EUR/USD Forecast: Euro stabilizes above key technical level

- EUR/USD fluctuates in a narrow band above 1.0900 on Wednesday.

- Improving risk mood helps the pair hold its ground.

- The US Treasury will hold a 10-year note auction later in the day.

EUR/USD closed in negative territory on Tuesday but managed to stabilize above 1.0900. The technical outlook is yet to point to a buildup of bearish momentum.

Following Monday's highly volatile action, markets have calmed down on Tuesday. After falling sharply at the beginning of the week, the US Dollar Index recovered modestly, causing EUR/USD to stay on the back foot. In the second half of the day, however, the positive shift seen in risk mood made it difficult for the USD to gather further strength and helped the pair find a foothold.

Euro PRICE This week

The table below shows the percentage change of Euro (EUR) against listed major currencies this week. Euro was the weakest against the New Zealand Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.02% | 0.81% | 0.53% | -0.84% | -0.76% | -1.01% | 0.47% | |

| EUR | -0.02% | 0.70% | 0.37% | -0.99% | -0.77% | -1.13% | 0.35% | |

| GBP | -0.81% | -0.70% | -0.28% | -1.66% | -1.46% | -1.82% | -0.35% | |

| JPY | -0.53% | -0.37% | 0.28% | -1.33% | -1.33% | -1.52% | -0.02% | |

| CAD | 0.84% | 0.99% | 1.66% | 1.33% | 0.13% | -0.17% | 1.15% | |

| AUD | 0.76% | 0.77% | 1.46% | 1.33% | -0.13% | -0.37% | 1.11% | |

| NZD | 1.01% | 1.13% | 1.82% | 1.52% | 0.17% | 0.37% | 1.49% | |

| CHF | -0.47% | -0.35% | 0.35% | 0.02% | -1.15% | -1.11% | -1.49% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

The data from Germany showed on Wednesday that Industrial Production expanded by 1.4% on a monthly basis in June. This reading came in better than the market expectation for an increase of 1%.

The economic calendar will not feature any high-tier data releases that could impact EUR/USD's action. Later in the American session, the US Treasury will hold a 10-year note auction. In the previous auction, the high-yield landed at 4.276%. In case the high-yield holds above 4% following Wednesday's auction, the benchmark 10-year US Treasury bond yield, which currently stays near 3.9%, recover further and help the USD stay resilient against its rivals.

Meanwhile, investors will also continue to watch the changes in risk perception. At the time of press, US stock index futures were up between 0.8% and 1%. A continuation of Tuesday's risk rally after the opening bell could limit the USD's potential gains and support EUR/USD.

EUR/USD Technical Analysis

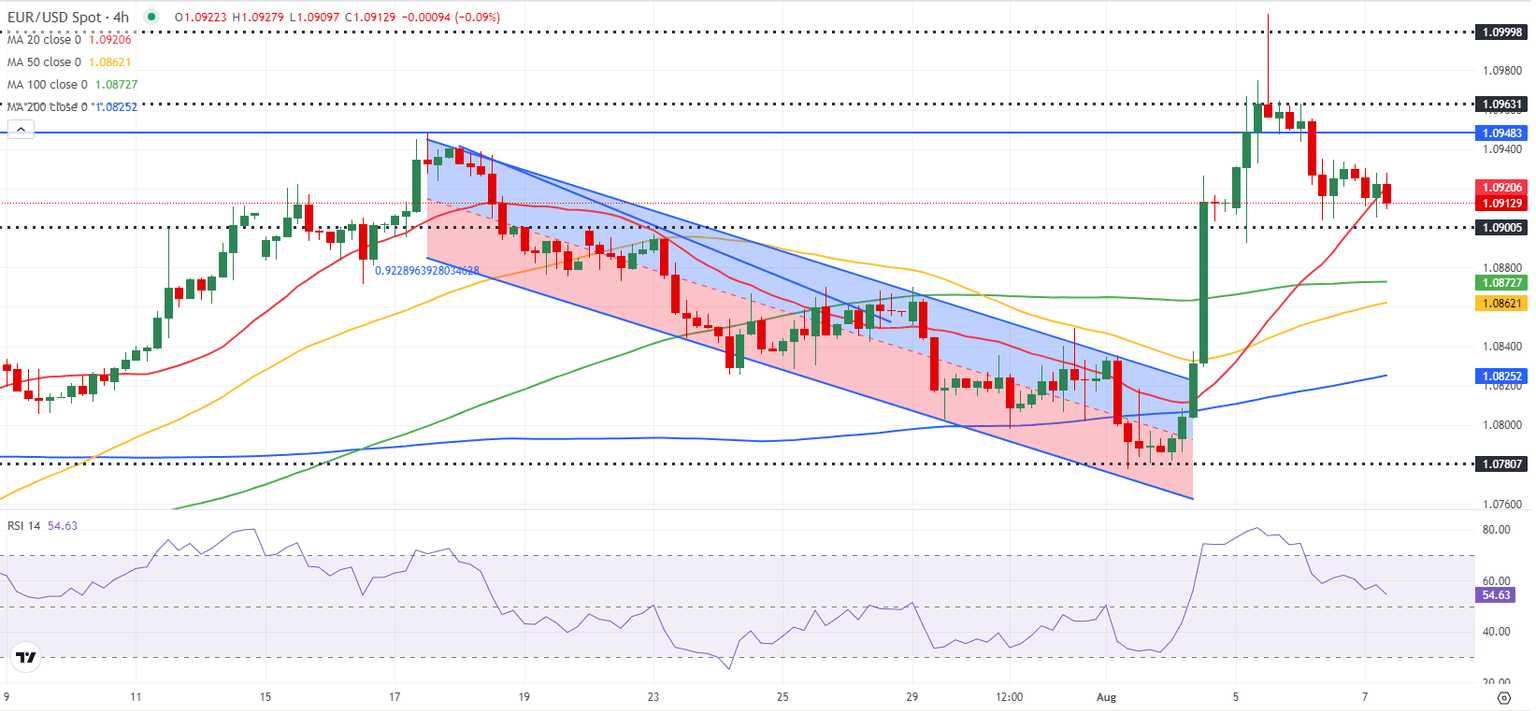

EUR/USD came within a touching distance of 1.0900 several times but recovered quickly afterward, confirming that level as the next technical support. In case the pair falls below this level and starts using it as resistance, 1.0870-1.0860 (100-period Simple Moving Average (SMA) on the 4-hour chart, 50-period SMA) and 1.0825 (200-period SMA) could be seen as next support levels.

On the upside, 1.0960 (static level) aligns as first technical resistance before 1.1000 (psychological level, static level).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.