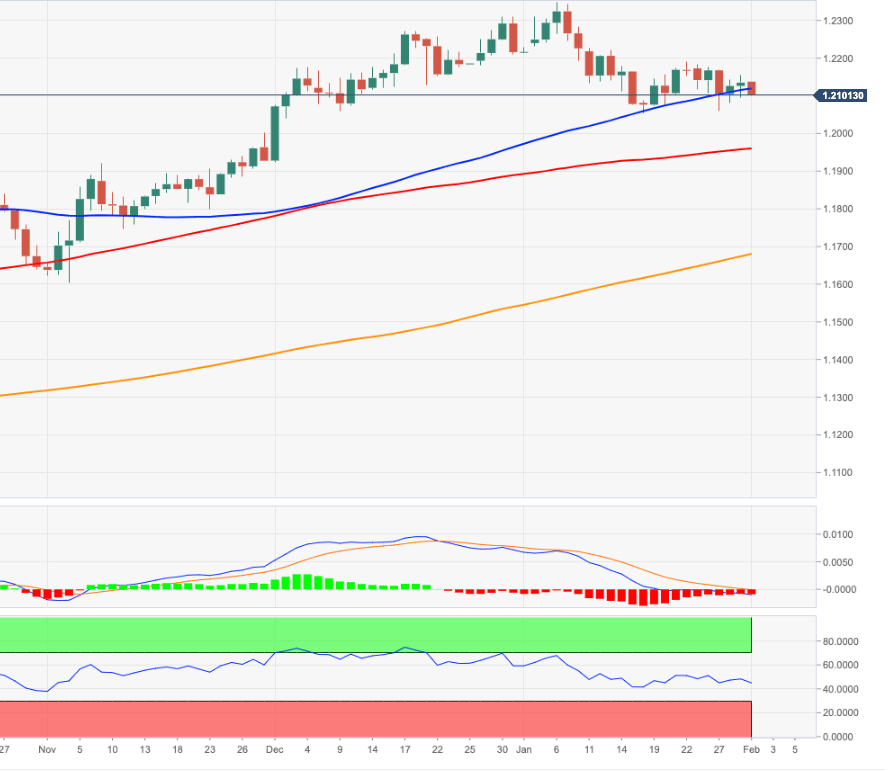

EUR/USD Forecast: Extra consolidation looks likely

- EUR/USD extends the rangebound trading above 1.2100.

- Decent support lines up in the 2021 lows around 1.2050.

The single currency starts the week on the defensive vs. the greenback following two consecutive sessions with gains. The current downtick in EUR/USD, however, falls within the consolidative range prevailing since mid-January.

In the meantime, the pair remains poised to extend this side-lined fashion in the very near-term pari passu with investors’ expectations of extra fiscal stimulus in the US.

Indeed, the progress of the coronavirus pandemic along with the vaccine rollout and the upcoming debate on the stimulus package by US policymakers (due later in the week) are seen the main drivers of the pair’s price action at least in the short-term horizon.

Near-term Price Outlook

The inability of bulls to push EUR/USD past recent tops in the vicinity of 1.2200 has sparked the ongoing consolidation with the lower bound of the range in the mid-1.2000s, or YTD lows. This idea is reinforced by the RSI navigating the proximity of the 50 level. A sustainable move beyond this area should pave the way for a test of the so far yearly peaks around 1.2350 (January 6). On the opposite side, the 2021 lows near 1.2050 (January 18) are expected to hold bouts of selling pressure. Further south of this level carries the potential to trigger a deeper pullback to, initially, the Fibo retracement (of the November-January rally) at 1.1976.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.