EUR/USD Forecast: Further consolidation likely in the near term

- EUR/USD trades above 1.0650 to start the new week.

- An improving risk mood could help the pair limit its losses.

- The Federal Reserve will announce policy decisions on Wednesday.

After posting losses for the eighth consecutive week, EUR/USD started the new week in a calm manner and went into a consolidation phase at around mid-1.0600s. The economic calendar will not offer any high-tier data releases and investors could remain reluctant to take large positions ahead of the Federal Reserve's (Fed) policy meeting.

The euro came under heavy bearish pressure in the second half of the previous week and EUR/USD touched its weakest level since March at 1.0630. Although the European Central Bank (ECB) unexpectedly opted to raise key rates by 25 basis points (bps) after the September policy meeting, it hinted that might be done with the tightening cycle. On the same note, “no further rate hikes are expected in the coming months," ECB policymaker Madis Muller said.

Euro price today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the weakest against the Swiss Franc.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 0.05% | 0.20% | -0.06% | 0.10% | -0.08% | 0.08% | -0.08% | |

| EUR | -0.05% | 0.16% | -0.12% | 0.07% | -0.13% | 0.03% | -0.14% | |

| GBP | -0.20% | -0.15% | -0.27% | -0.08% | -0.31% | -0.12% | -0.30% | |

| CAD | 0.07% | 0.10% | 0.26% | 0.16% | -0.03% | 0.15% | -0.03% | |

| AUD | -0.11% | -0.05% | 0.10% | -0.18% | -0.22% | -0.02% | -0.19% | |

| JPY | 0.08% | 0.12% | 0.28% | 0.04% | 0.19% | 0.15% | 0.01% | |

| NZD | -0.09% | -0.03% | 0.12% | -0.15% | 0.01% | -0.18% | -0.15% | |

| CHF | 0.08% | 0.14% | 0.30% | 0.03% | 0.23% | -0.01% | 0.17% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Early Monday, US stock index futures trade in positive territory. A bullish opening in Wall Street could make it difficult for the US Dollar (USD) to find demand in the absence of fundamental catalysts.

On Tuesday, Eurostat will release revisions to August inflation readings and the Fed will announce its interest rate decision and unveil the updated Summary of Economic Projections (SEP) on Wednesday.

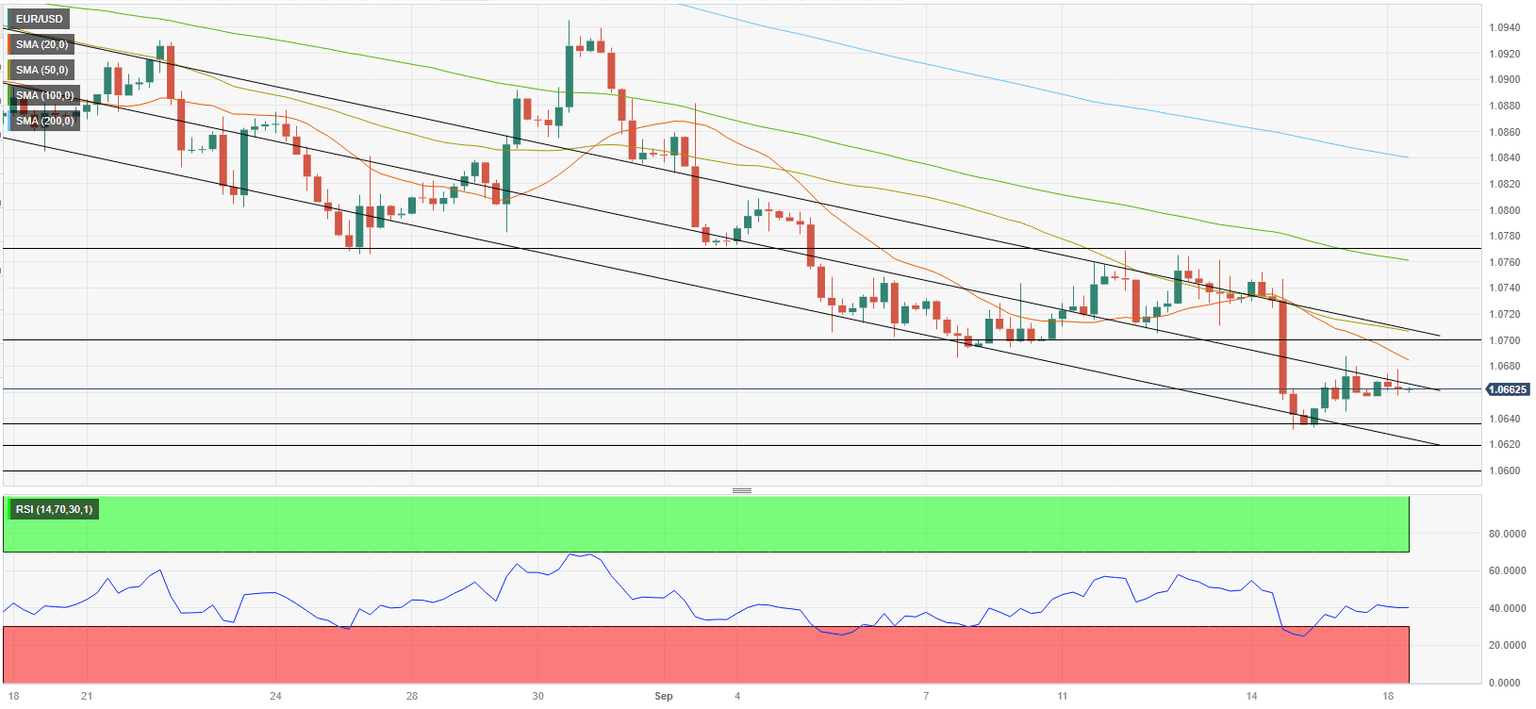

EUR/USD Technical Analysis

EUR/USD was last seen trading near the mid-point of the descending regression channel at 1.0660. If the pair manages to stabilize above that level, the upper limit of the channel at 1.0700, which is also reinforced by the 50-period Simple Moving Average (SMA) on the four-hour chart, could be seen as the next recovery target before 1.0760 (100-period SMA).

On the downside, 1.0630 (static level, lower limit of the descending channel) aligns as first support before 1.0600 (psychological level) and 1.0540 (static level from February).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.