EUR/USD Forecast: Extra losses likely below 1.0790

- EUR/USD came under renewed downward pressure.

- The marked rebound in the US Dollar weighed on the pair.

- Fed-ECB policy divergence remains at centre stage.

The resumption of the positive trend in the US Dollar (USD) motivated the USD Index (DXY) to reverse part of the recent weakness while putting the risk-linked galaxy under noticeable pressure and sending EUR/USD back to the proximity of the 1.0700 neighbourhood on Thursday.

On another front, the pair's decent drop came despite further easing of political concerns on the old continent, particularly in France, ahead of the first round of the snap elections scheduled for June 30.

Still in the region, the European Central Bank’s (ECB) Klaas Knot supported market expectations for one or two more interest rate cuts this year, noting that inflation appeared to be moving towards the 2% target.

On this, money markets see around 42 bps of easing by year-end, while market consensus expects the ECB to maintain its policy rate unchanged at its July 18 gathering.

Regarding the Fed, Minneapolis Fed President Neel Kashkari suggested early in the session that it could take one or two years for US inflation to reach the Fed’s target.

Additionally, the CME Group's FedWatch Tool now indicates nearly a 66% probability of lower interest rates in September.

In the short term, the European Central Bank's (ECB) recent rate cut, contrasting with the Fed's decision to maintain rates, has widened the policy gap between the two central banks, potentially exposing EUR/USD to further weakness.

Looking ahead, the Eurozone's emerging economic recovery and perceived slowdowns in the US economy are expected to mitigate this disparity, providing some support for the pair in the short term.

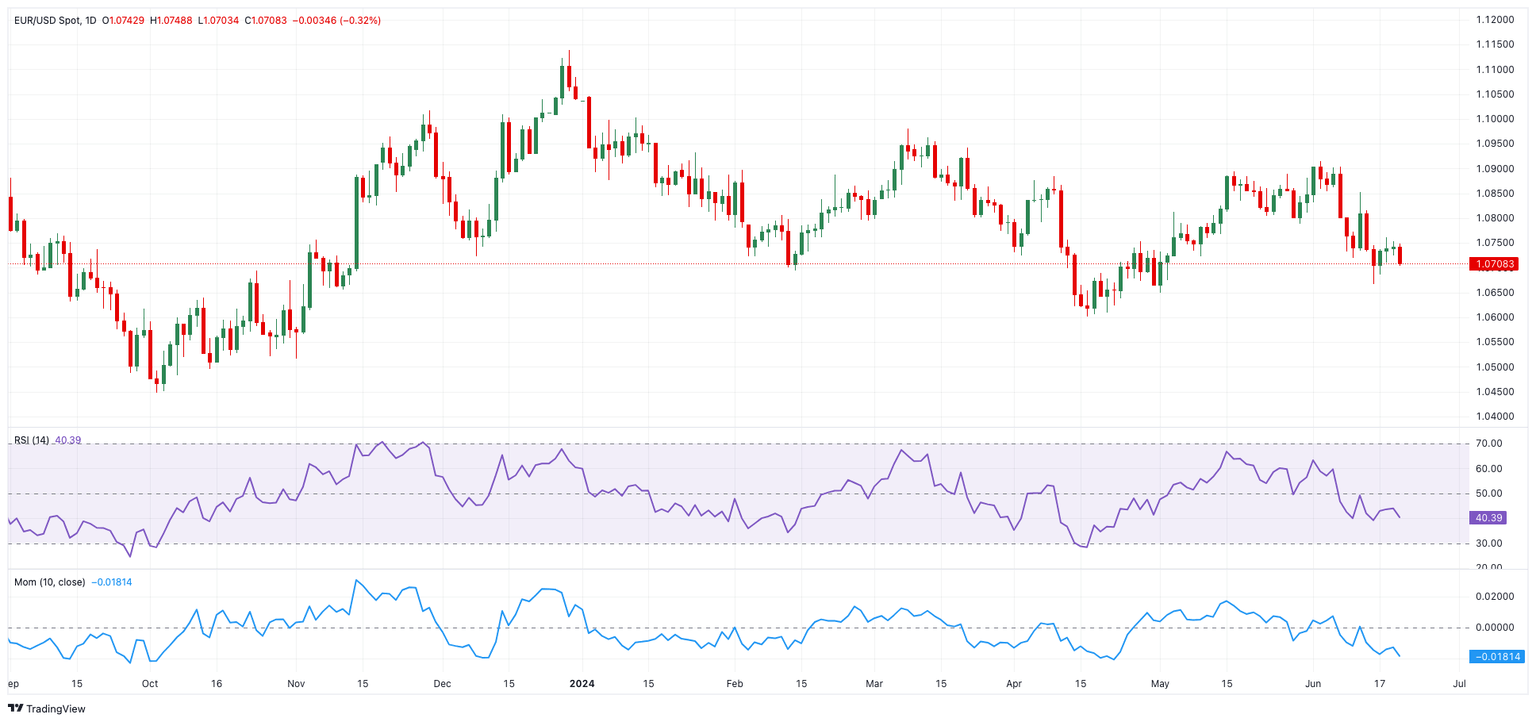

EUR/USD daily chart

EUR/USD short-term technical outlook

If EUR/USD rebound gains traction, the 200-day SMA at 1.0788 looms as the next objective, ahead of the weekly peak of 1.0852 (June 12) and the June high of 1.0916 (June 4). The breakout of this level reveals the March top of 1.0981 (March 8), followed by the weekly peak of 1.0998 (January 11), and the critical 1.1000 yardstick.

If bears take control, the pair may revisit the June low of 1.0667 (June 14), seconded by the May low of 1.0649 (May 1), and finally the 2024 bottom of 1.0601 (April 16).

The 4-hour chart as far shows some signs of renewed weakness. Initial resistance comes at 1.0761 ahead of 1.0808 and 1.0852, 1. The earliest support appears at 1.0667, followed by 1.0649 and 1.0601. The Relative Strength Index (RSI) has stabilized around 37.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.