EUR/USD Forecast: Euro turns technically overbought ahead of US data

- EUR/USD climbed to fresh multi-month highs above 1.1100.

- Near-term technical outlook suggests that the pair is overbought.

- US economic docket will feature weekly Initial Jobless Claims.

EUR/USD gathered bullish momentum and advanced to its highest level since late July above 1.1100. The pair seems to have gone into a consolidation phase on Thursday as investors await macroeconomic data releases from the US.

Euro price this week

The table below shows the percentage change of Euro (EUR) against listed major currencies this week. Euro was the strongest against the US Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.83% | -0.69% | -0.55% | -0.61% | -1.09% | -0.63% | -2.00% | |

| EUR | 0.92% | 0.17% | 0.41% | 0.29% | -0.22% | 0.31% | -1.06% | |

| GBP | 0.81% | -0.23% | 0.41% | 0.09% | -0.42% | 0.24% | -1.43% | |

| CAD | 0.55% | -0.61% | -0.20% | -0.32% | -0.54% | 0.09% | -1.59% | |

| AUD | 0.62% | -0.28% | -0.08% | 0.07% | -0.49% | 0.03% | -1.57% | |

| JPY | 1.07% | 0.28% | 0.21% | 0.82% | 0.50% | 0.65% | -1.05% | |

| NZD | 0.64% | -0.25% | -0.02% | 0.10% | -0.02% | -0.52% | -1.28% | |

| CHF | 2.14% | 1.05% | 1.12% | 1.58% | 1.59% | 1.04% | 1.38% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

In the absence of fundamental drivers, the US Dollar came under selling pressure as US Treasury bond yields turned south. As the benchmark 10-year yield slumped to a fresh multi-month low near 3.8%, the USD Index lost 0.8% on Wednesday.

Early Thursday, markets remain relatively quiet. Meanwhile, US stock index futures trade flat after Wall Street's main indexes registered marginal gains on Wednesday.

In the second half of the day, weekly Initial Jobless Claims data will be featured in the US economic docket, alongside Goods Trade Balance for November.

A reading below 200K in Jobless Claims could help the USD stay resilient against its rivals. A significant increase in this data, on the other hand, could have the opposite impact on the currency and help EUR/USD stretch higher.

EUR/USD Technical Analysis

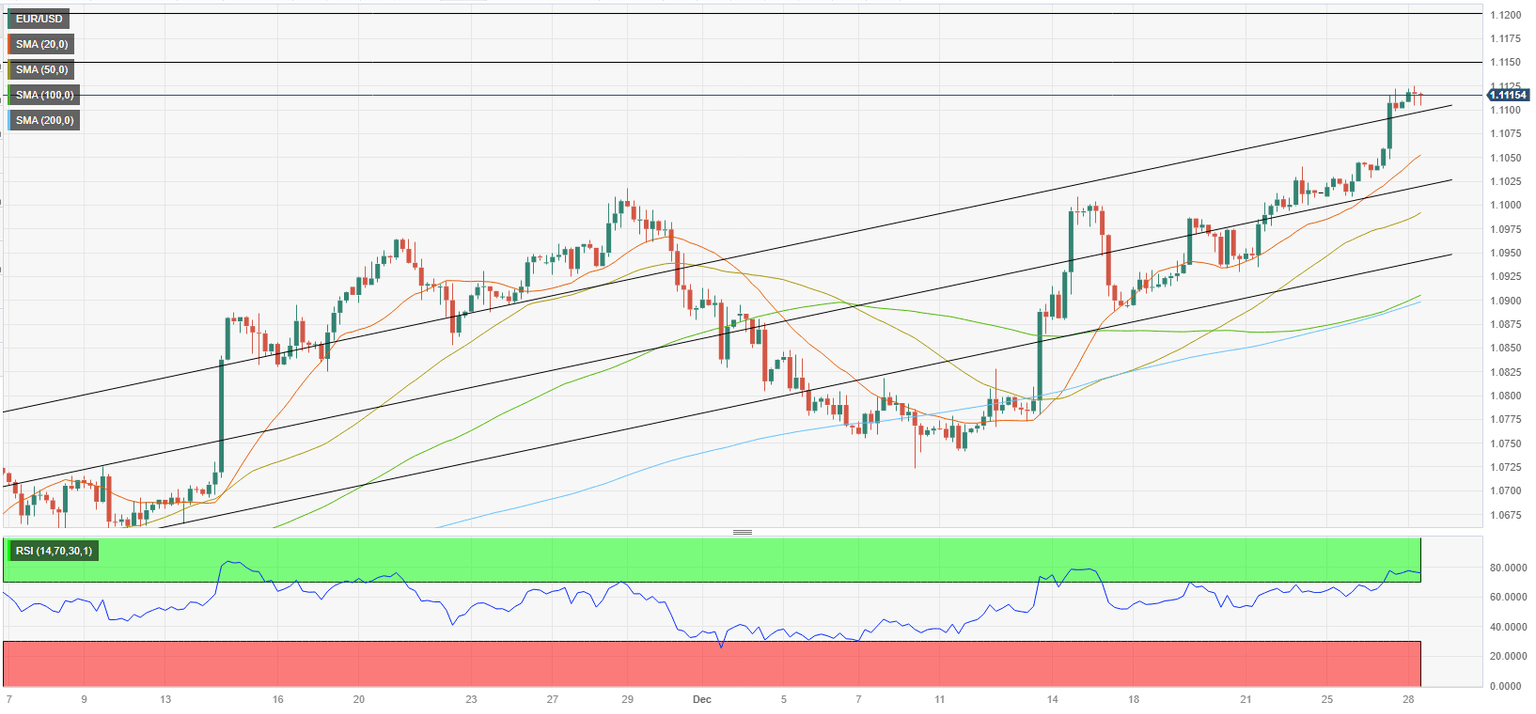

EUR/USD climbed above the upper limit of the ascending regression channel and the Relative Strength Index (RSI) indicator on the 4-hour chart rose above 70, reflecting overbought conditions for the pair.

1.1100 (upper limit of the ascending channel) aligns as first support before 1.1050 (20-period Simple Moving Average) and 1.1020 (mid-point of the ascending channel). In case the pair confirms 1.1100 as support, 1.1150 (static level) and 1.1200 (static level, psychological level) could be seen as next bullish targets.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.