EUR/USD Forecast: Euro's bullish bias intact as 2023 gets underway

- EUR/USD has managed to regain its traction following a short-lived decline.

- The pair's technical outlook suggests that sellers remain on the sidelines.

- Markets are likely to stay quiet on the first trading day of the year.

After having declined toward 1.0650 in the early European morning on Monday, EUR/USD has managed to rebound toward 1.0700. On the back of Friday's gains, the pair closed the previous six weeks in positive territory and the near-term technical outlook suggests that buyers could look to continue to dominate the action.

In an interview with a Croatian newspaper over the weekend, European Central Bank President Christine Lagarde noted that wages in the Eurozone were rising at a faster pace than expected. "We must not allow inflationary expectations to become de-anchored or wages to have an inflationary effect," Lagarde added. Although these comments sound slightly hawkish, the Euro doesn't seem to be capitalizing on them for the time being.

Meanwhile, S&P Global's Manufacturing PMI for the Eurozone came in at 47.8, matching the market expectation and the flash estimate. Commenting on the data, "with the global economic backdrop darkening and eurozone interest rates rising again in December, risks to the demand outlook remain skewed to the downside," said Chris Williamson, Chief Business Economist at S&P Global Market Intelligence. On a negative note, S&P Global Manufacturing PMI in Germany arrived at 47.1, slightly lower than the initial estimate of 47.4.

There won't be any high-impact macroeconomic data releases in the remainder of the day. Bond and stock markets in the Eurozone and the US will be closed in observance of the New Year holiday, suggesting that EUR/USD is likely to fluctuate in a tight channel in the second half of the day.

EUR/USD Technical Analysis

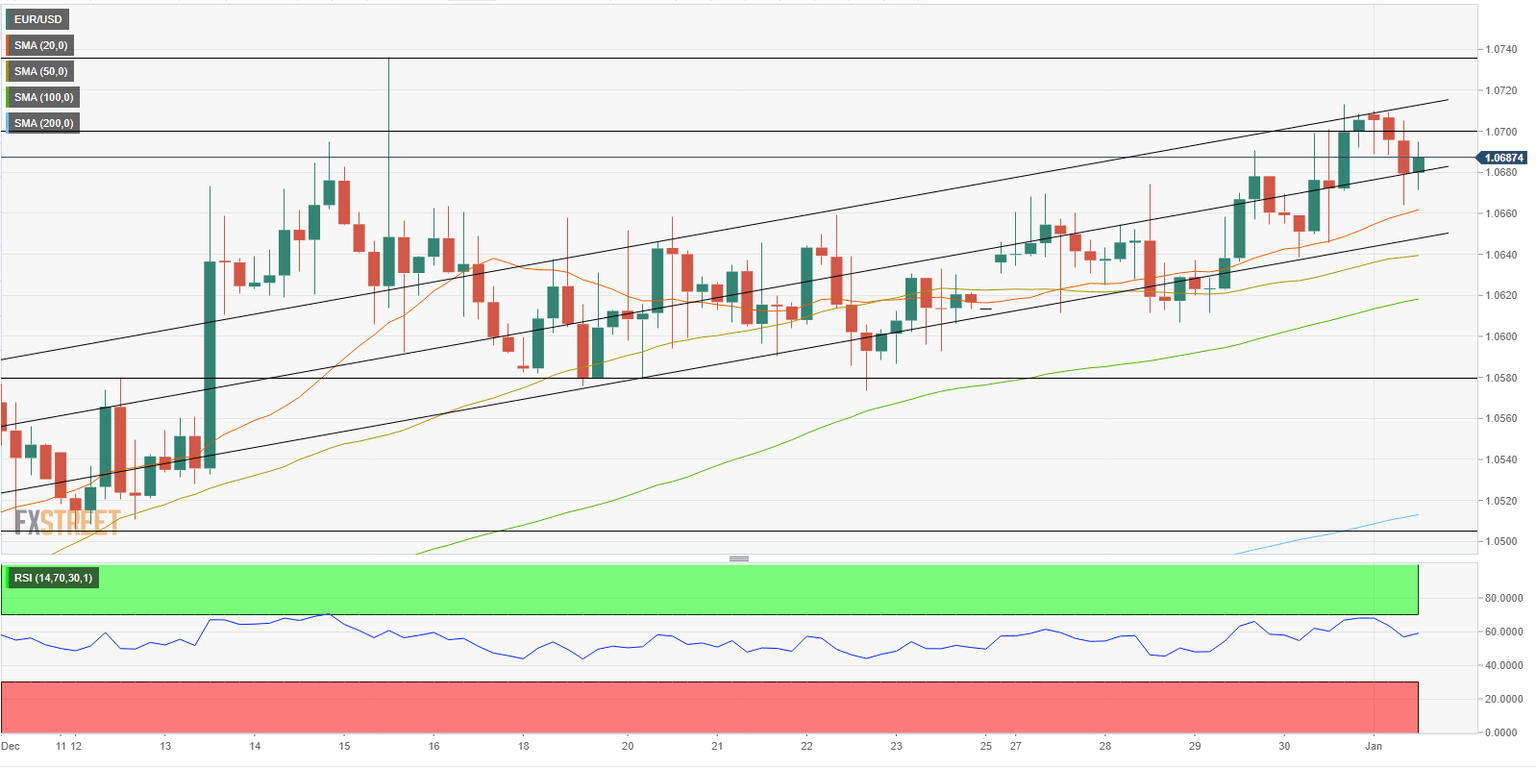

EUR/USD holds above the 20-period Simple Moving Average (SMA) and continues to trade within the upper half of the ascending regression channel, suggesting that sellers remain uninterested. Additionally, the Relative Strength Index (RSI) indicator on the four-hour chart stays above 50, confirming the bullish bias in the short-term outlook.

On the upside, the 1.0700/1.0710 area (psychological level, upper limit of the ascending regression channel) aligns as initial resistance. In case the pair rises above that level, it could target 1.0735 (December 15 high) and 1.0780 (Static level from late May).

First support is located at 1.0680 (mid-point of the regression channel) before 1.0660 (20-period SMA) and 1.0640/50 (lower limit of the ascending channel, 50-period SMA).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.