US Dollar to find demand and helps the pair stay in range.

GBP/USD treads water above 1.2900 amid risk recovery

GBP/USD is keeping its range play intact above 1.2900 in the American session on Monday. The positive shift seen in risk sentiment doesn't allow the US Dollar to gather strength and helps the pair hold its ground ahead of this week's key data releases.

Gold struggles to hold above $2,400

Gold loses its traction and trades in negative territory below $2,400 after suffering large losses in the second half of the previous week. The benchmark 10-year US Treasury bond yield holds above 4.2% and risk flows return to markets, not allowing XAU/USD to rebound.

Crypto Today: Bitcoin is less than 10% away from all-time high as Ethereum ETF approval anticipation brews

Bitcoin trades around $68,000 early on Monday, less than 10% away from its all-time high of $73,777 on Binance. Ethereum ETF anticipation brews among traders and Ether investment products see inflow of over $45 million in the past week.

Election volatility and tech earnings take centre stage

/stock-market-graph-gm532464153-55981218_XtraSmall.jpg)

The US Dollar managed to end the week higher as Trump Trades ensued. Safe-havens CHF and JPY were also higher while activity currencies such as NOK and NZD underperformed.