EUR/USD Forecast: Euro stays dangerously close to key support

- EUR/USD has been struggling to find direction in the absence of fresh catalysts.

- European Central Bank will release the minutes of March policy meeting.

- Risk aversion could provide a boost to USD later in the day.

EUR/USD has been having a hard time making a convincing move in either direction this week. Following Wednesday's choppy action, the pair stays quiet near mid-1.0900s early Thursday and the near-term technical outlook fails to provide a clear directional clue.

The European Central Bank (ECB) will release the March Monetary Policy Meeting Accounts later in the session. Since that policy meeting, several ECB policymakers have stated that they are looking to raise key rates by 25 or 50 basis points (bps) in May. Nevertheless, the ECB's publication is unlikely to hint at the size of the next rate hike.

The US economic docket will feature the weekly Initial Jobless Claims and the Existing Home Sales data for March. Although a significant decline toward 200K in weekly claims could help the US Dollar (USD) gather strength, it is unlikely to influence the Federal Reserve rate hike expectations in a meaningful way.

Several Fed policymakers, including Governor Christopher Waller and hawkish policymaker Lorie Logan, will be delivering speeches later in the day.

Investors will also pay close attention to risk perception. Early Thursday, US stock index futures are down between 0.5% and 0.9%, pressured by disappointing earning figures from big technology firms. In case safe-haven flows dominate the market action in the American session, EUR/USD could come under renewed bearish pressure.

EUR/USD Technical Analysis

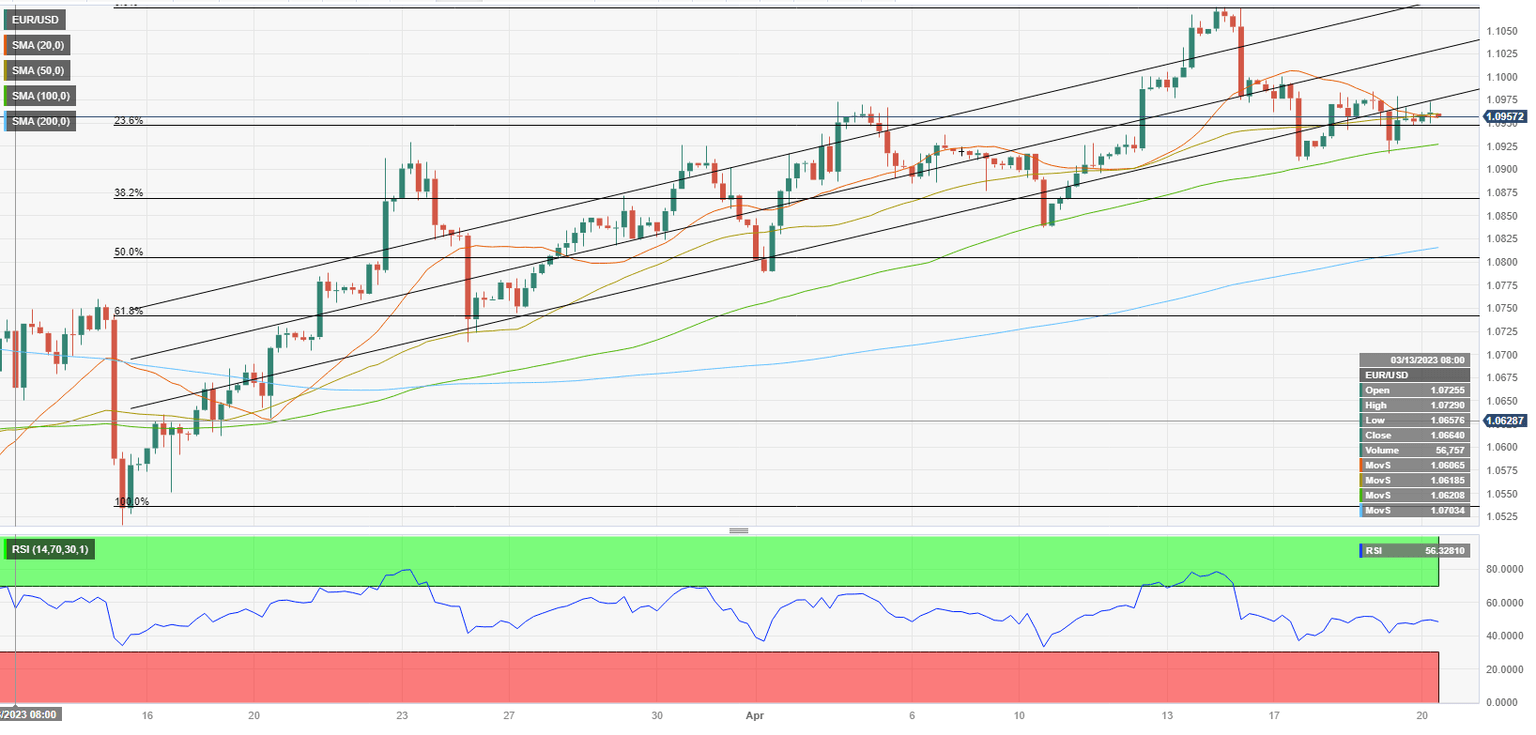

EUR/USD was last seen trading near the 20-period and the 50-period Simple Moving Averages (SMA) on the four-hour chart. Reflecting the pair's indecisiveness, the Relative Strength Index (RSI) indicator continues to move sideways near 50.

On the downside, 1.0950 (Fibonacci 23.6% retracement of the latest uptrend) aligns as interim support before 1.0925 (100-period SMA). A four-hour close below the latter could attract sellers and open the door for an extended slide toward 1.0900 (psychological level) and 1.0870 (Fibonacci 38.2% retracement).

1.0980 (lower limit of the broken regression channel) forms initial resistance before 1.1000 (psychological level, static level) and 1.1030 (mid-point of the channel).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.