EUR/USD Forecast: Firmer US Dollar suggests lower lows ahead

EUR/USD Current price: 1.0812

- Without relevant macroeconomic data, attention remains on central banks’ officials.

- The United States upwardly revised the Q4 Gross Domestic Product to 3.4%.

- EUR/USD extends its slide sub-1.0800 and could soon retest 1.0694.

The US Dollar gained momentum in the mid-European session, pushing EUR/USD to a fresh one-month low of 1.0774. The decline accelerated after Germany reported Retail Sales fell 2.7% YoY in February, much worse than the 0.8% slide anticipated. Other than that, investors continue to act according to central bank officials´words, as upcoming rate cuts remain the main theme.

Hawkish comments from Federal Reserve (Fed) Governor Chris Waller late on Wednesday provided initial support for the American currency. According to his own words, Waller is not in a rush to cut the policy rate, as recent data “tells me that it is prudent to hold this rate at its current restrictive stance perhaps for longer than previously thought to help keep inflation on a sustainable trajectory toward 2%.”

Across the pond, European Central Bank (ECB) Board member Fabio Panetta noted that the risks to price stability in the Euro Zone are diminishing, materializing the conditions for starting to ease monetary policy. Several ECB officials have hinted at a rate cut in June, following President Christine Lagarde’s words following the latest central bank meeting.

Government bonds fell with Waller’s words, while stocks rallied. Wall Street closed Wednesday with solid gains, underpinning most overseas rivals. The Japanese Nikkei, however, edged sharply lower as the Bank of Japan (BoJ) poured cold water on expectations for additional rate hikes after finally pulling the trigger for the first time in almost two decades.

Ahead of Wall Street’s opening, the United States (US) released the final estimate of the Q4 Gross Domestic Product (GDP), which was upwardly revised to 3.4% from the previous 3.2% estimate. Additionally, the country released Initial Jobless Claims for the week ended March 22, which came in better than anticipated at 210K. The country will release the March Michigan Consumer Sentiment Index and February Pending Home Sales during the upcoming American session.

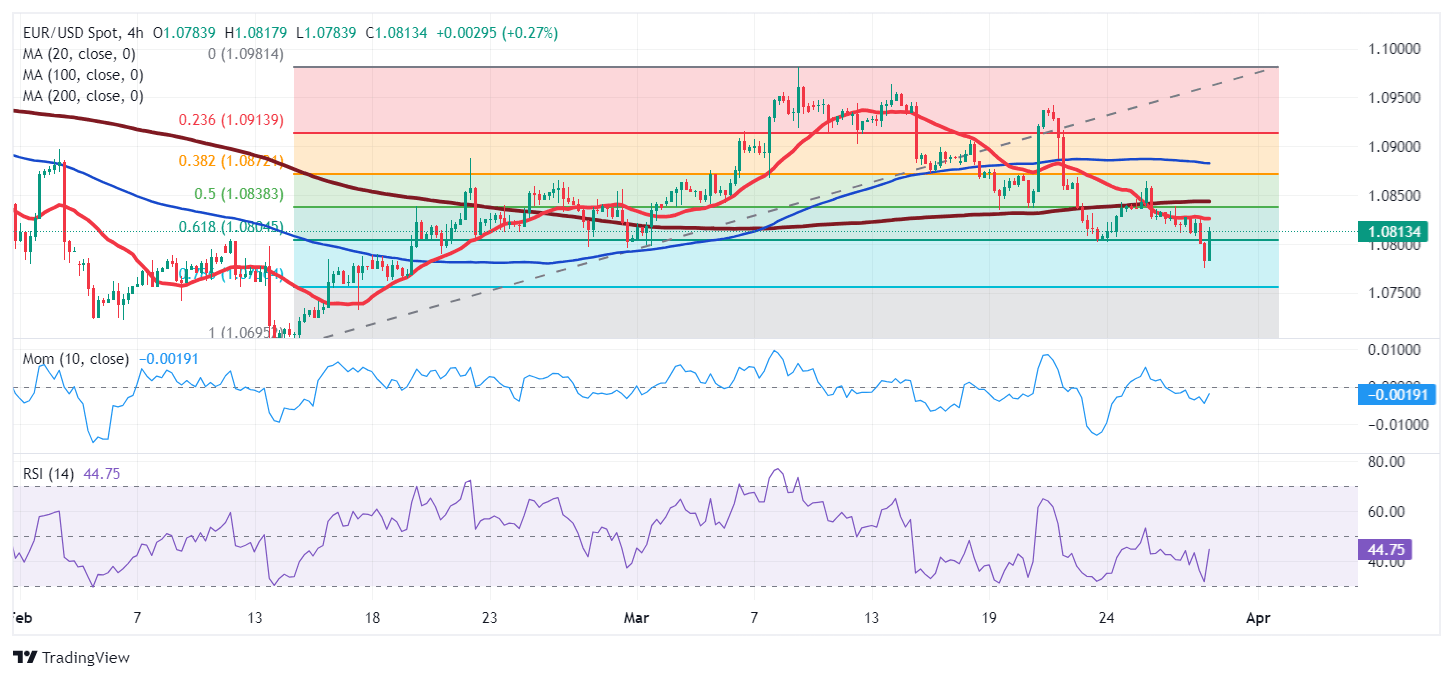

EUR/USD short-term technical outlook

The EUR/USD pair bounced modestly from its intraday low and trades above the 1.0800 threshold. It also stands above the 61.8% Fibonacci retracement of the 1.0694/1.0981 rally at 1.0803, with renewed selling pressure below it favoring a full retracement towards the base of the range. Meanwhile, technical readings in the daily chart supports a lower low ahead. EUR/USD develops below all its moving averages, with a flat 200 Simple Moving Average (SMA) converging with the next Fibonacci resistance level at 1.0835. Finally, technical indicators extended their slides within negative levels, maintaining their downward slopes.

According to the 4-hour chart, the risk also skews to the downside in the near term. EUR/USD develops below all its moving averages, with a bearish 20 SMA accelerating lower below the longer ones. Technical indicators bounced modestly from their intraday lows but remain far below their midlines without signs of a more sustained recovery.

Support levels: 1.0795 1.0750 1.0710

Resistance levels: 1.0835 1.0870 1.0920

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.