- ECB President Mario Draghi said before the European Parliament that recent economic developments have been weaker than expected

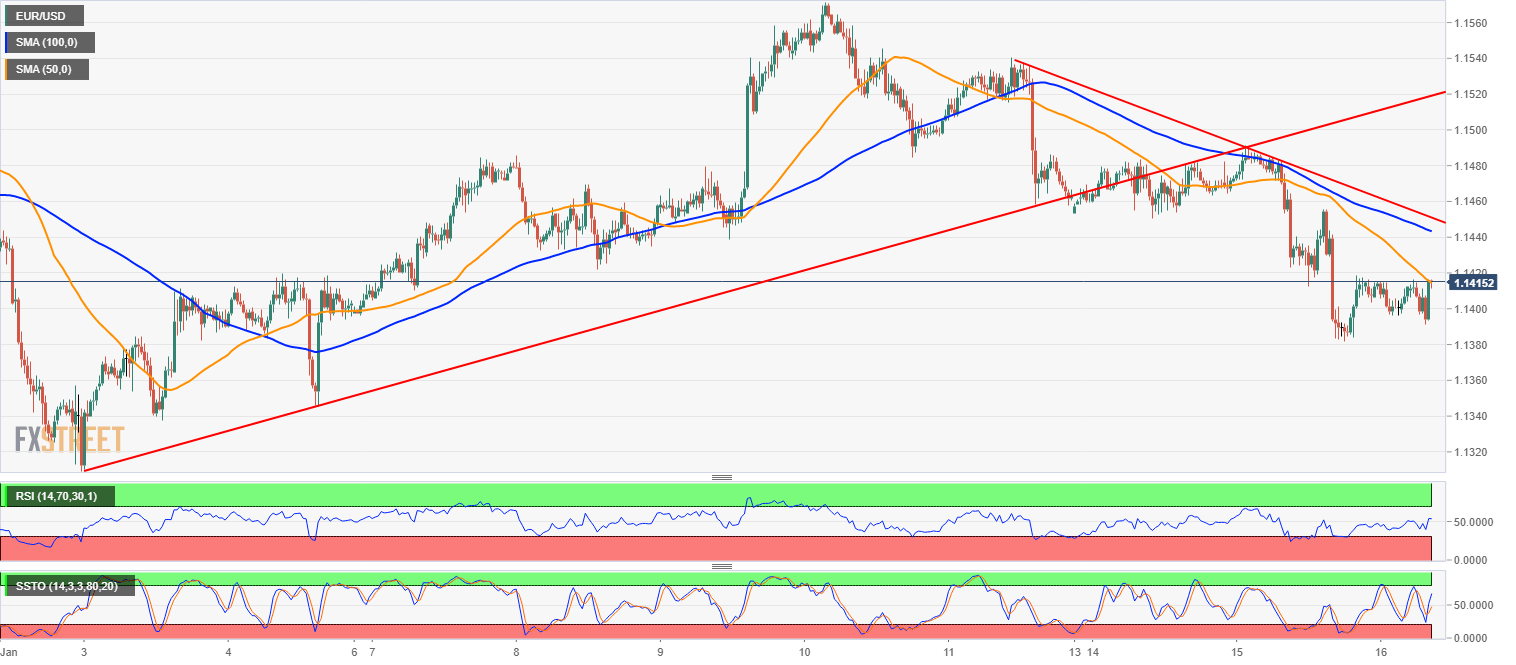

- The sideways trend on EUR/USD is prevailing as currency pair remains below the short-term triangle structure.

- Regional Federal Reserve President of Dallas and Kansas City both confirmed the “patience” language introduced by the chairman Jerome Powell two weeks ago.

- German inflation remained stable at 1.7% y/y in December as oil prices weighed.

The EUR/USD is trading little changed on the downside at around 1.1400 on Wednesday as the trade optimism and the technical picture favors the greenback after the ECB President Mario Draghi acknowledged the worse-than-expected performance of the Eurozone economy in his European Parliament testimony on Tuesday.

The EUR/USD remains in the consolidation phase after flash move below 1.1500 last Friday with little reason for the currency pair to move amid lack of the macro drivers. With the US government shutdown continuing, the major data like retail sales report is delayed while scheduled events including import prices and Fed’s Beige book headline the economic calendar.

Regional Fed officials confirmed the “patience” language while talking about the outlook for the US monetary policy on Tuesday. Kansas City Federal Reserve Bank President Esther George and a voting member of the FOMC said that “it might be a good time to pause” on rate hikes while Dallas Federal Reserve President Robert Kaplan said that patience on interest rates should last at least a quarter or two, and should be a matter of "months" not weeks. Kaplan added that a call for patience does not necessarily mean the Fed should stop raising rates altogether.

While the macro data scheduled for Tuesday confirmed German inflation rising 1.7% over the year in December, the Brexit related events headline the day after the historic defeat of Theresa May’s Brexit deal in the House of Commons with Prime Minister facing a no-confidence vote in parliament today. Markets expect May to win the confidence vote as Conservatives are likely to avoid early elections at the time of low public popularity.

Technically the EUR/USD broke from the consolidation triangle on the downside while it is still moving within a sideways trend. The slide lower in the EUR/USD reflects risk-off sentiment ruling the market amid the slowdown of the global economy with safe have currencies like the US Dollar benefitting. The broader sideways trend is prevailing with the short-term breakout from the triangle structure indicating further US Dollar strength.

EUR/USD 30-minutes chart

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD stays in daily range slightly below 1.0900

EUR/USD continues to move up and down in a narrow band slightly below 1.0900 in the second half of the day on Monday. The modest improvement seen in risk mood makes it difficult for the US Dollar to find demand and helps the pair stay in range.

GBP/USD treads water above 1.2900 amid risk recovery

GBP/USD is keeping its range play intact above 1.2900 in the American session on Monday. The positive shift seen in risk sentiment doesn't allow the US Dollar to gather strength and helps the pair hold its ground ahead of this week's key data releases.

Gold struggles to hold above $2,400

Gold loses its traction and trades in negative territory below $2,400 after suffering large losses in the second half of the previous week. The benchmark 10-year US Treasury bond yield holds above 4.2% and risk flows return to markets, not allowing XAU/USD to rebound.

Crypto Today: Bitcoin is less than 10% away from all-time high as Ethereum ETF approval anticipation brews

Bitcoin trades around $68,000 early on Monday, less than 10% away from its all-time high of $73,777 on Binance. Ethereum ETF anticipation brews among traders and Ether investment products see inflow of over $45 million in the past week.

Election volatility and tech earnings take centre stage

/stock-market-graph-gm532464153-55981218_XtraSmall.jpg)

The US Dollar managed to end the week higher as Trump Trades ensued. Safe-havens CHF and JPY were also higher while activity currencies such as NOK and NZD underperformed.