- EUR/USD has been retreating from the highs amid trade pessimism and further headlines are awaited.

- President Trump's pressure on Powell previously pushed the currency pair higher.

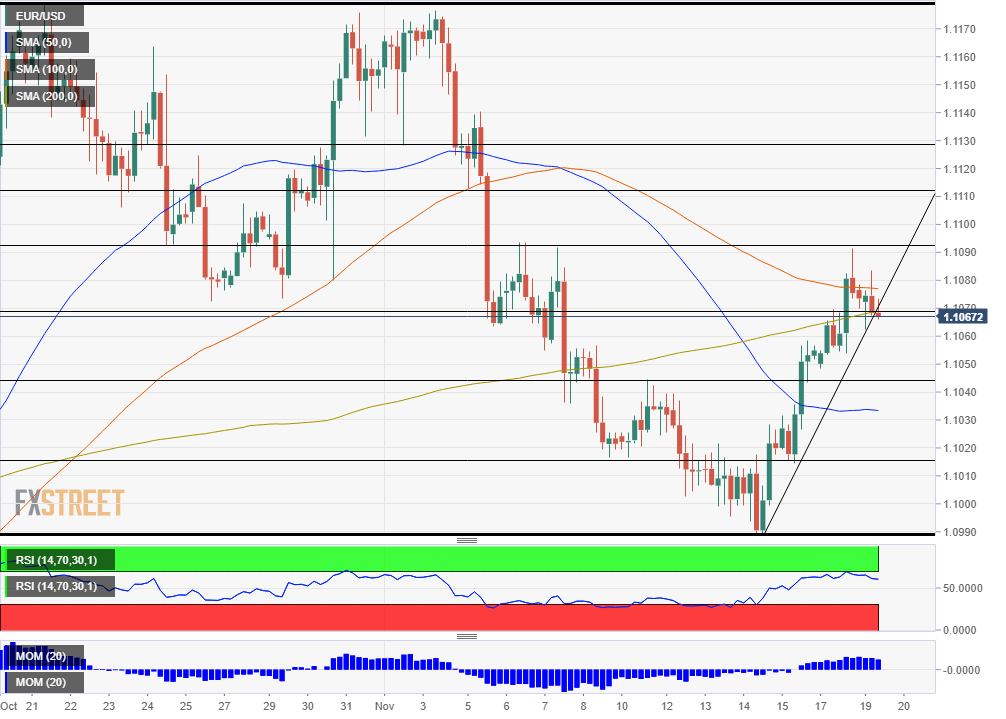

- Tuesday's four-hour chart is pointing to a loss of upwards momentum.

"At my meeting with Jay Powell this morning, I protested the fact that our Fed Rate is set too high." – That tweet by President Donald Trump has been weighing on the dollar.

It joined reports that the president pressured Jerome Powell, Chairman of the Federal Reserve in an unscheduled meeting at the White House. Trump added that he wants rates to be lower than competitors, adding "Too strong a Dollar hurting manufacturers and growth."

The Fed's communication emphasized that the bank makes its decisions according to the data and independent of political considerations. While the bank will likely resist Trump's demands, it may be unable to hold back if the economic situation deteriorates due to worsening US-Sino trade relations that the president shapes.

Reports coming out of Beijing suggest that China is skeptical about reaching a broad trade deal with the US. That has also been preventing stocks from extending their gains and also adds some pressure on the US Dollar – as it raises the chances of a rate cut.

The clock is ticking toward the next round of planned US tariffs on China, on December 15. The Asian giant has requested that the US not only refrain from slapping new duties but also removes previous ones.

EUR/USD Today

The US publishes Housing Starts and Building Permits for October. These construction-sector figures are set to show a gradual increase.

Later on, John Williams, President of the New York branch of the Federal Reserve, may shed more light on future monetary policy amid growing trade uncertainty but satisfactory economic performance. Eric Rosengren, his colleague from the Boston Fed – a known hawk – has expressed concern about the bank's recent rate cuts and said that they leave the institution with fewer tools to battle a future recession.

The euro-zone Current Account balance beat expectations with 28.2€ billion in October, but the common currency has shrugged it off and remains focused on US developments.

EUR/USD Technical Analysis

Euro/dollar has retreated from the highs around 1.1090 and momentum on the four-hour chart is waning. Moreover, the currency pair is struggling to hold onto the steep uptrend support line that has been accompanying it since late last week. EUR/USD also lost the 100 Simple Moving Average and struggles to hold onto the 200 SMA.

Overall, the picture is mixed.

Resistance awaits at 1.1090, which was the high point on Monday and also capped euro/dollar in early November. It is followed by 1.1110, a swing low from earlier in the month, and then by 1.1130 and 1.1180.

Support awaits at 1.1070, which provided support twice in late October and held EUR/USD on its way up last week. Next, we find 1.1045, which served as resistance last week, followed by 1.1015, which provided support around the same time. 1.0990, which is November's low point, is next.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD stays in daily range slightly below 1.0900

EUR/USD continues to move up and down in a narrow band slightly below 1.0900 in the second half of the day on Monday. The modest improvement seen in risk mood makes it difficult for the US Dollar to find demand and helps the pair stay in range.

GBP/USD treads water above 1.2900 amid risk recovery

GBP/USD is keeping its range play intact above 1.2900 in the American session on Monday. The positive shift seen in risk sentiment doesn't allow the US Dollar to gather strength and helps the pair hold its ground ahead of this week's key data releases.

Gold extends slide below $2,400

Gold stays under persistent bearish pressure after breaking below the key $2,400 level and trades at its lowest level in over a week below $2,390. In the absence of fundamental drivers, technical developments seem to be causing XAU/USD to stretch lower.

Crypto Today: Bitcoin is less than 10% away from all-time high as Ethereum ETF approval anticipation brews

Bitcoin trades around $68,000 early on Monday, less than 10% away from its all-time high of $73,777 on Binance. Ethereum ETF anticipation brews among traders and Ether investment products see inflow of over $45 million in the past week.

Election volatility and tech earnings take centre stage

/stock-market-graph-gm532464153-55981218_XtraSmall.jpg)

The US Dollar managed to end the week higher as Trump Trades ensued. Safe-havens CHF and JPY were also higher while activity currencies such as NOK and NZD underperformed.