EUR/USD Forecast: Euro stays near 2021 lows as ECB doubles down on dovish outlook

- EUR/USD has been struggling to stage a convincing recovery.

- ECB's Lane doesn't think a monetary policy action is warranted to battle inflation.

- EUR/USD stays within touching distance of 15-month low set at 1.1530.

The common currency stays on the back foot in the first half of the week as investors can't find a reason to anticipate a reversal of direction.

Despite the subdued trading action on Monday, the EUR/USD pair ended up closing the day in the negative territory and seems to have gone into a consolidation phase around mid-1.1500s on Tuesday. The 15-month low the pair set at 1.1530 on October 6 remains within the touching range.

Commenting on the inflation outlook on Monday, European Central Bank (ECB) chief economist Philip Lane said that they need to be "less trigger happy" and wait for data. "The medium-term inflation dynamic is too slow, not too fast," Lane added and noted that the trigger for monetary policy action is not there.

On Tuesday, October ZEW Survey - Economic Sentiment data for Germany and the eurozone will be featured in the European economic docket.

Even if these surveys point to a modest improvement in economic sentiment, the shared currency could have a tough time attracting investors, who are likely to put more weight on the policy divergence between the ECB and the Fed. Later in the day, the NFIB Business Optimism Index and JOLTS Job Openings data from the US will be looked upon for fresh impetus. However, it wouldn't be surprising to see a muted market reaction ahead of Wednesday's US inflation report and FOMC Minutes.

US Consumer Price Index September Preview: Inflation averaging, what inflation averaging?

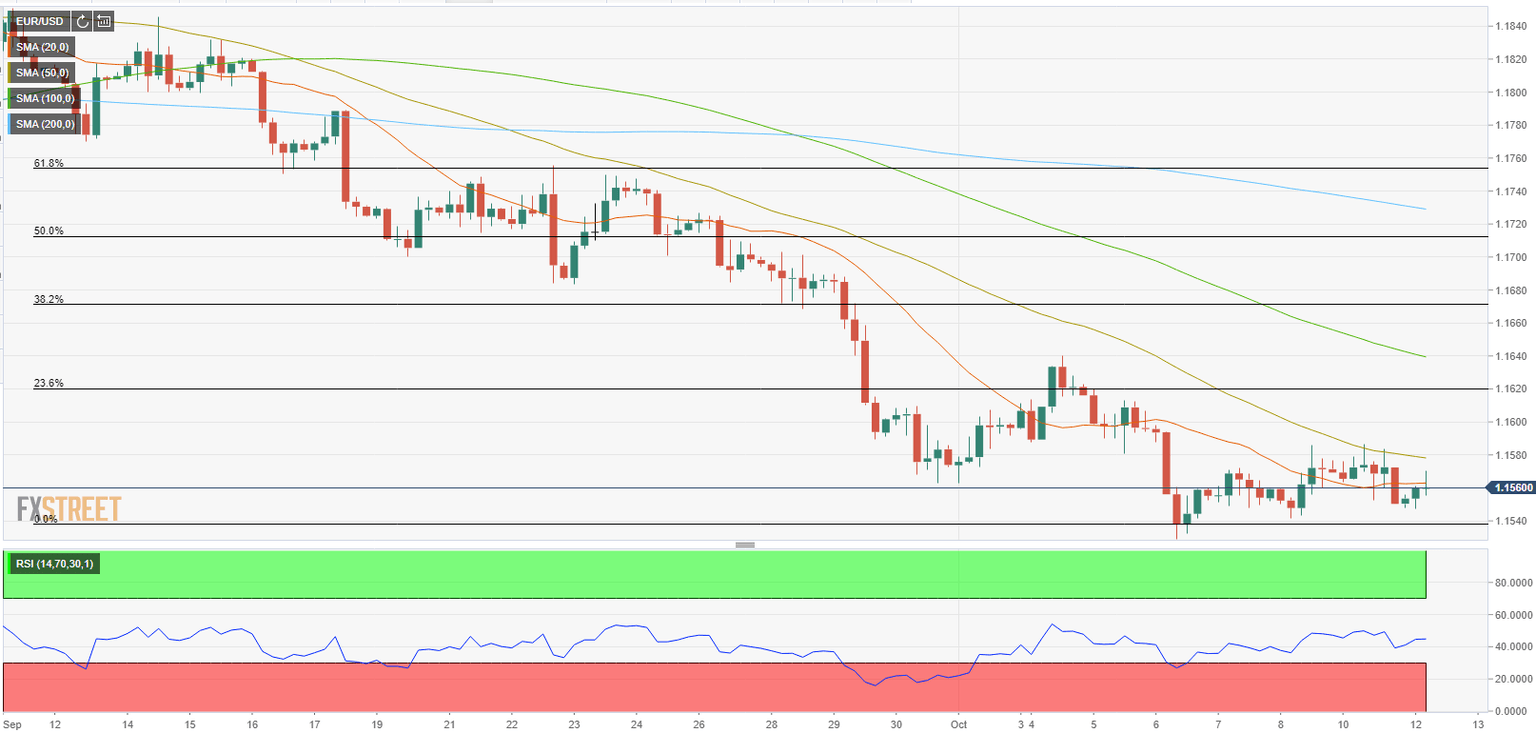

EUR/USD Technical Analysis

The near-term technical outlook for EUR/USD remains bearish with the Relative Strength Index (RSI) indicator on the four-hour chart staying below 50. Additionally, the previous two candles on the same chart closed below the 20-period SMA, confirming the lack of interest in the euro.

On the downside, 1.1530 (15-month low) aligns as the first technical support ahead of 1.1500 (psychological level). A daily close below the latter could attract sellers and trigger another leg lower toward 1.1450 (former resistance).

The initial hurdle is located at 1.1580 (50-period SMA) before EUR/USD could extend its recovery toward 1.1620 (Fibonacci 23.6% retracement of the downtrend that started in early September) and 1.1640 (100-period SMA).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.