EUR/USD Forecast: Euro set to rally on newfound ECB hawkishness, bullish technical setup

- EUR/USD has slipped back to 1.18 in end-of-month adjustments.

- ECB intentions to taper bond buys and prevailing Fed-fueled optimism may send the pair higher.

- Wednesday's four-hour chart is painting a bullish picture for the pair.

Is September tapering coming? That has been the question markets have been asking about the US Federal Reserve – but the focus now shifts toward the European Central Bank. That could be favorable for EUR/USD bulls.

Tuesday's trading session was choppy due to end-of-month flows, sending the world's most popular currency pair up and then down as money managers' adjusted their portfolios. Choppy trading seemed to mask a significant development – eurozone inflation is rising and ECB hawks are taking notice.

The headline Consumer Price Index for August hit 3% YoY and Core CPI reached 1.6% in the preliminary read for August, both above estimates. Higher inflation has reached the old continent and prompted both Klaas Knot and Robert Holzmann of the ECB to suggest the bank should reduce its bond-buying scheme.

The Frankfurt-based institution is buying some €20 billion worth of bonds every week and these remarks triggered a sell-off in German sovereign debt, as well as that of other countries. Will higher yields push the euro higher? Not all on the ECB's Governing Council seem worried about inflation, with Vice President Luis de Guindos coming on Wednesday to project price rises will decelerate.

Nevertheless, a hawkish shift in ECB policy is now in play for next week's decision, and that is a novelty.

Where does the Fed stand? Five days after Chair Jerome Powell's relatively dovish speech at the virtual Jackson Hole Symposium, there is still some pressure on the dollar. The bank convenes later in September but Friday's Nonfarm Payrolls report is already on traders' minds. Ahead of that release, Wednesday's economic calendar features two significant clues.

ADP, America's largest payrolls provider, publishes its report for private sector employment later in the day, with estimates standing at an increase of over 600,000 positions. Correlation with official labor statistics is mixed, but the publication impacts markets.

The ISM Manufacturing Purchasing Managers' Index may have a substantial impact this time – as the Services PMI is released only after the NFP. Economists expect a moderate decline in both the headline and the all-important employment component. This publication may risk the euro rally.

ISM Manufacturing PMI Preview: Why it could be the trigger for a big greenback comeback

Overall, there is room for euro/dollar to resume its gains, yet US data poses a risk.

EUR/USD Technical Analysis

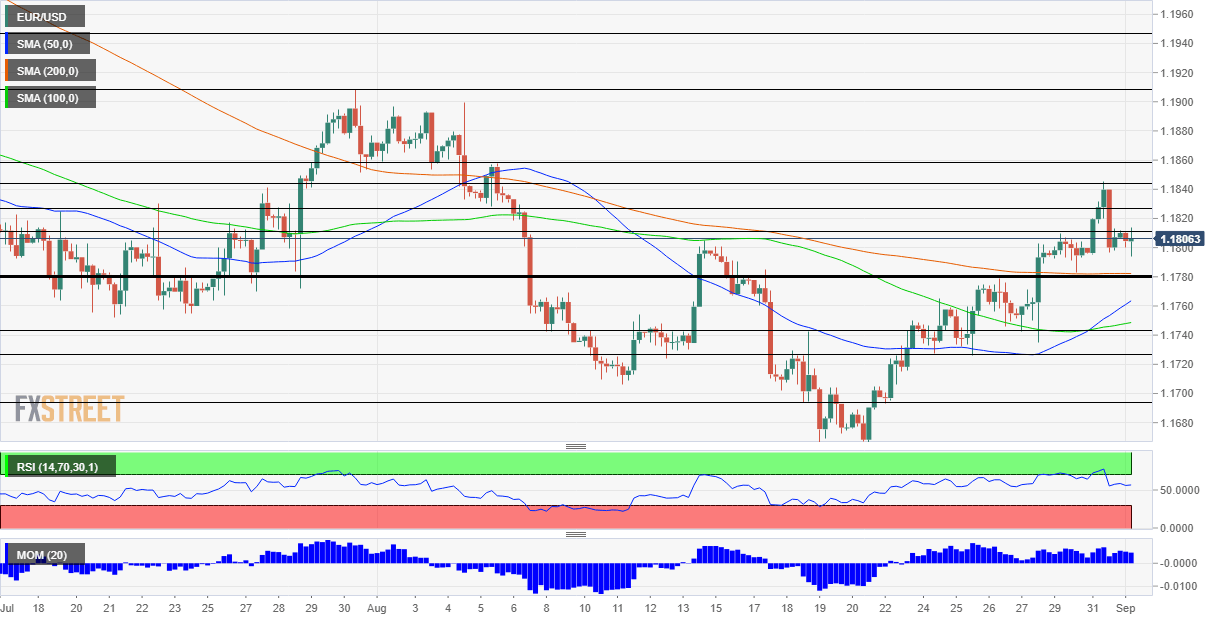

The Relative Strength Index (RSI) on the four-hour chart has dropped back below 70, thus exiting overbought conditions and allowing for more gains. EUR/USD continues benefiting from upside momentum and trades above the 50, 100 and 200 Simple Moving Averages. All in all, bulls are in control.

Some resistance is at the daily high of 1.1813, followed by 1.1830 and 1.1845, the latter being Tuesday's peak. Further above, 1.1860 and 1.1910 are eyed.

Critical support awaits at 1.1780, which capped EUR/USD and later served as support. It is also where the 200 SMA hits the price. Further down, 1.1740, 1.1725 and 1.1695 are eyed.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.