EUR/USD Forecast: Euro on track to challenge 2023 lows

- EUR/USD has gone into a consolidation phase near 1.0550 following last week's drop.

- Near-term technical outlook shows that sellers remain in control.

- A rebound in Wall Street's main indexes could help the pair limit its losses.

EUR/USD has stabilized near 1.0550 after having touched its lowest level since early January at 1.0532 in the European morning. The pair's technical outlook shows that the bearish bias stays intact in the short term. In case safe-haven flows dominate the markets on the first trading day of the week, the pair could challenge 2023 lows below 1.0500.

On Friday, the US Bureau of Economic Analysis reported that the Personal Consumption Expenditures (PCE) Price Index edged higher to 5.4% on a yearly basis in January from 5.3% in December (revised from 5%). Additionally, the annual Core PCE Price Index, the Fed's favorite gauge of inflation, came in at 4.7%, surpassing the market expectation of 4.3%.

The US Dollar capitalized on hot PCE inflation data ahead of the weekend and forced EUR/USD to stay under bearish pressure.

Early Monday, markets remain relatively quiet. US stock index futures trade modestly higher on the day following the sharp decline witnessed in Wall Street's main indexes on Friday.

In the second half of the day, January Durable Goods Orders will be featured in the US economic docket. The market consensus points to a 4% decline after December's impressive 5.6% increase. In case the data arrives in positive territory, the US Dollar could keep its footing with the initial reaction. Investors are, however, likely to pay close attention to US stocks. If there is a convincing rebound in major equity indices following the opening bell, the USD is likely to lose some interest and help EUR/USD stage a technical correction.

The European Commission will release the Economic Sentiment Indicator for February, which is forecast to improve to 101 from 99.9 in January. Although this data is unlikely to trigger a significant market reaction, market participants could see a stronger-than-expected print as an opportunity to unwind shorts.

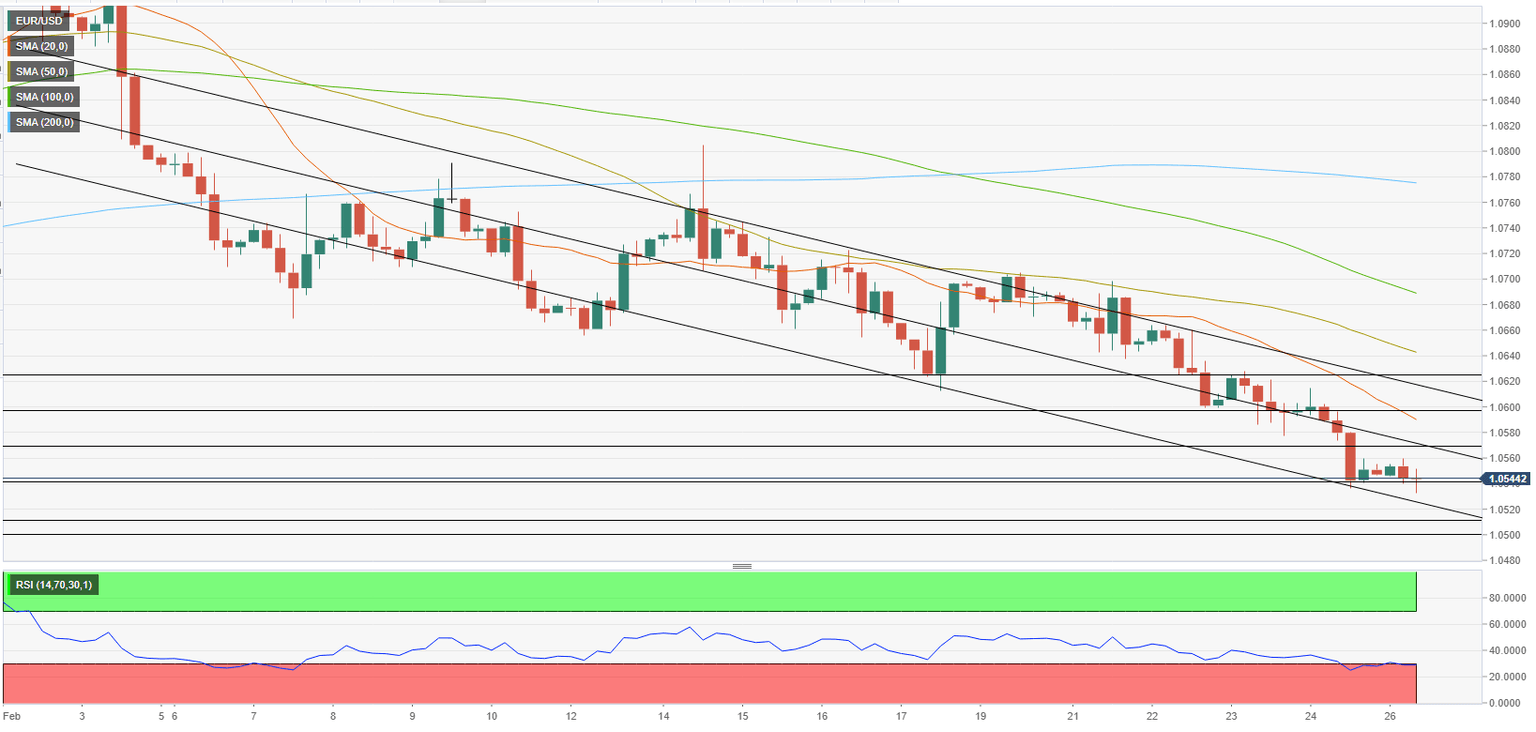

EUR/USD Technical Analysis

EUR/USD stays withing the lower half of the descending regression channel coming from early February. Although the Relative Strength Index (RSI) indicator on the four-hour chart suggests that the pair is about to turn oversold, the lower-limit of that channel at 1.0530 could be tested before sellers target 1.0500 (psychological level) and a fresh 2023-low at 1.0480.

In case the pair rises above 1.0570 (mid-point of the descending channel) and stabilizes there, it could extend its correction toward 1.0600 (20-period Simple Moving Average, psychological level, static level) and 1.0640 (50-period SMA).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.