- EUR/USD faltered once again around 1.1000.

- The dollar gathered pace on dwindling rate cut bets.

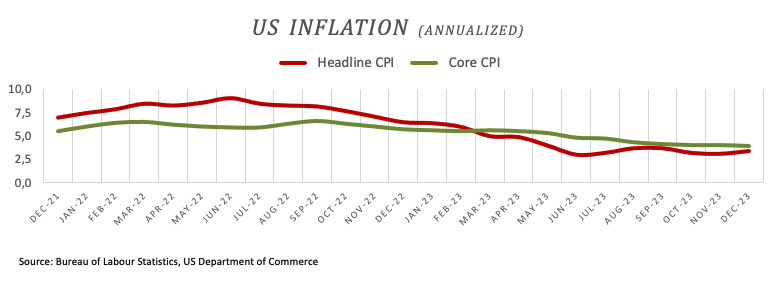

- US inflation surprised to the upside in December.

EUR/USD failed to revisit or surpass the psychological 1.1000 barrier on Thursday, sparking a marked corrective move soon after US inflation figures rose more than expected in December.

Indeed, a firmer-than-estimated US CPI in the last month of 2023 lent support to the greenback as investors trimmed their expectations that the Federal Reserve might start cutting its FFTR in Q2.

The daily downtick in the pair also came amidst the mixed performance of US yields across different maturities as investors repriced their bets on potential rate cuts.

Speaking about the Fed, L. Mester (Cleveland) conveyed that the Fed has not reached the point of considering rate cuts; she emphasized the need for additional evidence indicating the economy's progress as anticipated. Mester added that the current assessment by the Fed revolves around determining the duration for which high interest rates and restrictive policies should be maintained, while she highlighted that a sustained decline in inflation is a prerequisite for any discussion about a potential rate cut. Furthermore, she highlighted the importance of the Fed fine-tuning its policy to achieve a soft landing.

Absent data releases in the domestic calendar, the US docket saw headline CPI rise 3.4% in the year to December and 3.9% from a year earlier when it comes to Core CPI. In addition, weekly Initial Claims rose by 202K in the week to January 6.

EUR/USD daily chart

EUR/USD short-term technical outlook

If the EUR/USD continues to decline and breaks through the 2024 low of 1.0876 (January 5), it may come into contact with the 200-day SMA at 1.0846. If the latter is lost, the December 2023 low of 1.0723 (December 8) may return ahead of the weekly low of 1.0495 (October 13, 2023), which is followed by the 2023 low of 1.0448 (October 3) and the round level of 1.0400. SO far, the pair's optimistic outlook is predicted to remain unchanged above the 200-day SMA.

The 4-hour chart continues to show some short-term consolidation. The breakout of this theme exposes the area of recent tops at 1.0998. This region being surpassed indicates that 1.1139 will most likely be visited. The MACD has largely recovered, indicating a short-term bounce, while the RSI has advanced past 53.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

GBP/USD pressured around 1.2900 after UK Budget report

GBP/USD remains under pressure, trading near fresh one-week lows sub-1.2900. Inflationary pressures kept easing in the United Kingdom, with annual CPI up by 2.8% in February, after printing at 3% in January. Chancellor Rachel Reeves delivers the Spring Statement, discusses the state of public finances.

EUR/USD stays below 1.0800 after upbeat US data

EUR/USD struggles to gain traction and trades below 1.0800 in the American session on Wednesday. Upbeat February Durable Goods Orders data from the US support the US Dollar in the second half of the day, making it difficult for the pair to stage a rebound.

Gold clings to modest daily gains above $3,020

Gold fluctuates in a relatively tight range and manages to hold above $3,020 midweek. The precious metal seems to be benefiting from the positive sentiment surrounding the commodities after Copper climbed to a new all-time high earlier in the day.

Bitcoin holds $87,000 as markets brace for volatility ahead of April 2 tariff announcements

Bitcoin (BTC) holds above $87,000 on Wednesday after its mild recovery so far this week. A K33 Research report explains how the markets are relatively calm and shaping up for volatility as the market absorbs the tariff announcements.

Sticky UK services inflation shows signs of tax hike impact

There are tentative signs that the forthcoming rise in employer National Insurance is having an impact on service sector inflation, which came in a tad higher than expected in February. It should still fall back in the second quarter, though, keeping the Bank of England on track for three further rate cuts this year.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.