EUR/USD Forecast: Euro set to tumble if Trump remains in hospital, but Congress could help

- EUR/USD has been attempting to bounce amid hopes that Trump leaves the hospital.

- The dollar may rise if the president does not return to the White House, yet fiscal stimulus hopes could balance the picture.

- Monday's four-hour chart is painting a mixed picture for the currency pair.

Should I stay or should I go? That is the question for President Donald Trump, who wants to convey an upbeat message about his COVID-19 illness and leave the Walter Reed hospital.

The president's doctors also painted a rosy picture, saying he is improving and may be discharged on Monday. That is pushing the safe-haven dollar down and EUR/USD higher, but that may be temporary.

That positive statement created expectations for an early release – and may face a reality check. Doctors have been scrutinizing the official data and are perplexed. Dr. Sean Conley, the president's personal doctor, said that Trump has been given dexamethasone – a steroid that has proved useful for serious coronavirus cases.

If the president is doing well, why would he need that treatment? And if doctors are throwing the kitchen sink at Patient No. 1, dexamethasone could do harm. In general, steroids suppress fever and also cause an upbeat feeling, sometimes reaching euphoric levels. That could explain Trump's positive video message and his drive-by to greet supporters. Entering an SUV, even with a mask, put his staff at risk of contracting the virus.

See Stocks to surge on Trump's discharge hopes, four reasons why a crash may follow

The good news coming from the hospital is that Trump spoke with Senate Majority Leader Mitch McConnell about the fiscal stimulus bill. Republicans and Democrats got closer to a deal last week, but differences remain – Dems want over $2 trillion and the GOP is ready for $1.5 trillion.

House Speaker Nancy Pelosi expressed hopes of striking a deal on Friday, helping stocks recover from the shock of hearing about Trump's positive coronavirus test. If both sides release optimistic assessments, the greenback could fall.

Investors will also eye the ISM Services Purchasing Managers' Index, which is projected to a minor slide from 56.9 in August to 56.3 in September. The indicator tends to have more impact when it is released ahead of the Non-Farm Payrolls, yet still serves as a forward-looking indicator of America's largest sector.

The jobs report – heavily overshadowed by Trump's news – disappointed with an increase of only 661,000 positions in September, signaling a slowdown in the recovery. It was partially balanced by a positive upward revision of August's numbers.

The jobless rate fell to 7.9% – an encouraging figure, but it may reduce the urge for further stimulus. Moreover, it is essential to remember that the drop in the unemployment rate is a result of a fall in the labor force participation rate.

See US Non-farm Payrolls September Report: The two-tier economy

While the world is closely watching Trump's coronavirus case, infections in Europe continue rising and somewhat limit the common currency's gains. The Spanish capital Madrid – Europe's hardest-hit city – was put under lockdown while the Paris region's alert level was raised to a maximum. COVID-19 cases are also rising Germany, the continent's largest economy.

Markit's Services PMIs for September and the Sentix Investor Confidence may reflect a more cautious mood amid these developments.

Overall, speculation about the president's condition is the main theme, but fiscal stimulus and other events have room to move EUR/USD.

EUR/USD Technical Analysis

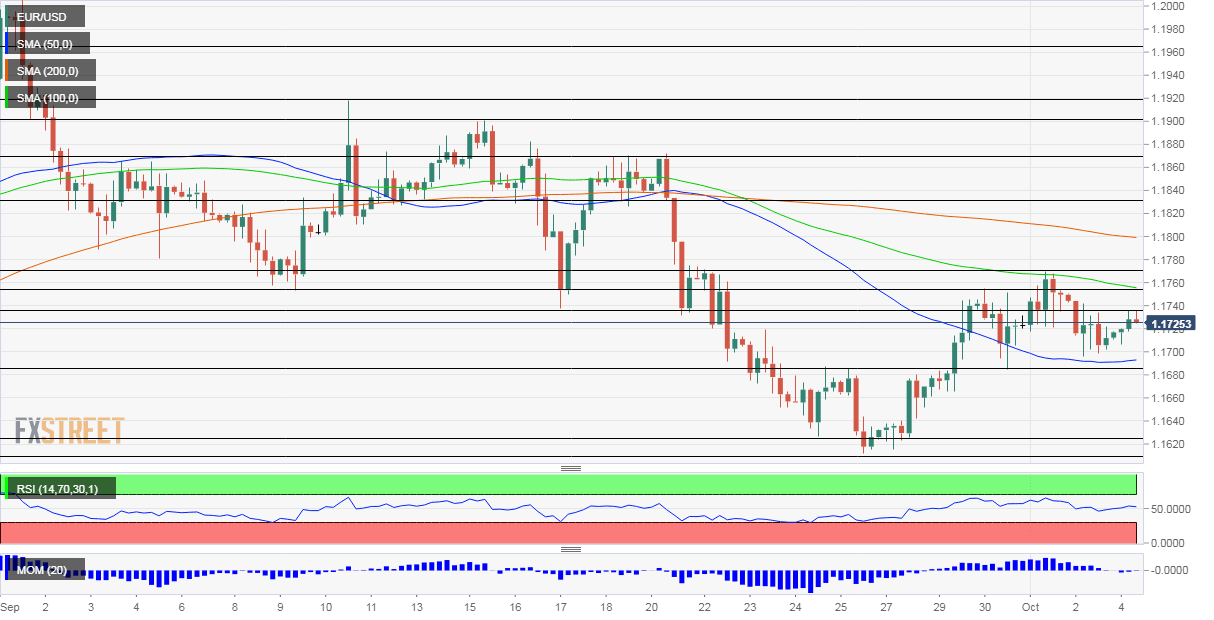

Euro.dollar is trading above the 50 Simple Moving Average on the four-hour chart but below the 100 and 200 SMAs. Momentum and the Relative Strength Index are going nowhere fast. All in all, the relatively limited range trading is showing up in these indicators.

Support awaits at 1.1685, which was a swing low last week. It is followed by 1.1625 and 1.1610, support lines from late September.

Looking up, the daily high of 1.1735 serves as immediate resistance. It is followed by 1.1755, a swing high from last week, followed by 1.1770, the October high.

More Who will be the next president? Markets seem to care more about Congress' actions (for now)

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.